Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

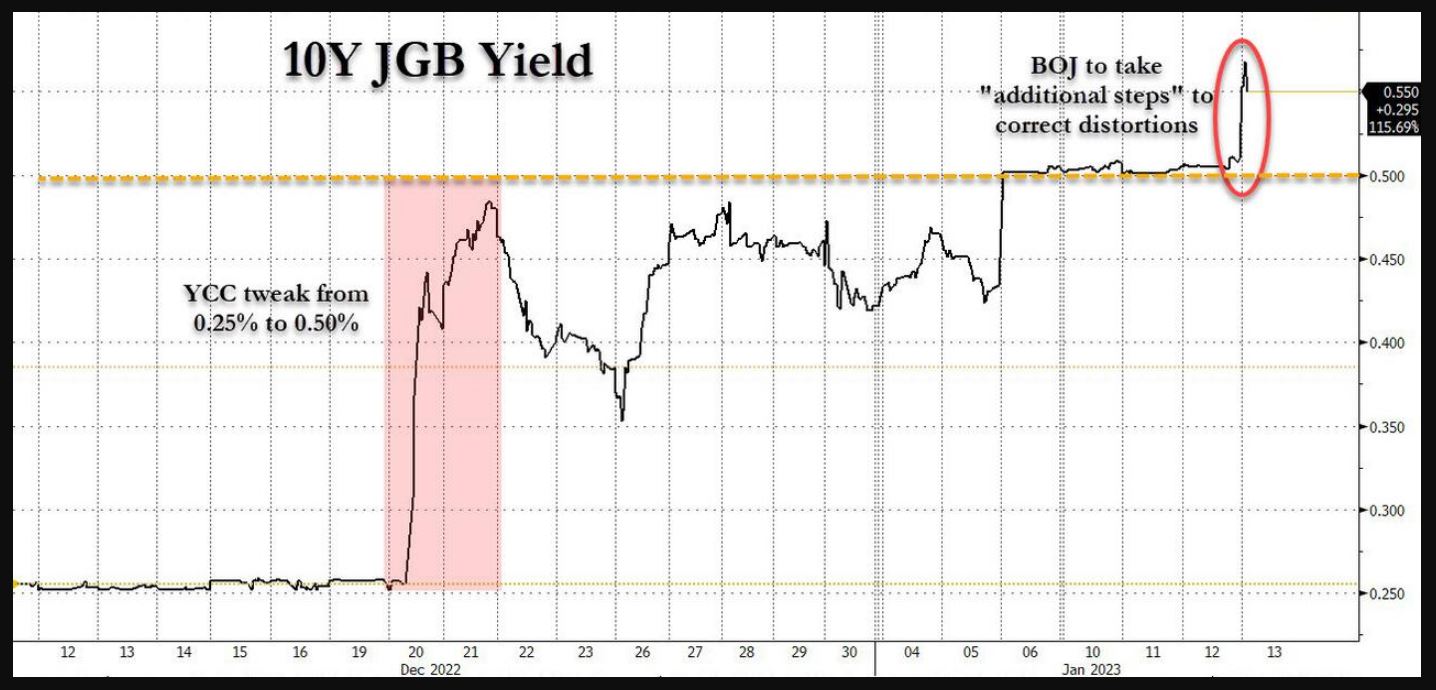

Is the Bank of Japan losing control of its bond market?

The Japanese yen soared overnight after Japan's Yomiuri reported that the BoJ is to review the side effects of its massive monetary easing at its policy meeting next week and may take additional steps to correct distortions in the yield curve, i.e there is a chance the BOJ will once again "surprise" the market with yet another Yield Curve Control tweak. JGB 10y has penetrated the 0.50% cap, reaching 0.568%. The USDJPY had tumbled as low as 128.66 from 132 yesterday, before bouncing modestly just above 129. Source: www.zerohedge.com, Bloomberg

Italy's 10y risk spread over Germany narrows to the lowest level since April 2022

Source: Bloomberg

Bond market in Germany sounds the recession alarm

German bond curve – measured by 2s/10s yield spread – inverts most in 30yrs. Typically, 10 year bonds pay investors more than 2 year to compensate for uncertainty that future holds. The anomaly often precedes a recession. Source: HolgerZ, Bloomberg

U.S. 3-month government bond yield hits new highs!

The yield on three-month U.S. T-Bill rose 8 basis points to 4.66 percent, its highest level since 2007. This reflects the latest comments from Fed members in favor of further increases in the federal funds rates. It is worth noting that the next FOMC meeting will be held on February 1 and the market is so far expecting a 25 basis point increase. Source: Bloomberg

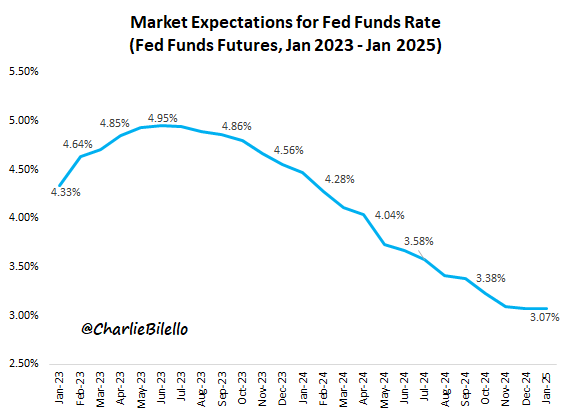

Current market expectations for path of the Fed Funds Rate..

-Feb 2023: 25 bps hike to 4.50%-4.75% -Mar 2023: 25 bps hike to 4.75%-5.00% -Pause -Rate cuts start in Dec 2023, continue in 2024... Source: Charlie Bilello

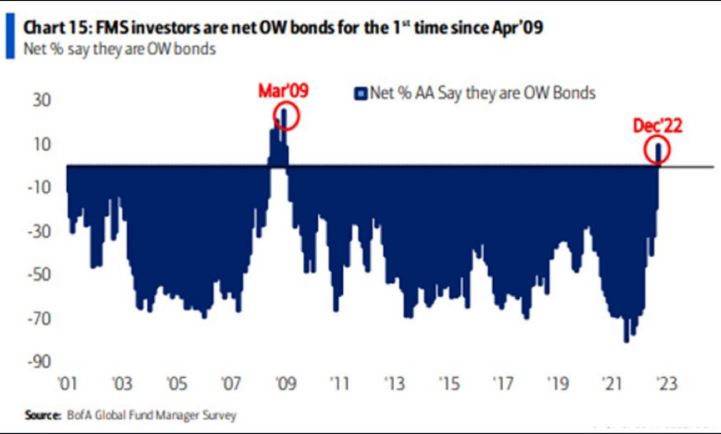

Between March 2009 and December 2022, global fund managers were never overweight bonds.

Fund managers surveyed by BofA are net overweight bonds for the 1st time since April 2009 Source: BofA Fund manager survey, Jeroen Blokland

Investing with intelligence

Our latest research, commentary and market outlooks