Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

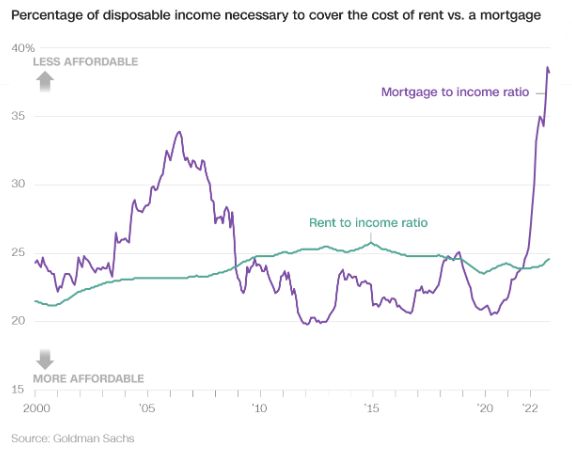

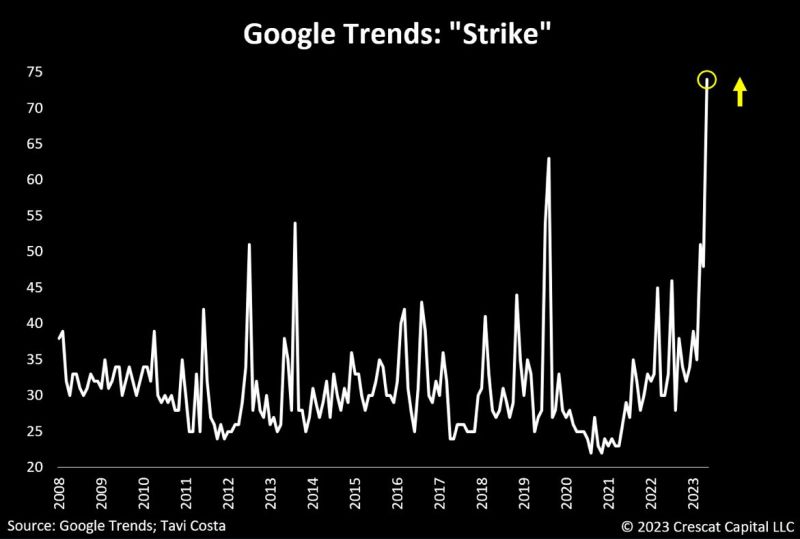

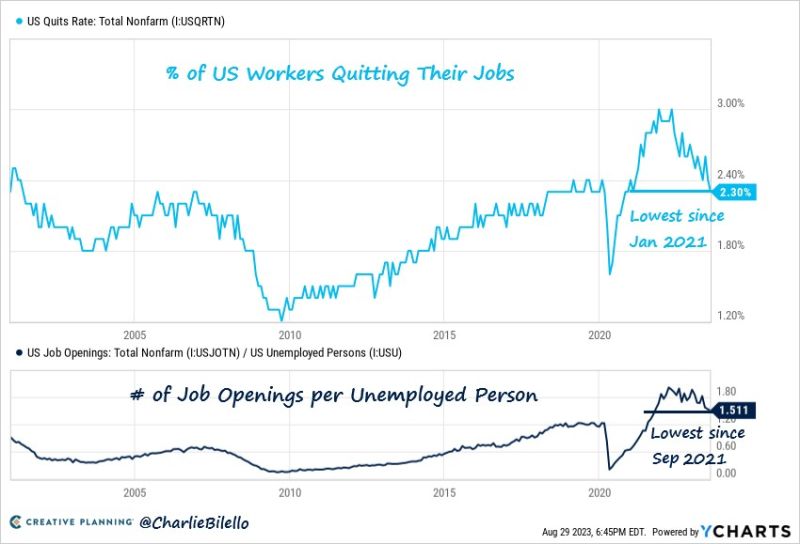

Is wage pressure in the US here to stay?

A highlighted by Tavi Costa, the word "strike" recently surged to record levels on Google trends. This surge implies a growing pressure among workers to secure improved compensation deals with their employers. Labor strikes are becoming a regular occurrence in society, reminiscent of their prevalence in the 1970s. The rising cost of living is placing significant pressure on wages to rise. Source: Crescat Capital, Google Trends

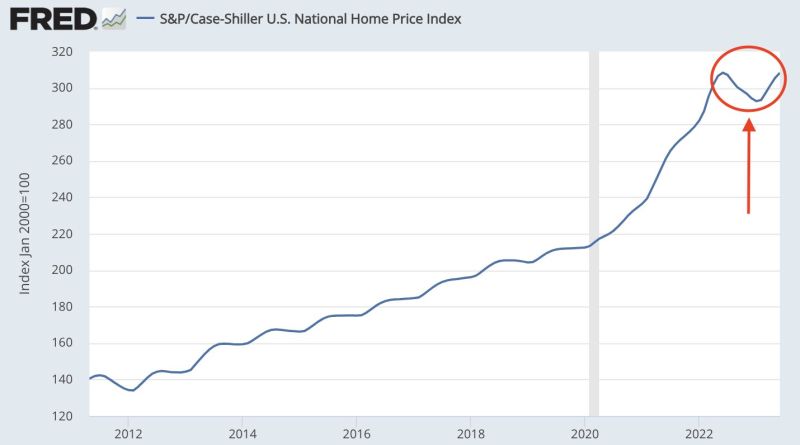

Despite surging mortage rates, US home prices are RISING to ALL-TIME-HIGHS

Higher rates are having an INVERSE effect on price. Rather than prices falling with higher rates, they are actually rising. Why is this happening? As explained by The Kobeissi Letter, as rates rise, existing home sales are falling, now down 16.6% at their lowest since 2010. Borrowers are locked-in to sub-3% mortgages and do not want to sell their homes to get a 2.5x higher rate. We need LOWER rates for LOWER prices... Truly a historic occurrence... Source: FRED, The Kobeissi Letter

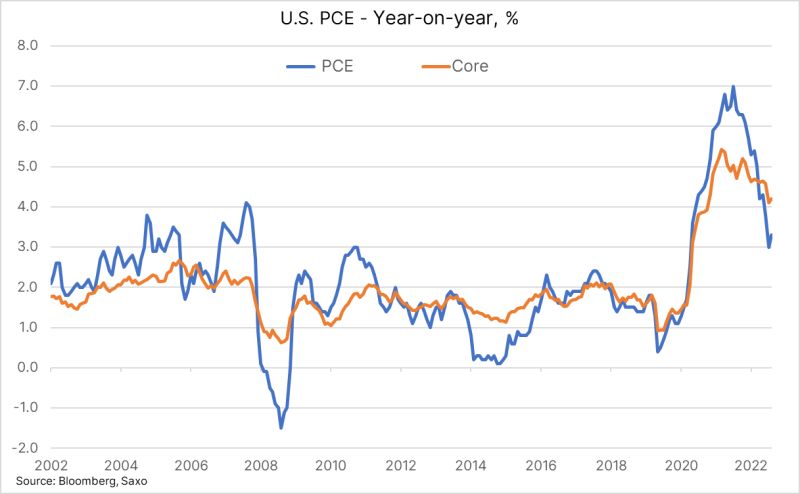

PCE Deflator, the FOMC's favorite inflation number, show a rise as expected with the YoY at 3.3% (from 3%) and the core at 4.2% (from 4.1%)

Jobless claims at 228k (235k expected) showing continued strength ahead of Friday's NFP report Source: Ole S.Hansen

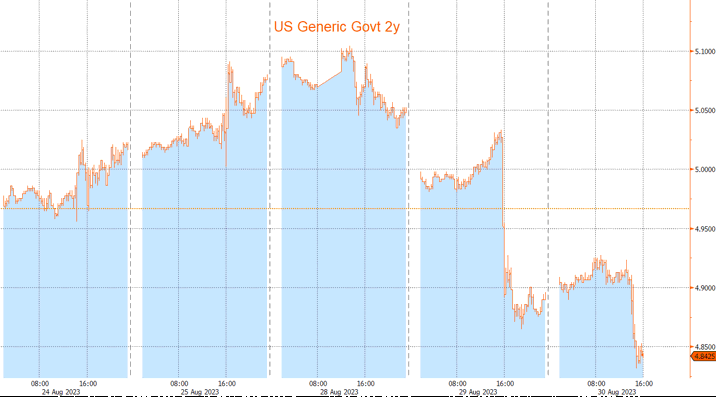

Treasury yields extend retreat from year’s highs after GDP data

Short-maturity yields led the move, with two-year yields declining about five basis points to around 4.85%, and most yields reached the lowest levels in more than two weeks. The

benchmark 10-year note’s yield touched 4.085%, the lowest level since Aug. 11.

Following downward revisions to the economy’s Q2 growth rate and related inflation measures, swap contracts tied to Fed meeting dates priced in slightly less than a 50% chance of another rate increase this year. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks