Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

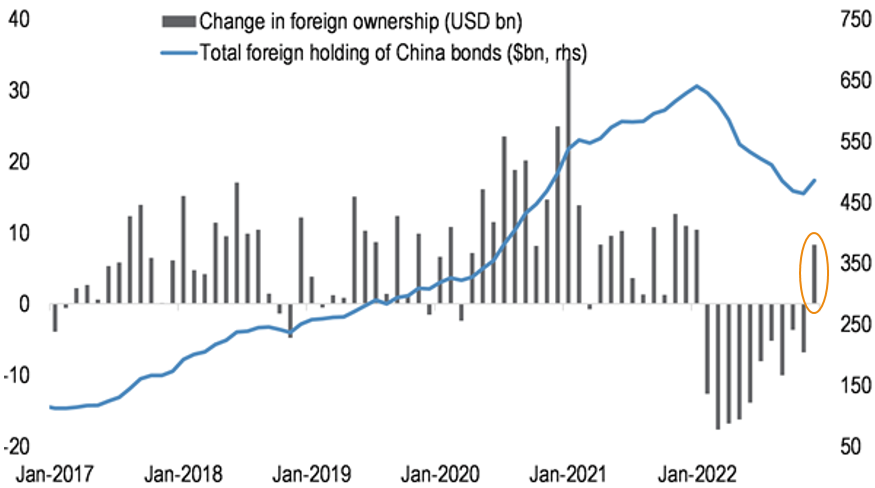

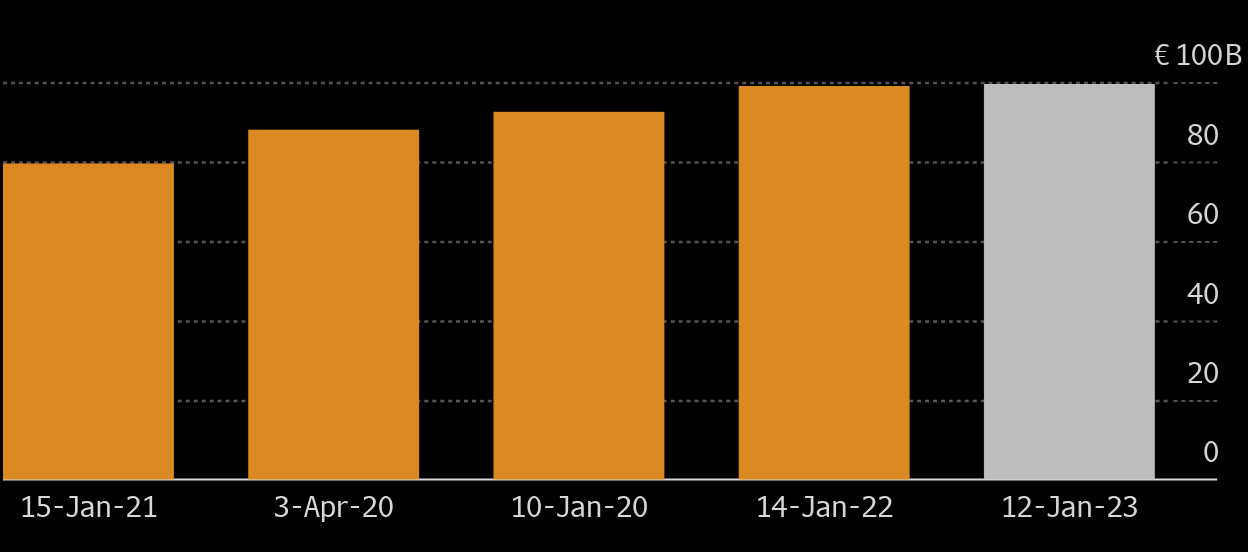

Foreign Investors are back in China bonds!

For the first time since January 2022, foreign investor flows into Chinese bonds returned to positive territory in December 2022, underscoring the region's supportive momentum. Despite this positive month, total foreign ownership declined in 2022 to a record $93 billion. Source: JPMorgan

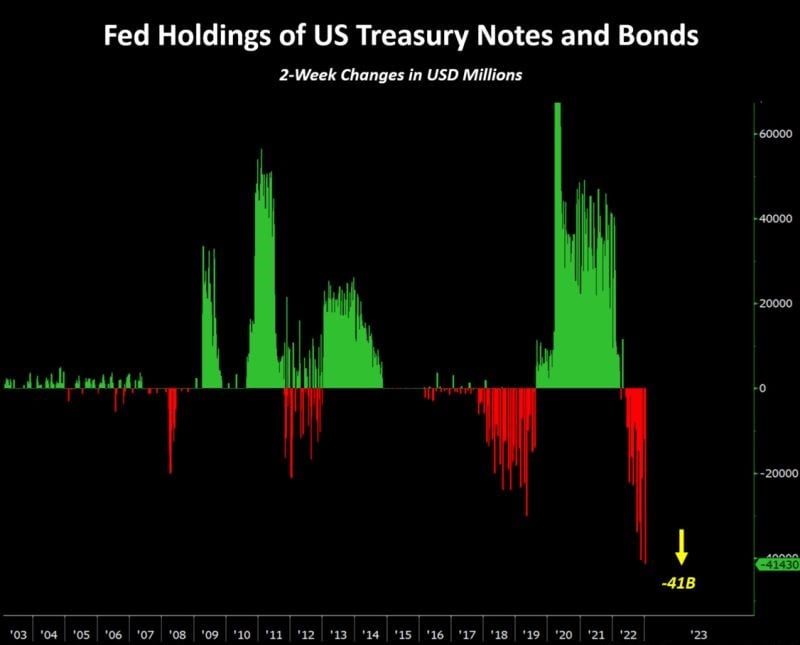

U.S. quantitative tightening is underway!

The amount of U.S. Treasury bonds held by the Federal Reserve (FED) has dropped by the largest amount ever (over $40 billion in two weeks). The reduction of the FED's balance sheet is in full swing. Source: Bloomberg, T.Costa

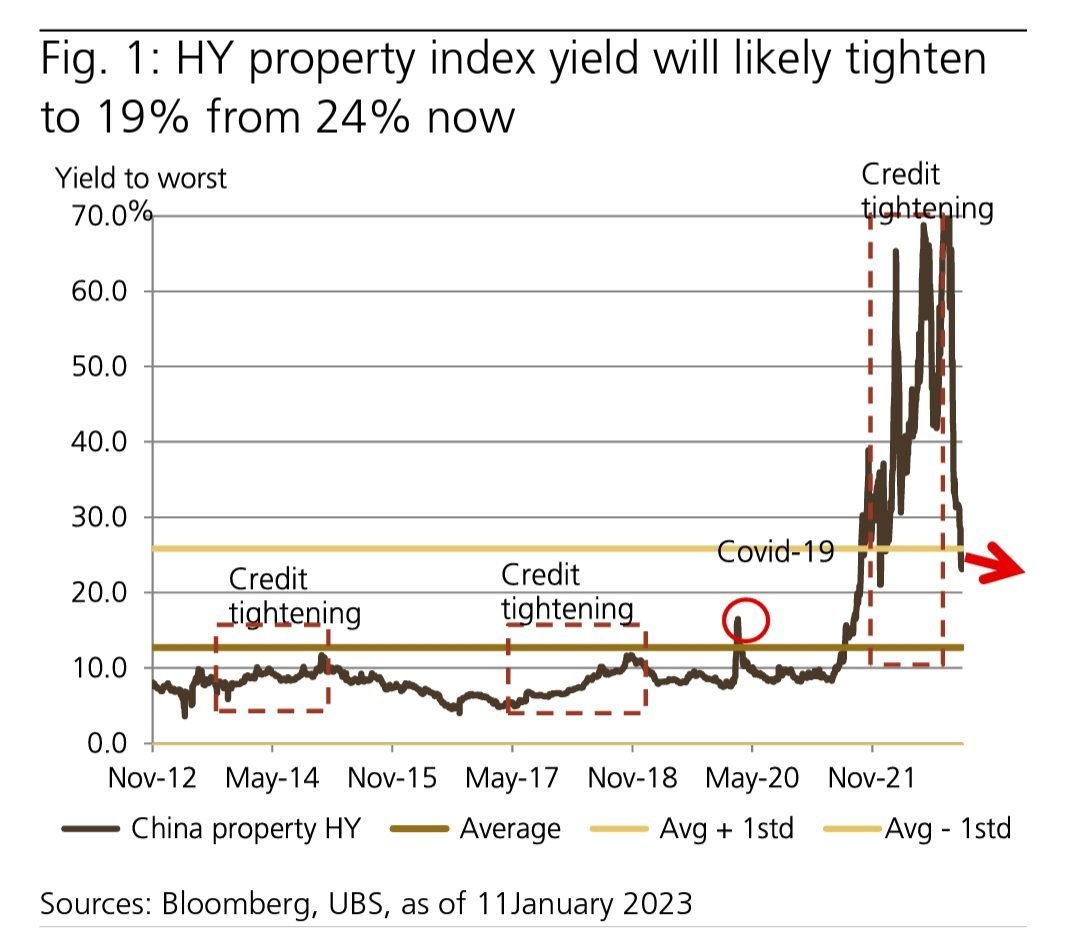

China High Yield property index yield is collapsing

According to UBS, China High Yiled property index yield is collapsing from 70% toward 19% as the housing sector is recovering amid stimulus.

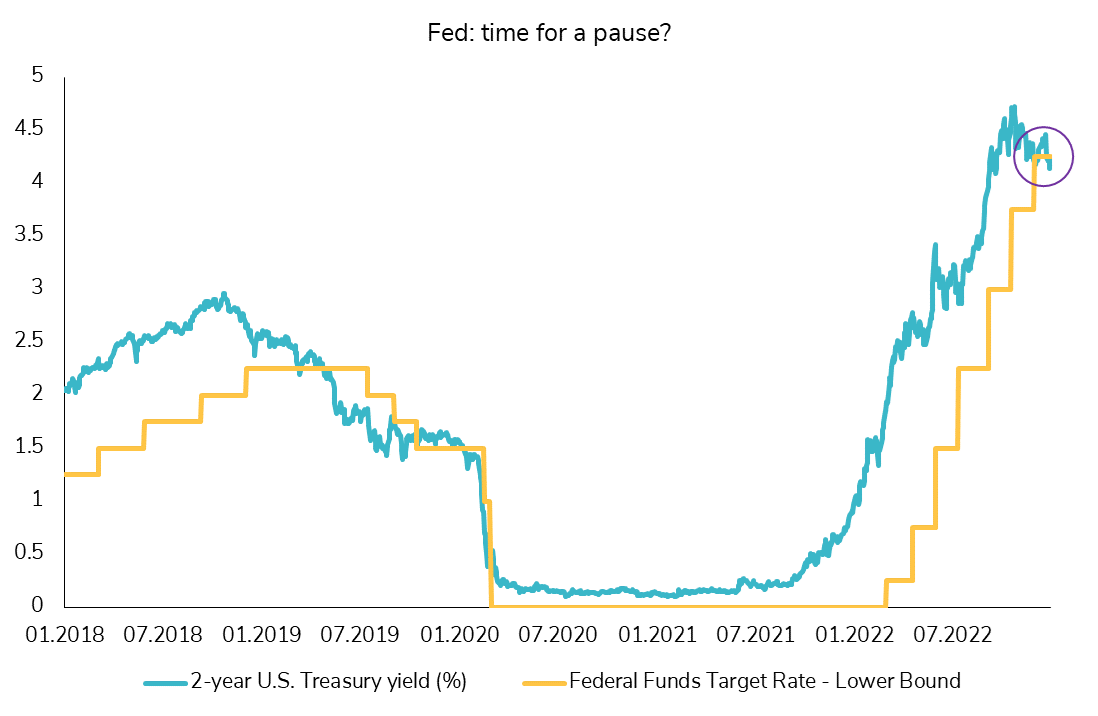

The Federal Reserve's hiking cycle: close to the end?

For the first time in this rate hike cycle, the 2-year U.S. Treasury yield is below the federal funds rate (lower bound). The market seems to be more and more convinced that this rate hike cycle of the US central bank will end soon.

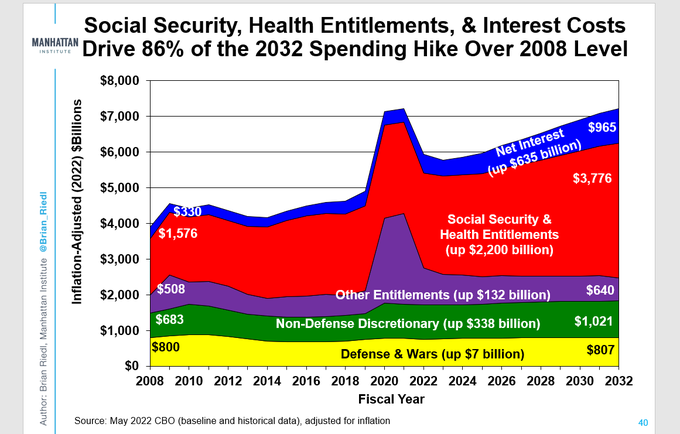

Close to $11T US Treasury bonds maturing in the next 24 months need to be refinanced

Current Funding Rate of these bonds hovers between1.6% to 1.9% The new one ranges between 3.4% and 4.6%. The debt service as a % of the US budget will explode from 8% to nearly 17%... Source: Lawrence McDonald, Manhattan Institute

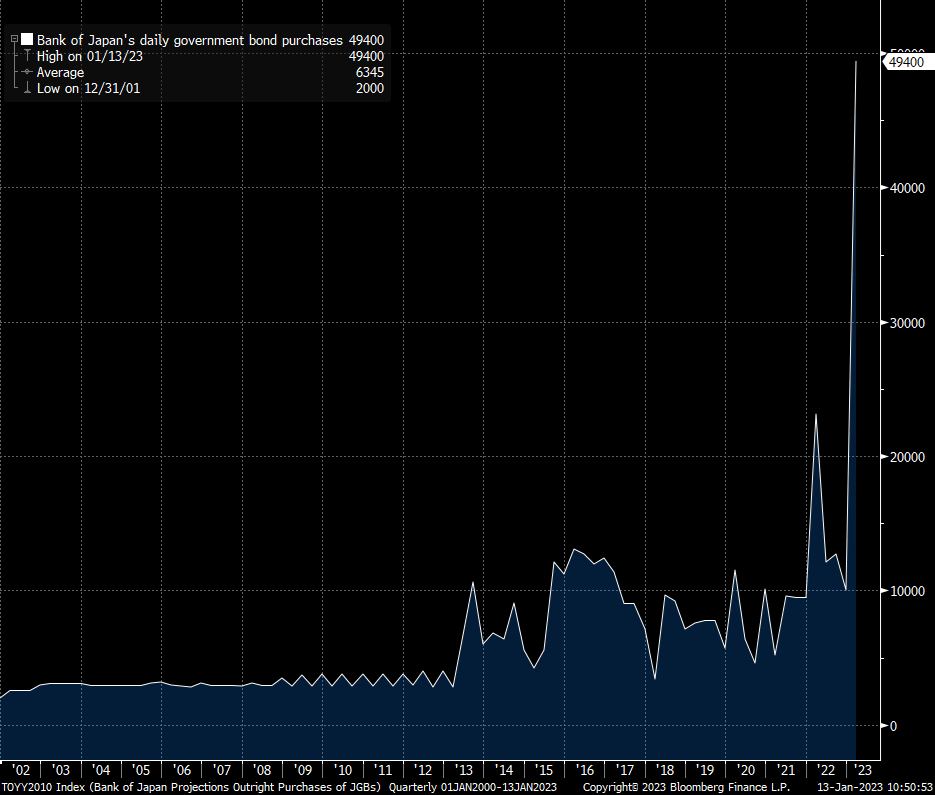

Bank of Japan's daily government bond purchases at an all-time high!

The Bank of Japan is buying huge amounts of government bonds in order to cap the yield on Japanese 10-year government bonds to 0.5%. Yesterday the BoJ bought 4.6 trillion yen and today it is close to 5t yen. Note that at the last meeting, the BoJ had decided on a 9t yen bond buying program ...per month! Source: Bloomberg

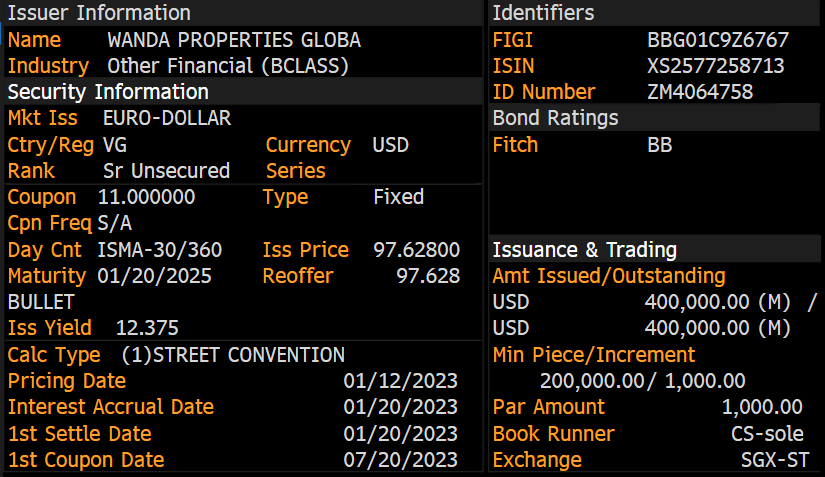

First USD-denominated bond issued by a Chinese property developer since September 2021!

New positive sign for the Chinese real estate sector? After 16 months of waiting, the dollar-denominated debt market has reopened for a Chinese property developer, Wanda Properties, without any guarantee from the Chinese government. This new issue was well received by investors as the book was oversubscribed four times. However, the majority of investors were from Asia (>80%) and while this news is positive for the sector (and its liquidity problem), it does not solve the problem of sales (demand) for now. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks