Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

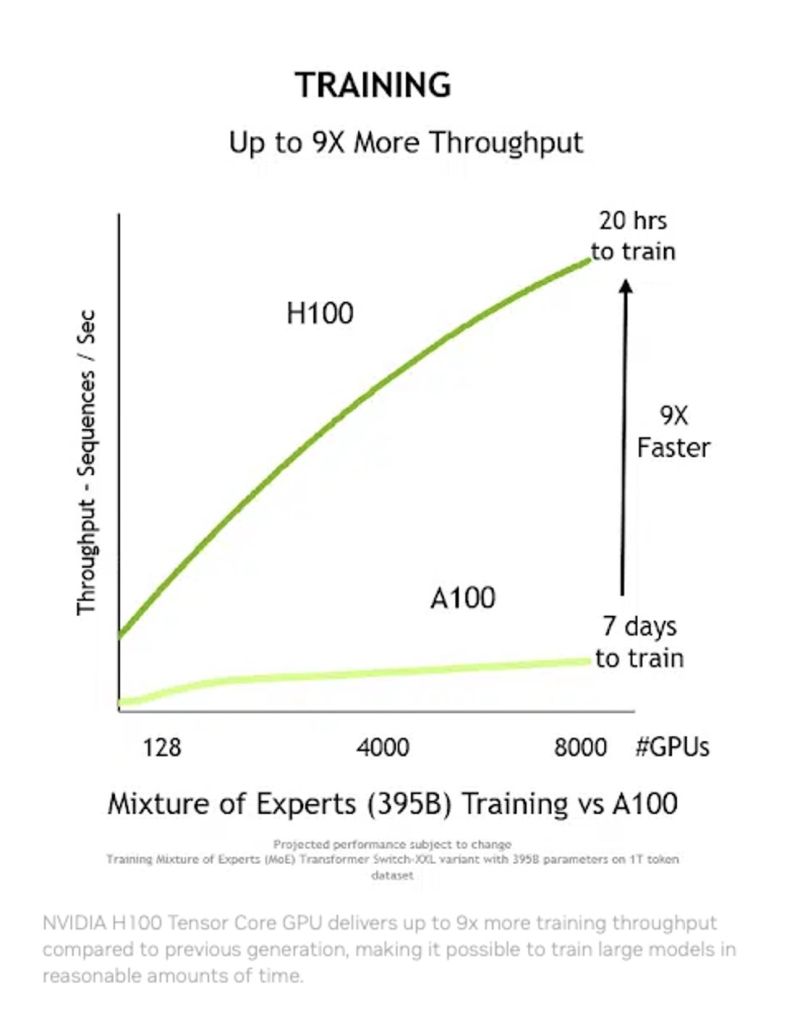

Nvidia's $NVDA data center revenue surpassed it's core business gaming thanks to two key releases, one of which could contribute upwards of $45B in revenue alone in FY24:

- The A100 GPU, released in 2020, boosted AI inference, training times and performance up to 20x over its predecessors. - The H100 GPU, released in late 2022, which is 9x faster than the A100. Source: Beth Kinding

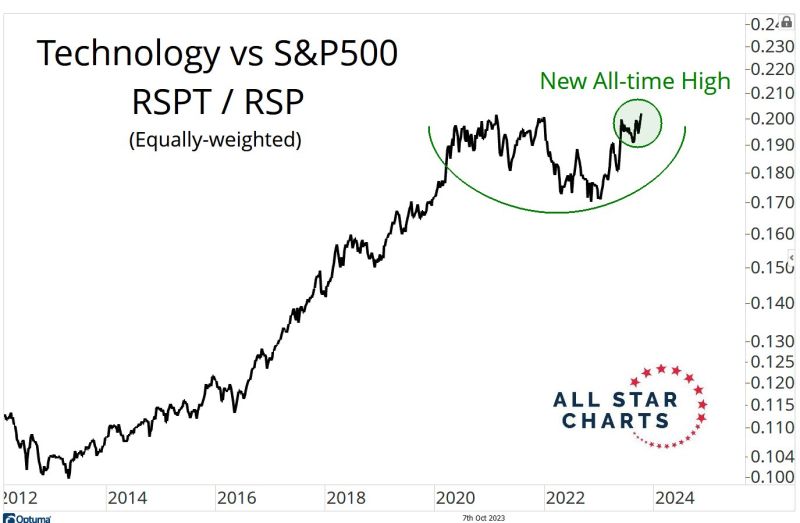

In case you missed it: technology hit a new all-time relative high

And this is on an equally-weighted basis. So it is not just 7 stocks... Source: J-C Parets

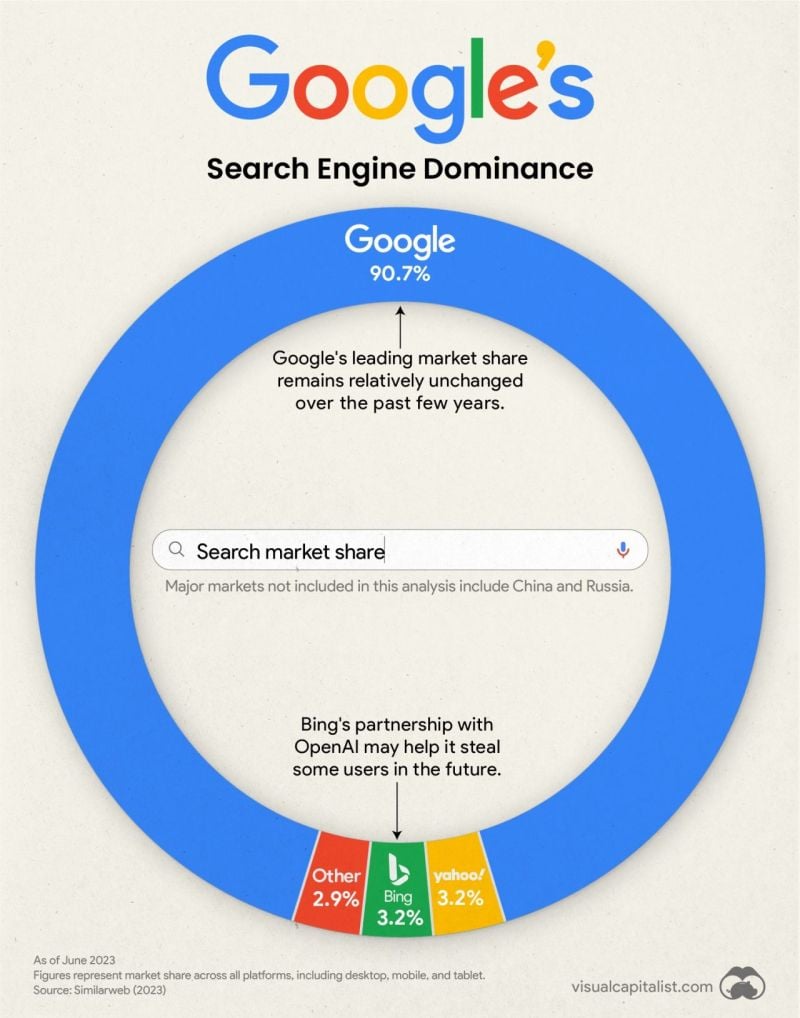

Visualizing Google’s Search Engine Market Share 🔍

https://lnkd.in/dAbVgCFJ

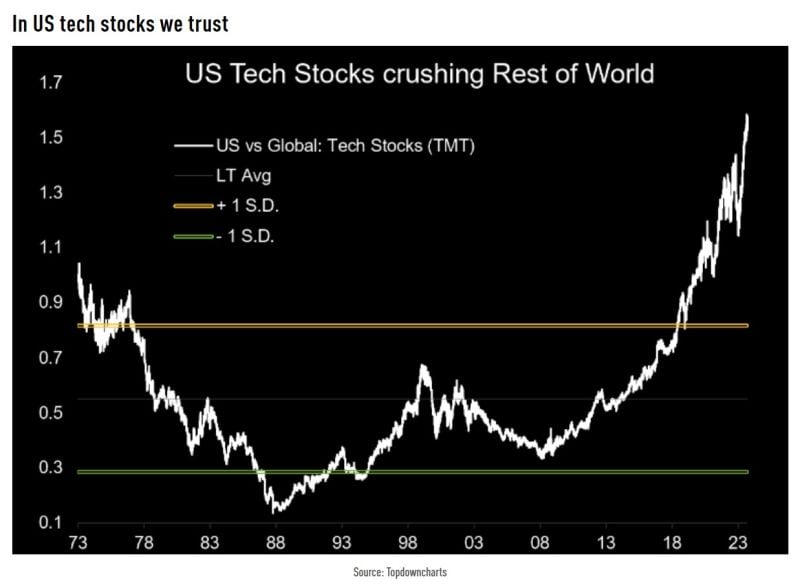

There is always a bull market somewhere...

Tesla’s recent acquisition of German wireless #EV startup puts the company at the forefront of the wireless EV charging sector. The global wireless EV charging market, currently valued at $30M, is anticipated to grow at an 89% CAGR, reaching close to $10B by 2032. This growth is largely attributed to ongoing R&D and supportive government incentives (source: Beth Kindig). So what is global wireless EV charging about? For electricvehicles, traveling range and charging process are the two major issues affecting it’s adoption over conventional vehicles. With the introduction of Wire charging technology, no more waiting at charging stations for hours, now get your vehicle charged by just parking it on parking spot or by parking at your garage or even while driving you can charge your electric vehicle

Over the years, 'soft consumption' such as entertainment has gained lots of traction, thanks to on-demand streaming services

Source: Genuine Impact

Investing with intelligence

Our latest research, commentary and market outlooks