Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

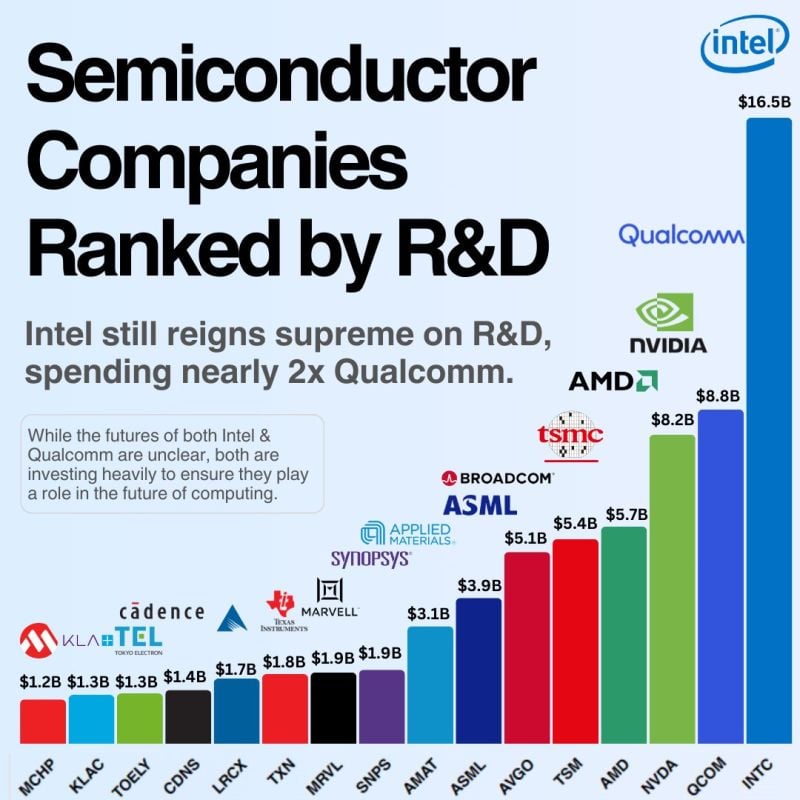

High R&D spending does NOT guarantee growth and/or high shareholder returns

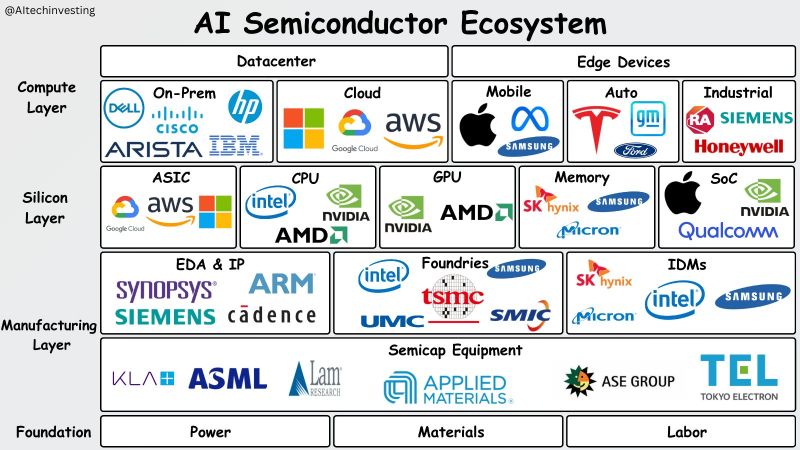

The chart below courtesey of Eric | AI & Tech Investing shows semiconductor companies ranked by R&D over the last 12 months. $INTC $QCOM $NVDA $AMD $TSM lead the way. Intel has spent over $100B in R&D over the last decade. Despite that, they have the 2nd lowest shareholder return of all these companies (see addt'l chart below). Intel has generated $52.9B in revenue over the last twelve months. A decade ago, Intel generated $52.4B in revenue. An important cautionary tale for investors: R&D doesn't guarantee growth. Source: Eric | AI & Tech Investing

Investing with intelligence

Our latest research, commentary and market outlooks