Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

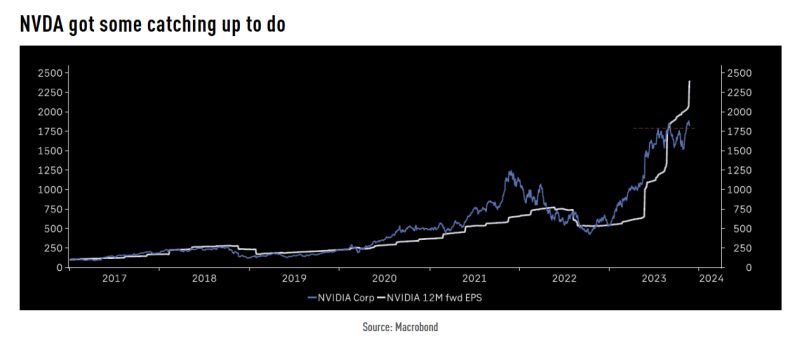

Peak Big Tech? Nvidia insiders unload shares after 220% AI rally:

Insiders sold or filed to sell about 370,000 shares last month worth ~$180mln. Zuckerberg sells 1st Meta shares in 2 years after 172% surge. Meta co-founder unloaded $185mln of stock in November. Meanwhile, Nvidia Corp. executives and directors last month sold or filed paperwork showing they intend to sell roughly 370,000 shares worth about $180 million, according to data compiled by the Washington Service. If all of the shares were sold, it would be the biggest monthly disposal by dollar value in at least six years. Source: Bloomberg, Holger Zschaepitz

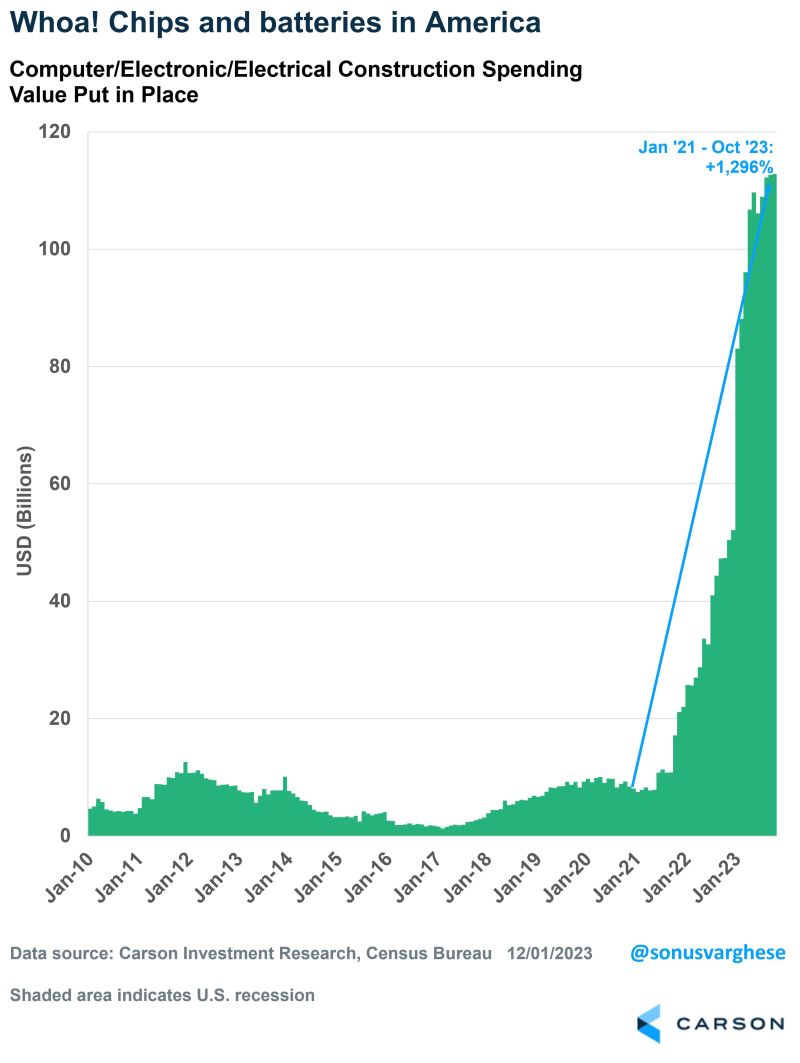

How do you say CHIPS act* in one chart?

Not all fiscal policy has to be a bad thing... this could indeed lead to a big increase in the productivity we will see over the coming years due to this. Source: Ryan Detrick, Carson * CHIPS Act -> In July 2022, Congress passed the CHIPS Act of 2022 to strengthen domestic semiconductor manufacturing, design and research, fortify the economy and national security, and reinforce America’s chip supply chains. The share of modern semiconductor manufacturing capacity located in the U.S. has eroded from 37% in 1990 to 12% today, mostly because other countries’ governments have invested ambitiously in chip manufacturing incentives and the U.S. government has not. Meanwhile, federal investments in chip research have held flat as a share of GDP, while other countries have significantly ramped up research investments. To address these challenges, Congress passed the CHIPS Act of 2022, which includes semiconductor manufacturing grants, research investments, and an investment tax credit for chip manufacturing. SIA also supports enactment of an investment tax credit for semiconductor design.

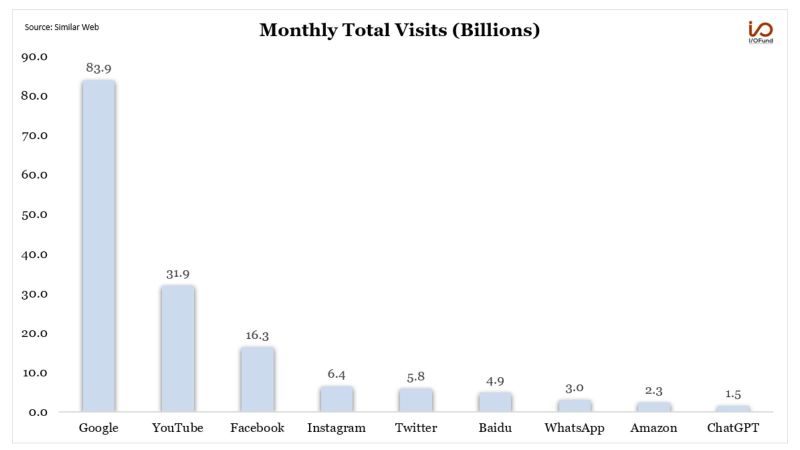

Google and YouTube continue to lead in internet traffic, amassing over 115 billion combined visits in the last month

This figure is more than triple the combined visits to Facebook's family of products, Twitter, Baidu, Amazon, and ChatGPT. Source: Beth Kindig $GOOGL $META $BIDU $AMZN $MSFT

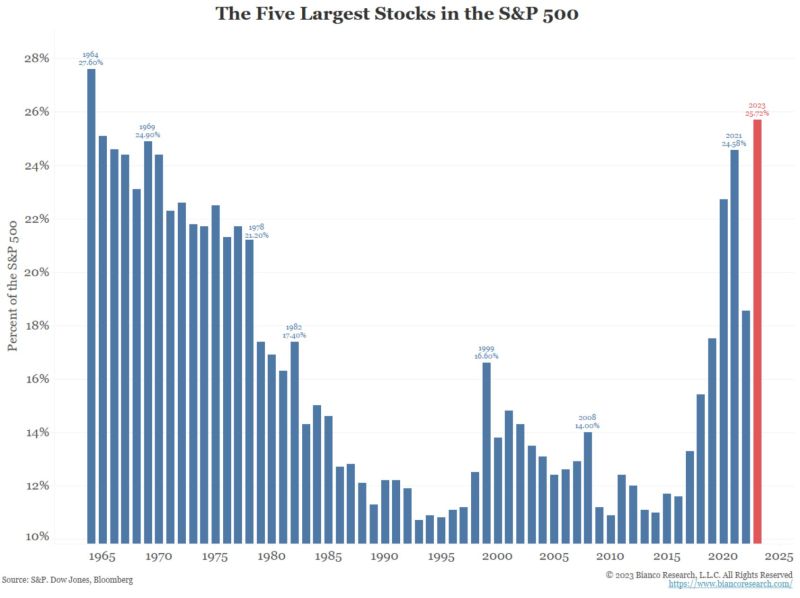

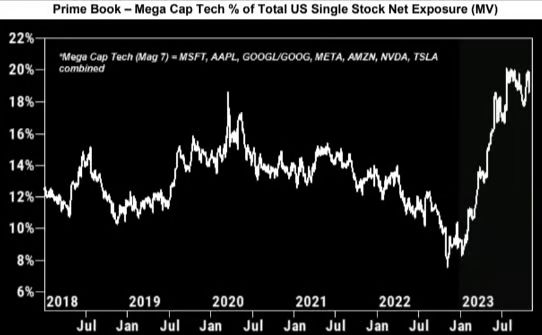

Hedge Fund exposure to the Magnificent Seven is quite high, according to data from Goldman Sachs

Source: Markets Mayhem

In the weeks leading up to his shocking ouster from OpenAI, Sam Altman was actively working to raise billions from some of the world’s largest investors for a new chip venture

(according to people familiar with the matter) Code-named Tigris, Sam planned to spin up an AI-focused chip company that could produce semiconductors that compete against those from $NVDA The goal is to provide lower-cost competition to market incumbent Nvidia and aid OpenAI by lowering the ongoing costs of running its own services like ChatGPT and Dall-E - Bloomberg Source: Cheddar Flow

Investing with intelligence

Our latest research, commentary and market outlooks