Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: Volatility

CBOE Volatility Index has plummeted 63% over the last 9 weeks, the largest volatility crush in history Source: Barchart

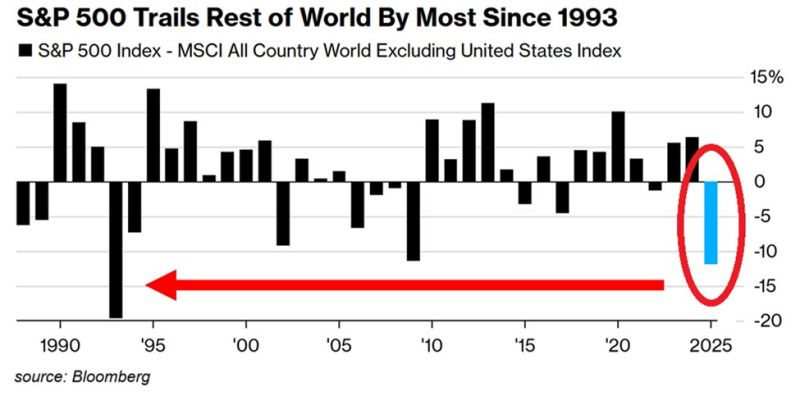

⚠️Despite US stocks outperformance in May, this is one of the WORST years for the US stock market in history:

The S&P 500 has UNDERPERFORMED World stocks excluding the US by 12 percentage points year-to-date, the most in 32 YEARS. Source: Bloomberg, Global Markets Investor

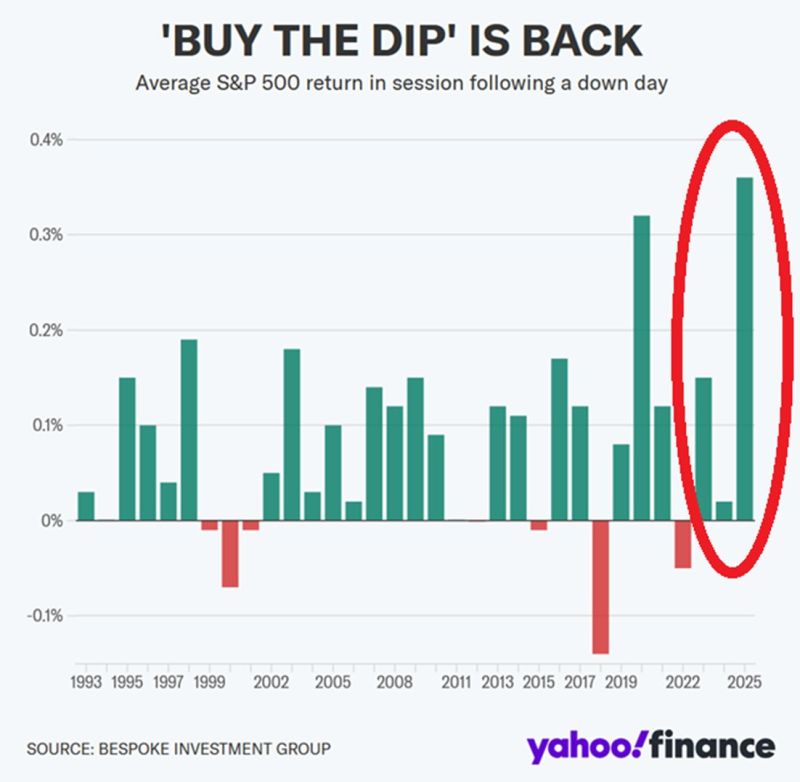

🚨Retail investors have bought every dip this year

The S&P 500 has returned 0.36% on average following a down day, the most ever recorded. By comparison, last year it was just 0.02%. Retail investors purchased over $50 billion in US equities since the April low. Source: Yahoo Finance, Global Markets Investor

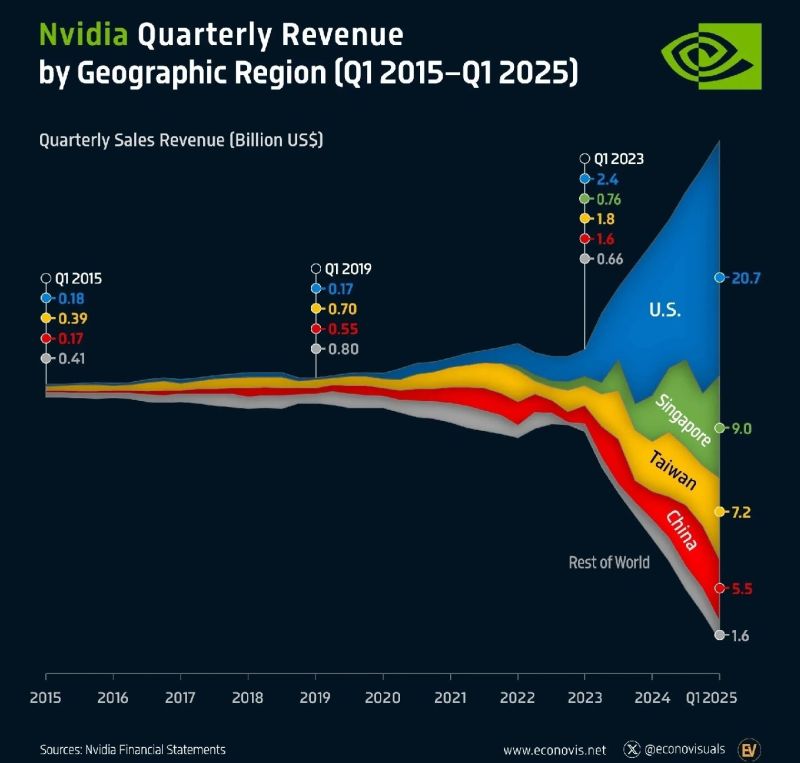

Nvidia quarterly revenues by regions over time...

Up to 20% of Nvidia’s revenue comes from Singapore a known gateway to China and when including direct sales to China and Hong Kong, roughly one-third of its total revenue ($15 billion) may be exposed to Chinese market risk. Source: econovisuals

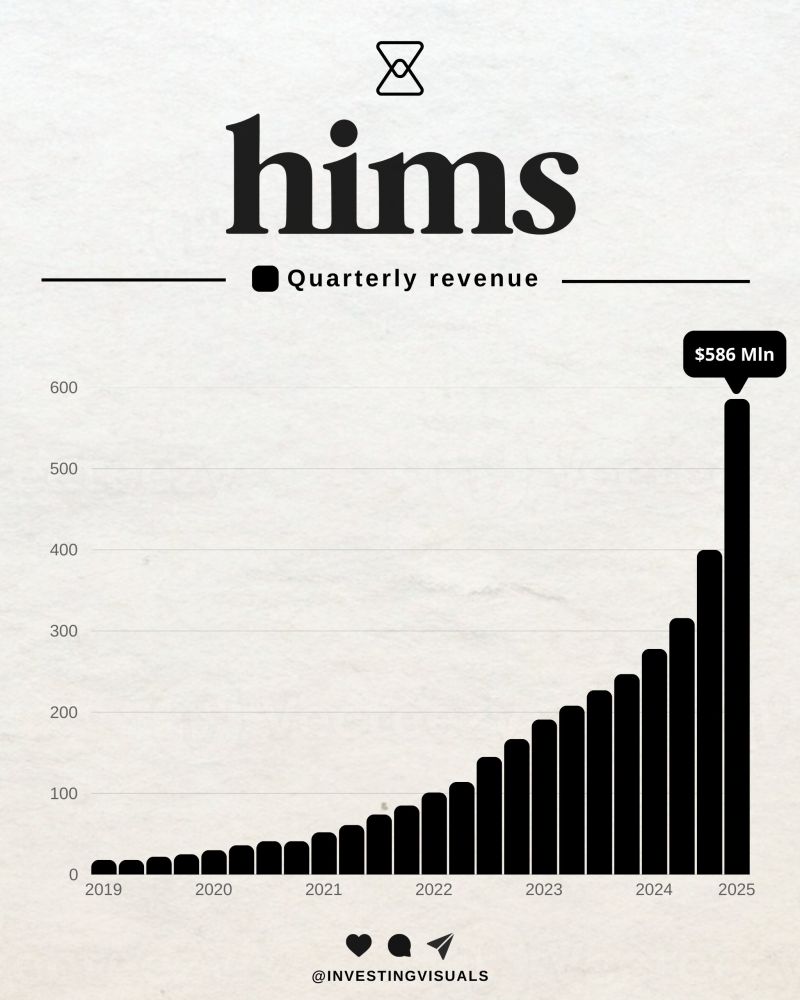

$HIMS spectacular revenue growth

Hims & Hers Health is a company that offers online consultations and treatments for sexual performance, hair regrowth, skin care, weight loss, and mental health. Learn how Hims connects you with licensed providers, delivers innovative products, and provides 24/7 support. Market Cap is $12.3 billion. Source: Investing visuals NB: This is NOT an investment recommendation

Investing with intelligence

Our latest research, commentary and market outlooks