Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

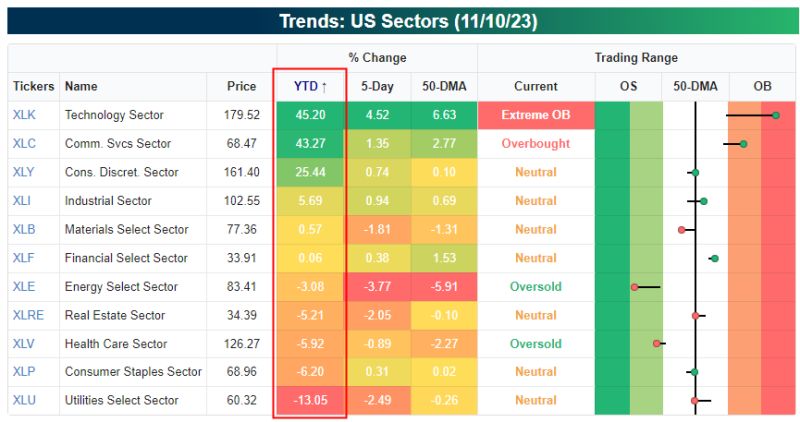

When the book on 2023 closes, extreme sector divergence will surely be considered one of the major plot points

Technology and Communication Services are each up more than 40% YTD, while five of eleven sectors are in the red on the year. Source: Bespoke

In case you missed it... The SP500 Equal Weighted Index is now down more than 5% this year...

Source: Barchart

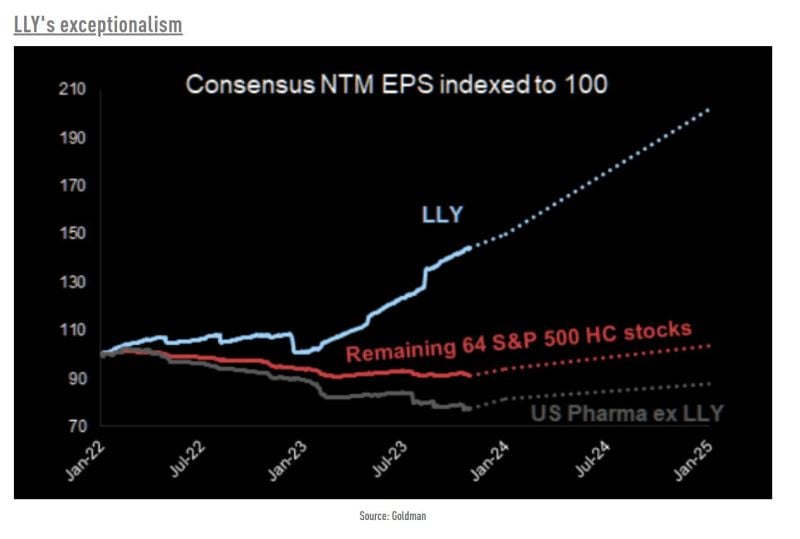

Eli Lilly exceptionalism... $LLY vs. rest of Pharma and S&P 500 Healthcare stocks

Source: Goldman Sachs, TME

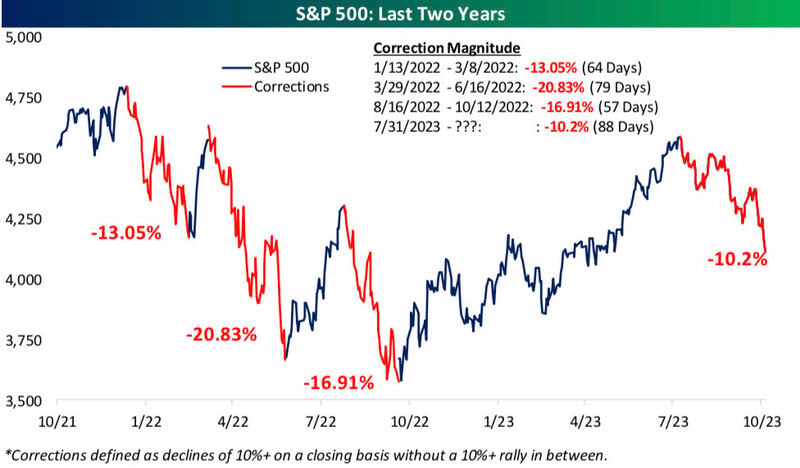

Here’s a look at the four 10%+ corrections we’ve had in the last two years

Just registered 4 last week. How deep will this one end up being? Source: Bespoke

The S&P 500 is now down over 10% from its high in late July, the largest drawdown thus far in 2023

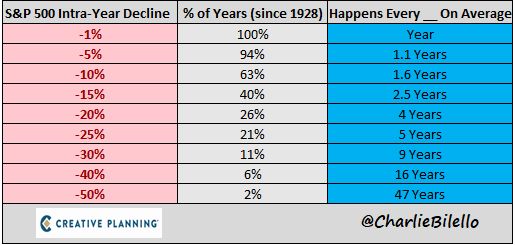

Is such a decline unusual? Not at all according to Charlie Bilello. A 10% intra-year drawdown has happened every 1.6 years on average.

4 of Wall Street's biggest banks have recently plummeted to levels not seen since the devastating March Banking Crisis

YTD losses are staggering, with 📉 ranging from -15% to -24% causing significant concerns for investors & overall market Source: The Coastal Journal

Magnificent Seven? How about Magnificent Mondays?

While the S&P 500 is up over 10% YTD, without Mondays it would be fractionally lower. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks