Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

In case you missed it...

Citigroup $C closed at its lowest price in more than 3.5 years Source: Barchart

LVMH vs Novo Nordisk gap is getting extreme. Is there cross asset logic here, or is it just hot money switching from one ex hot asset to another "must have" asset?

Source: TME, Refinitiv

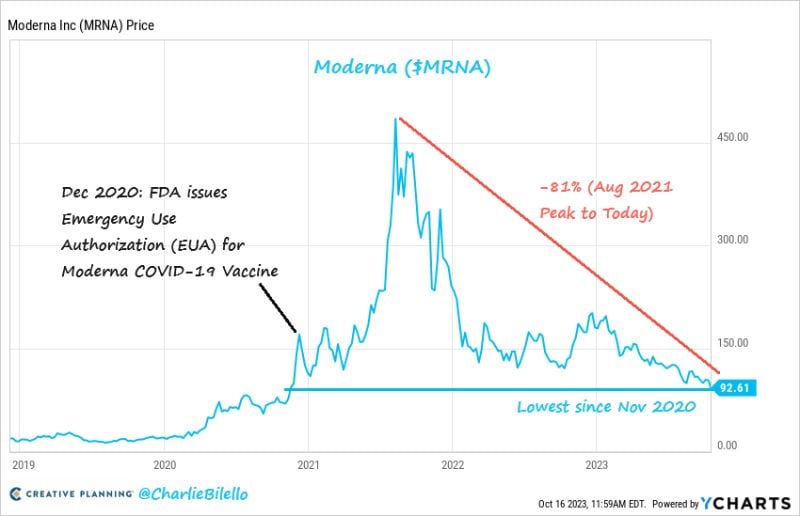

Moderna's stock is now down 81% from its peak and below the price it was trading at when the FDA issued an EUA for its Covid-19 vaccine back in December 2020

$MRNA Source: Charlie Bilello

Standard Chartered is ramping up its bullish Bitcoin prediction

Targeting as much as $120,000 by the end of 2024 — almost quadruple the current price — as increasingly cash-rich miners reduce sales of the token. “Increased miner profitability per BTC mined means they can sell less while maintaining cash inflows, reducing net BTC supply and pushing BTC prices higher,” Geoff Kendrick at Standard Chartered wrote Monday.

The bull-market is one-year old and the leadership has been unusual

• Since 1980, every single end to a bear market and start of a new bull has been accompanied by a broad rally in stocks, with the Equal Weight Index and small-caps stocks outperforming the S&P 500. • This time is different: the S&P 500 is heavily influenced by the 10 largest companies, which have enjoyed outsized returns. The so-called "magnificent seven" (Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA and Tesla) are up 77% over the past 12 months. But the S&P 500 Equal Weight Index, which assigns the same weight to all the stocks that are included, is up a more modest 11% for the same timeframe. Small-cap stocks are up 5%. Source: Edward Jones

Two different years

Two different reactions by growth stocks. Source: J-C Parets

Maximum 3-month total return 60/40 nominal drawdown

Source: TME, Haver

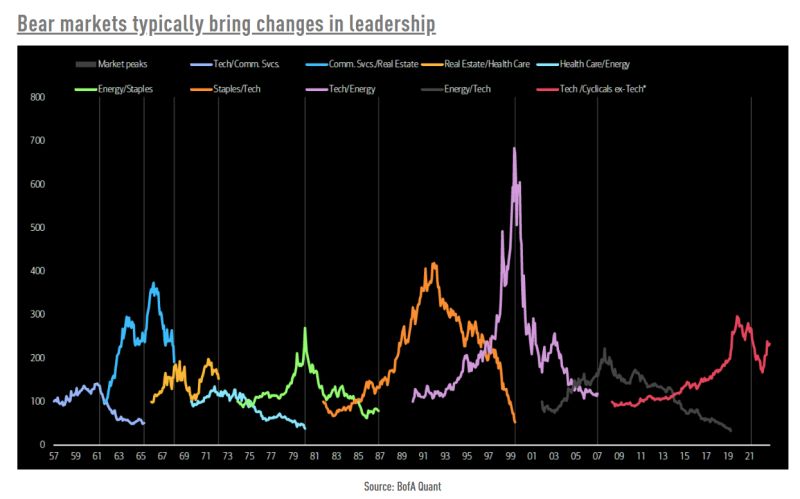

Relative performance of prior bull market leader vs. the next bull market leader (beginning of bull market = 100)

Source: BofA, TME

Investing with intelligence

Our latest research, commentary and market outlooks