Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

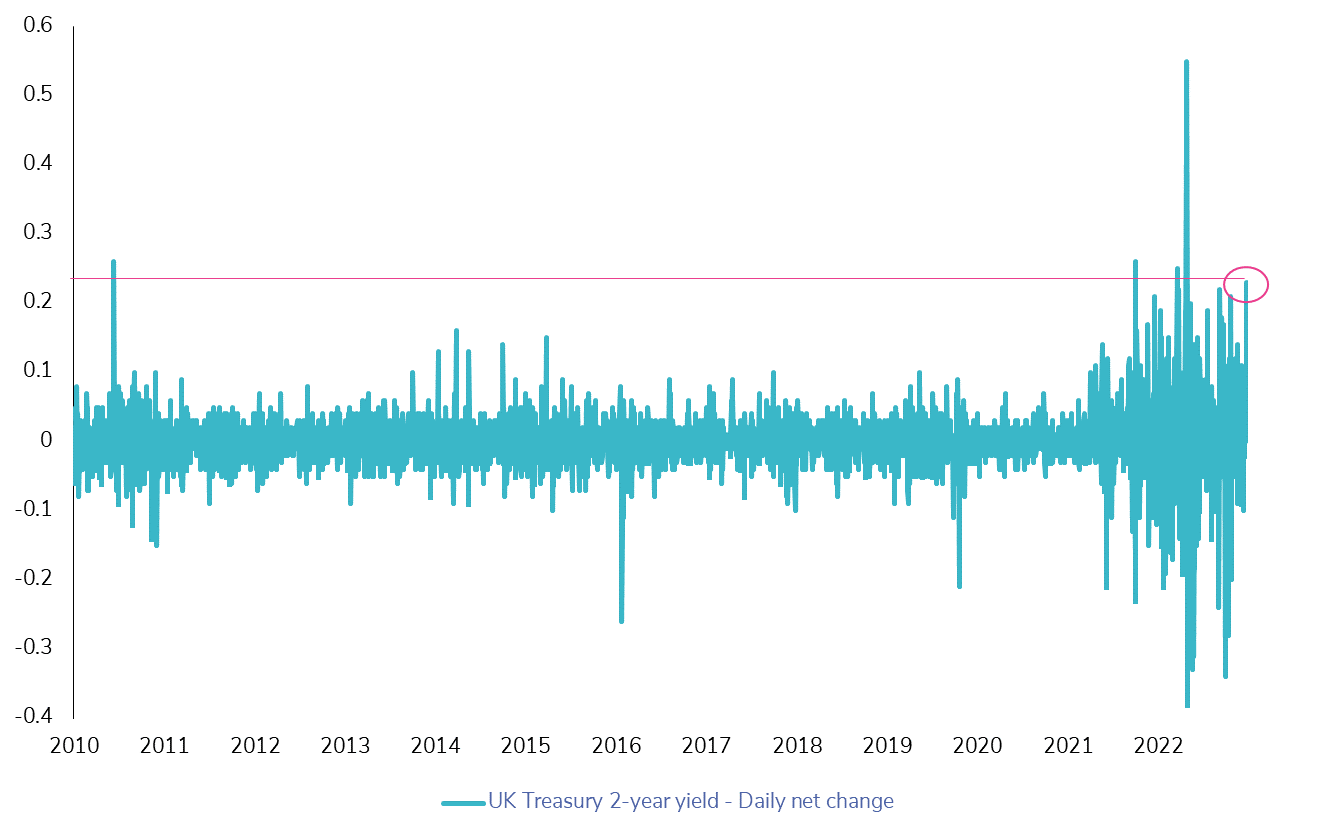

UK Bond Market Suffers Major Blow on Unforeseen Surge in UK CPI!

The UK bond market witnessed a substantial downturn due to an unexpected surge in Britain's core inflation rate, reaching its highest level in over three decades. This surprising release led to a sharp 25bps rise in the two-year UK Treasury yield. Consequently, market sentiment has shifted, with rate hike expectations now fully priced in for June, and projections even suggesting a potential 50bps increase. As a result, the terminal rate, anticipated for December 2023, is now hovering at almost 5.5%, a significant shift from less than 5% merely two days ago. Source: Bloomberg.

Greece’s 10-year government bond yield fell to 3.80%

The rate is down more than 110 basis points since last year’s high, taking down the spread to Italy bonds to -40bps.

Prime Minister Kyriakos Mitsotakis’s center-right New Democracy received almost 41% of the vote vs 20% for the leftist Syriza party. Mitsotakis could maybe secure a single-party government in about a month.

Will Greece be back in Investment Grade party?

Source: Bloomberg

Italy Maintains Investment Grade Status: Moody's Decision Confirmed!

In a crucial development for Italy's economic landscape, Moody's has confirmed the nation's BBB- sovereign debt rating after conducting a comprehensive review of its credit profile. This decision reinforces Italy's investment grade status, providing stability and reassurance to the market. The anticipated outcome is evident in the behavior of the spread between Italian and German 10-year yields, which has remained steady, along with remarkably low volatility in this spread over the past few weeks. Source: Bloomberg

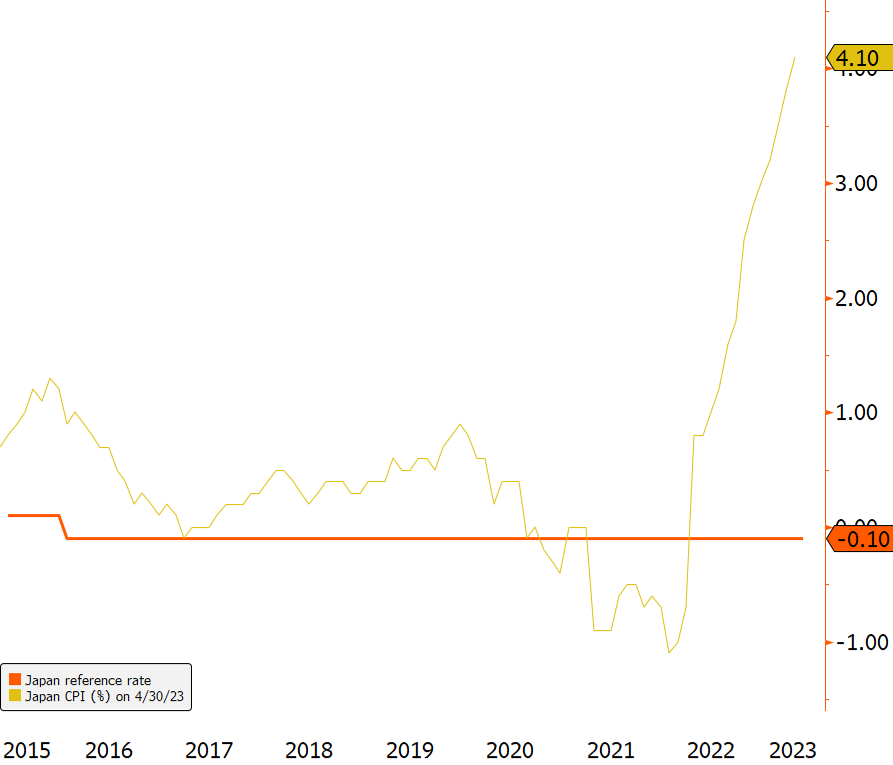

How long can the Bank of Japan maintain its ultra-accommodating policy?

As Japan's core Consumer Price Index (CPI) reaches an impressive milestone of 4%, the nation finds itself at a pivotal juncture in its inflation landscape. This surge places Japanese inflation well above the Bank of Japan's (BoJ) target. While the BoJ's specific objective remains the maintenance of stable inflation at around 2%, the question arises: How long can the BoJ sustain its ultra-accommodative policy stance? With Japan's staggering debt-to-GDP ratio surpassing 200%, finding the right balance becomes crucial in addressing the potential challenges of runaway inflation. Source: Bloomberg

📉 Significant drop in High Yield volatility!

The recent sharp decline in European High Yield volatility highlights the market's complacency towards this fixed income segment. 📊 Examining the 30-day price volatility over the past decade, the High Yield index has reverted to 2021 levels, now standing one standard deviation below the average. 💼 Is the anticipated future recession in Europe already fully priced in on the soft side? Source : Bloomberg, RBC.

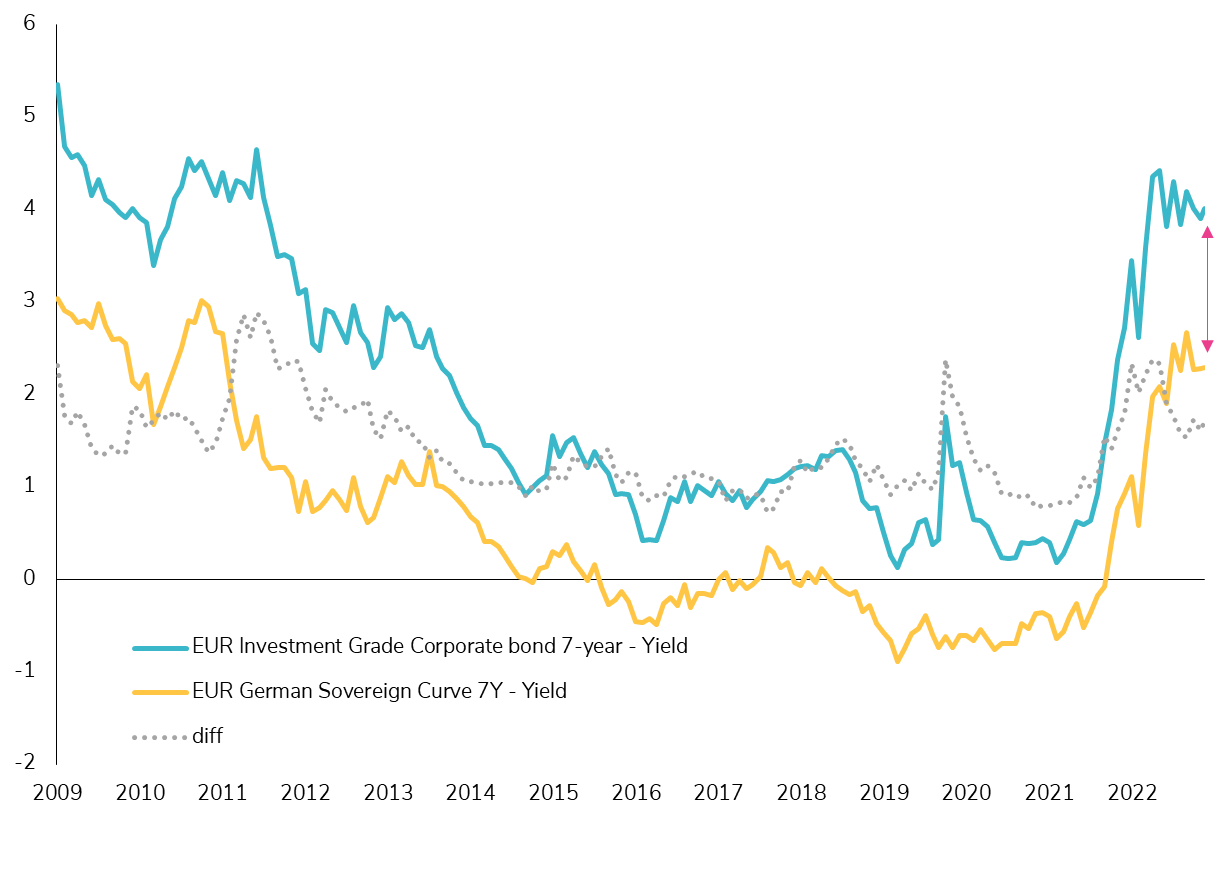

Attractive high quality European corporate bonds?

🌍 European investment grade corporate bonds offer some of the most attractive yields in a decade. 📉 Multiple factors contribute to this level, including the European Central Bank's sudden monetary policy tightening and widening credit spreads resulting from concerns over a deeper recession in Europe and higher default rates. 💼 The recent Credit Suisse event has further increased the European premium, creating compelling opportunities. 📈 Currently, the EUR swap curve (the reference curve for corporate refinancing in EUR) is historically high compared to the German yield curve, due to factors such as the supply shortage and the flight to quality. ❓ Despite the risk of recession in Europe, should we take advantage of the attractive long-term entry points of the European high quality credit segment?

Treasuries reaction to debt ceiling result will be noisy

One look at the recent price compression for 2-year Treasury futures and its clear that bond traders have a lot resting on the outcome from the debt ceiling talks.

If a deal is reached -> Fed speakers become the key for direction

No deal -> The X-date comes into play

Source: Bloomberg

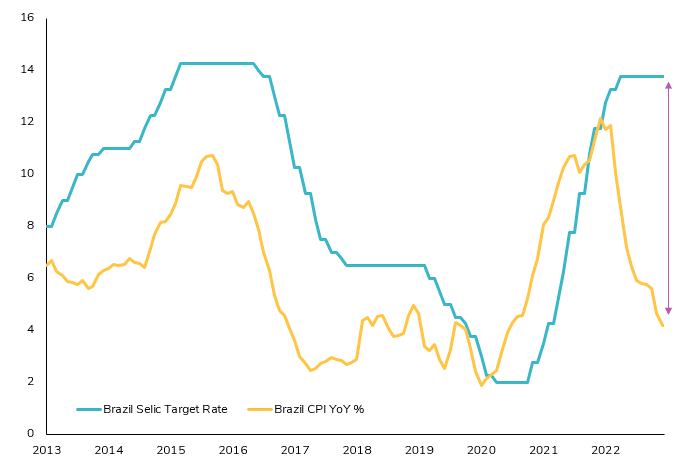

⏬ Time to consider a shift for the Central Bank of Brazil?

🇧🇷 Brazil's Consumer Price Index (CPI) is nearing the end of its normalization process, hitting a low of 4.18% in April, the lowest level since October 2020! 📊 The Banco Central do Brasil (Central Bank of Brazil) took proactive steps by raising its key rates (Selic rate) early on to address inflationary pressures. Their actions have yielded positive results, bringing inflation back in line with Brazil's historical patterns. ⚖️ The potential for rate cuts is now significant, particularly if Lula appoints his preferred candidates, like Gabriel Galípolo, to influential positions within the Brazilian central bank. President Campos Neto is widely respected as one of Latin America's top central bankers. However, his focus on controlling inflation rather than stimulating Brazilian growth, coupled with his association with former President Bolsonaro, may put his position at risk. 🛑 Is Brazil on a similar trajectory as Turkey, where concerns arise over the central bank's alignment with the government? Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks