Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

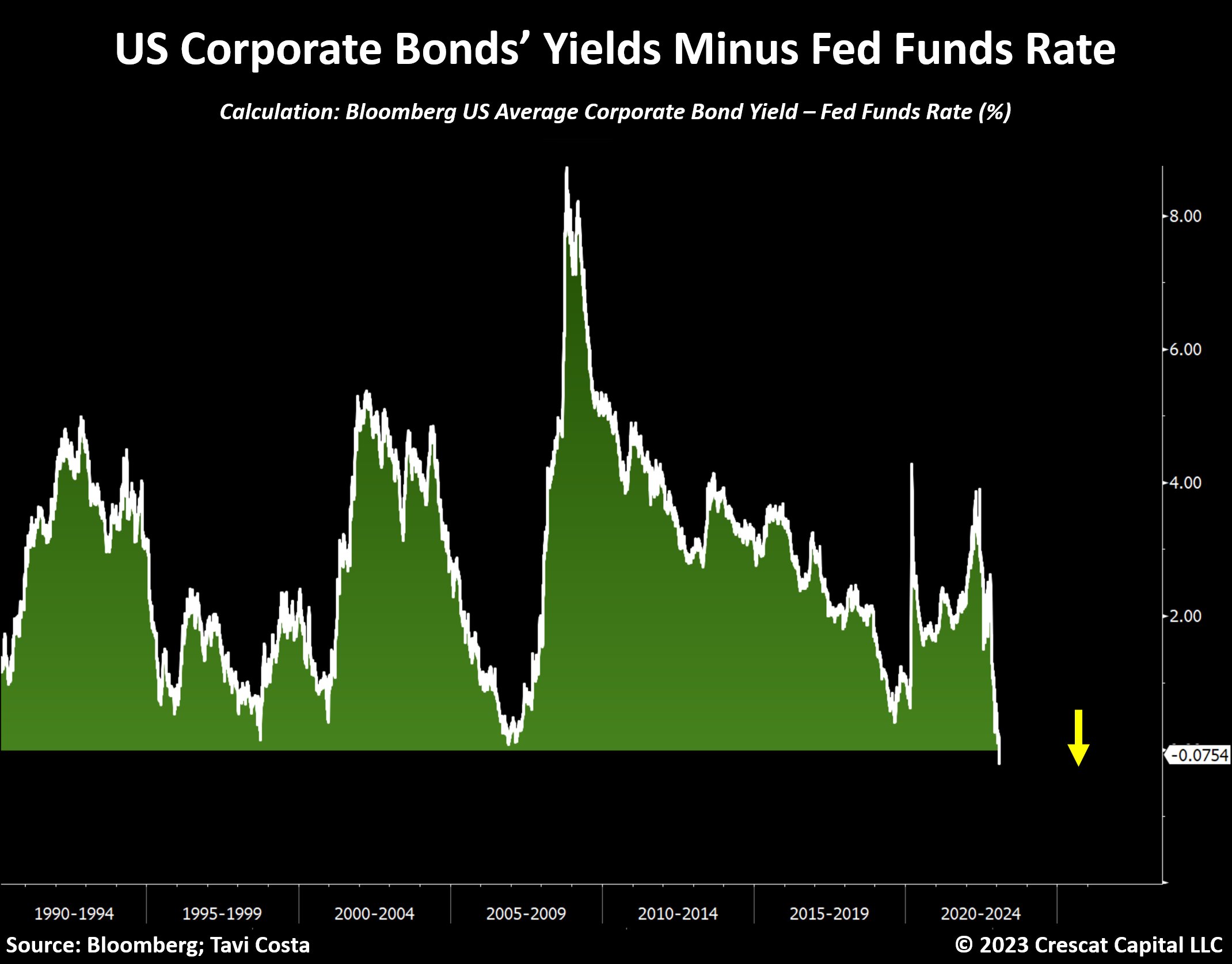

Corporate bonds yield less than the Fed funds rate for the first time in 30 years

Source: Tavi Costa, Bloomberg

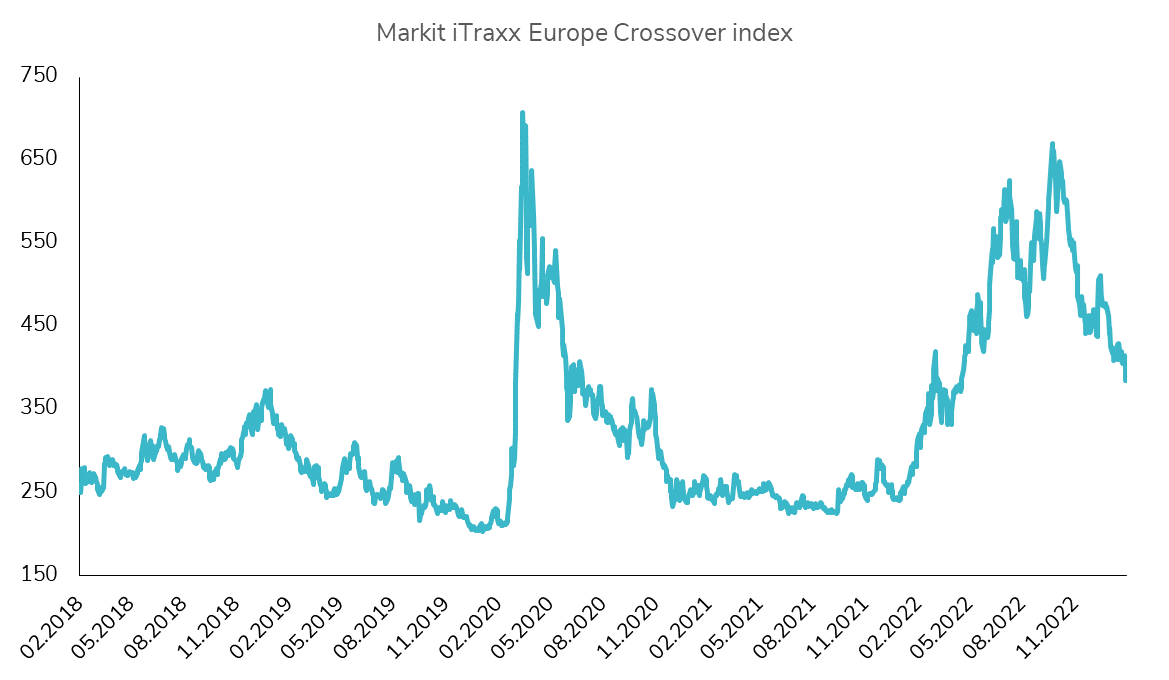

The Itraxx Xover index below 400bps for the first time since April 2022!

The spread of the Markit iTraxx Xover index, which is a good indicator of investor sentiment on European high yield, fell below 400 basis points for the first time since April 2022. The index is tightening by 25 basis points today following Ms. Lagarde's reassuring comment on the growth outlook. Source: Bloomberg

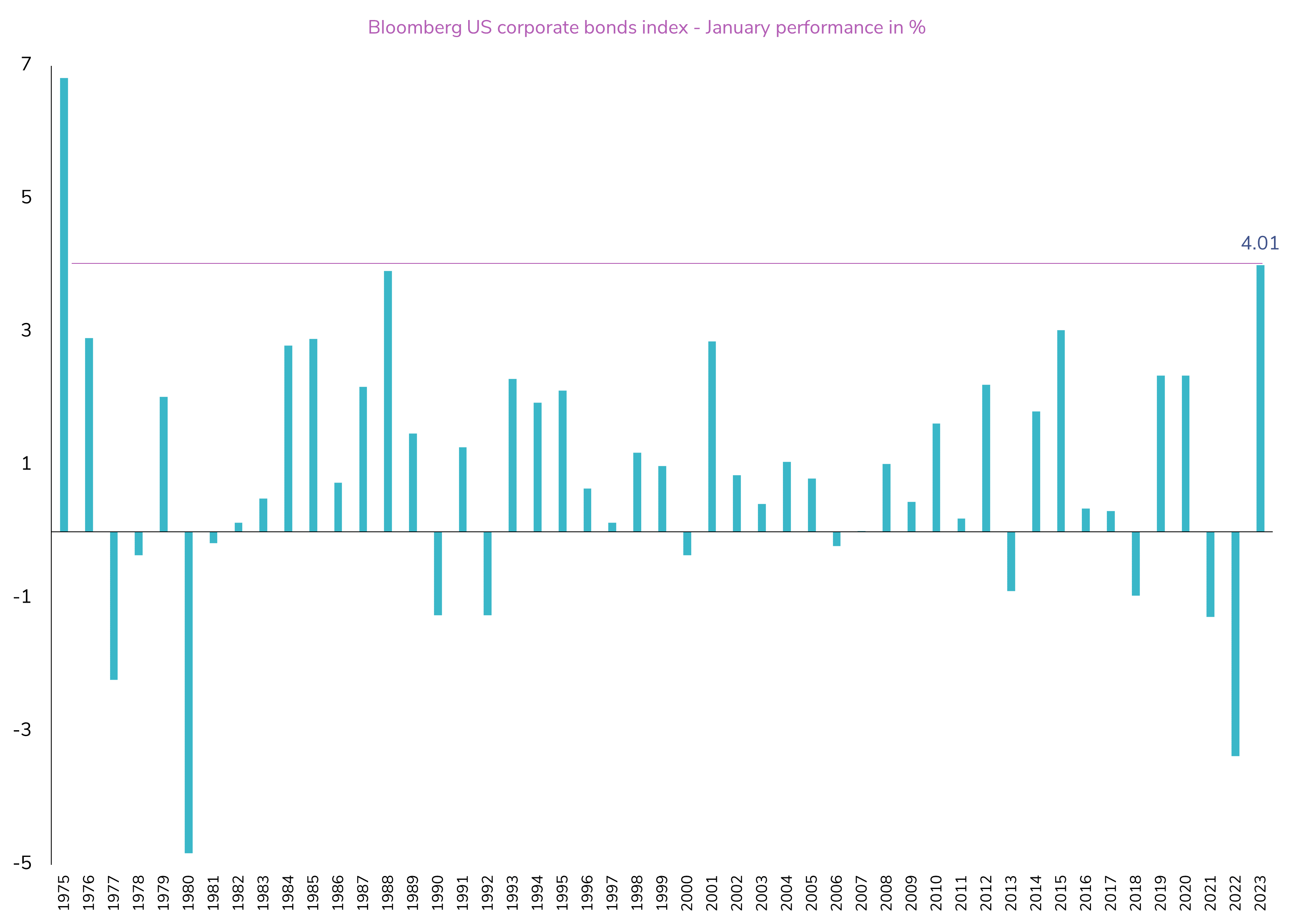

Best January since 1975 for US Investment Grade bonds

U.S. investment grade (IG) bonds recorded their best January performance (+4%) since 1975! After having its worst year in 2022 (-15.8%), the IG bond market is recovering thanks to the slowing of the Federal Reserve's monetary policy tightening and a better than expected economic outlook. Source: Bloomberg

Hedge Funds Boost #Treasury Shorts to Record on Doubts Over Rally

Source: Bloomberg

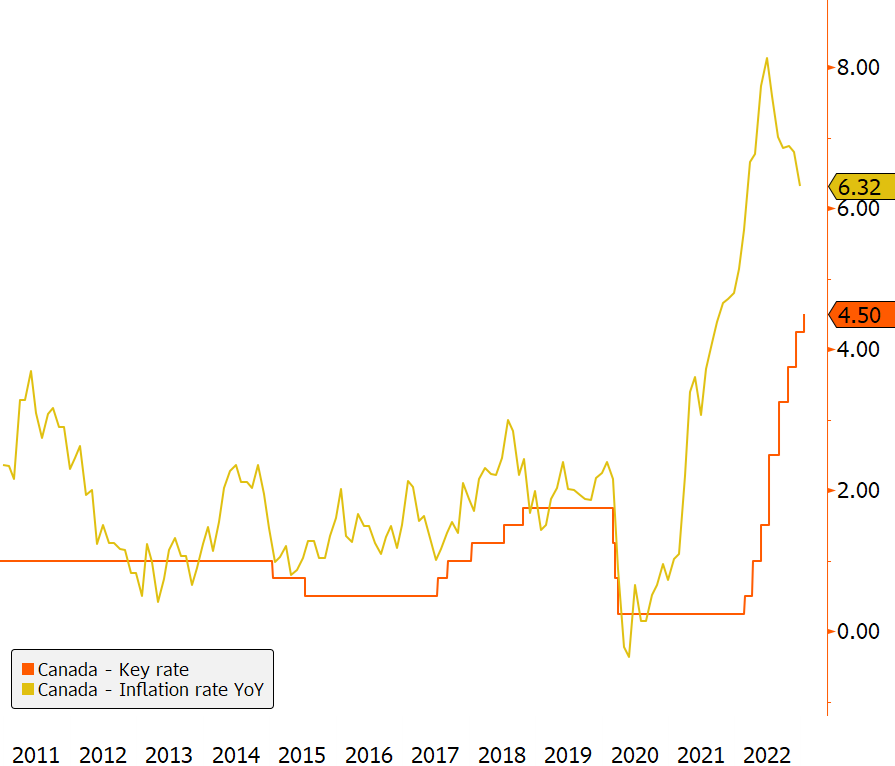

End of the tightening cycle for the Bank of Canada?

The Bank of Canada (BoC) raised its policy rate by 25bps to 4.5%, its highest level since 2008. Surprisingly, the central bank and its governor Tiff Macklem stated that the policy rate will be held at its current level unless economic data (#inflation) surprises on the upside. Source: Bloomberg.

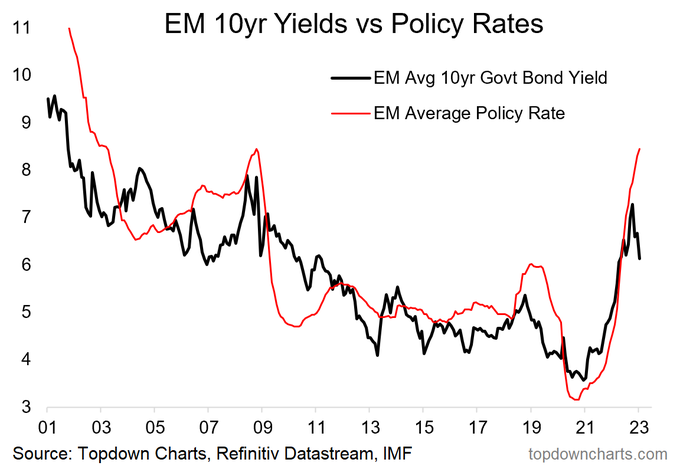

Time for emerging market central banks to pivot?

As the Citi Inflation Surprise Index for emerging markets (EM) turned negative for the first time since July 2020, the bond market appears to be hoping for a pivot from EM central banks (CBs). The end of policy tightening in EM is already visible, as the pace and magnitude of rate hikes by EM CBs has begun to slow. Source: Topdown charts.

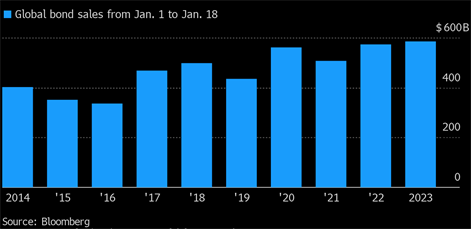

Global bond sales to record start!

In less than three weeks, governments and corporates raised nearly $600 billion in new financing, a record. This new record was helped by both the best start ever for global fixed income indices and the largest inflow into investment grade bonds in over a year. Source: Bloomberg

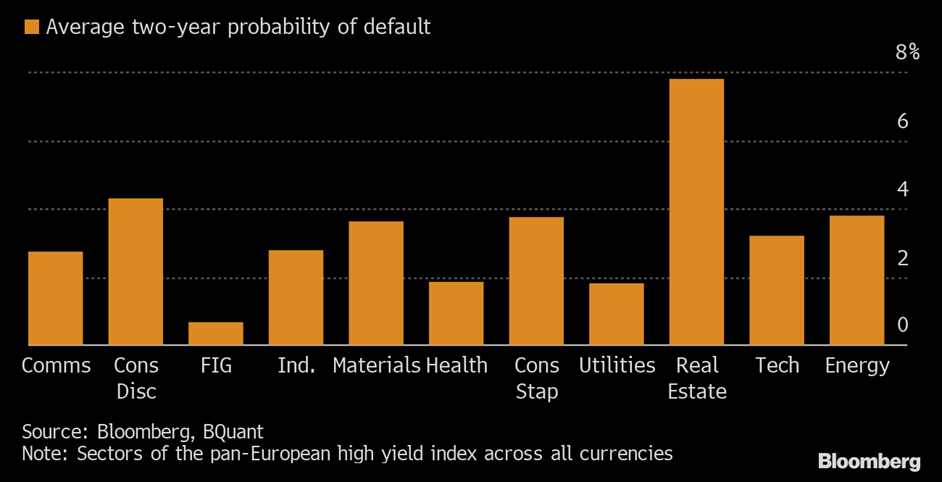

Real estate debts in Europe have the most concerns!

One of the main consequences of the sharp rise in interest rates is the level of damage it could have on the real estate sector. The European high yield market is already anticipating complicated months for the real estate sector with a cumulated default probability of 8% over the next two years , the highest of all sectors. Is the worst to come? Source: Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks