Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

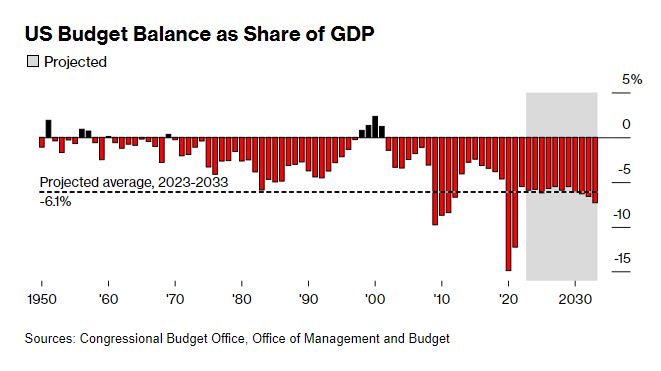

US Budget Deficits Are Exploding Like Never Before

Some economists and investors warn that the Biden administration’s fiscal spending—it’s pouring hundreds of billions of dollars into programs to bolster domestic manufacturing of electric cars and semiconductors, and to repair roads and bridges—could rekindle inflation and make it hard for the Fed to dial back its rate hikes. Source: Bloomberg

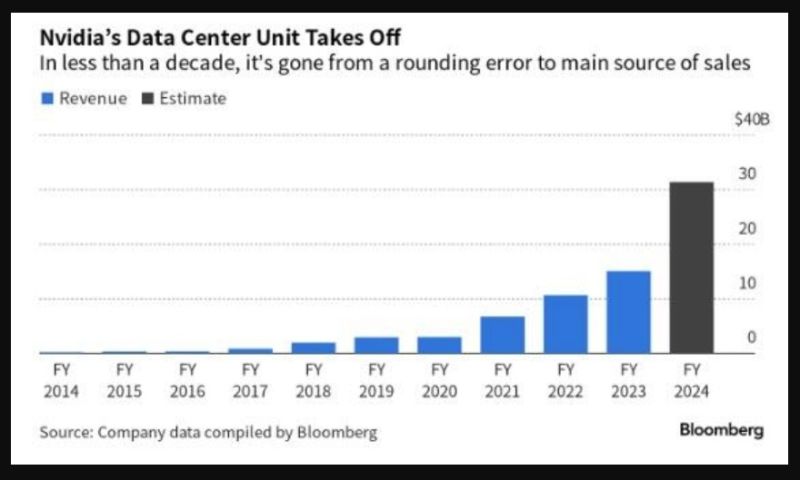

Nvidia ($NVDA) data center revenue in 2Q was $10.32 billion vs. $3.81 billion y/y, beating estimates of $7.98 billion

In less than a decade, it's gone from a rounding error to the main source of sales. Source: Bloomberg

The Nvidia share shows very well that analysts usually lag behind the share price with their price targets

Source: HolgerZ, Bloomberg

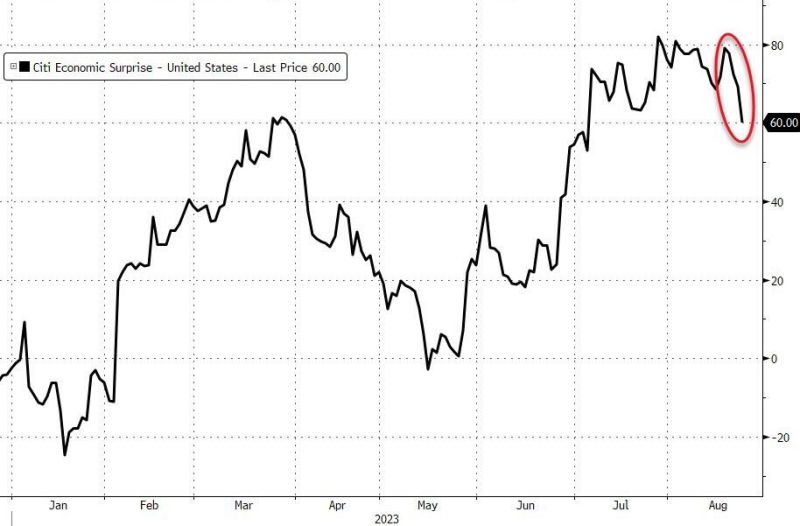

Jackson Hole might NOT be the key market driver

Indeed, nvidia ($NVDA) results tonight could be THE main market event this week given the weight of Nvidia in the main #us #equity indices (4.6% of Nasdaq 100 and 3.1% of S&P 500) and the level of market expectations in terms of top-line growth (68% QoQ) and gross margins (+400bps improvement). Moreover, the Street (and algos) will count the number of times that Jensen says "AI" during the conf call this evening... Source: Markets Mayhem

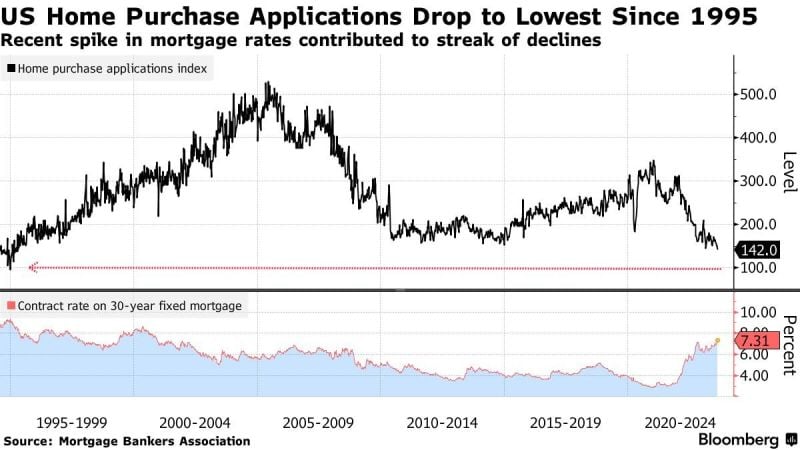

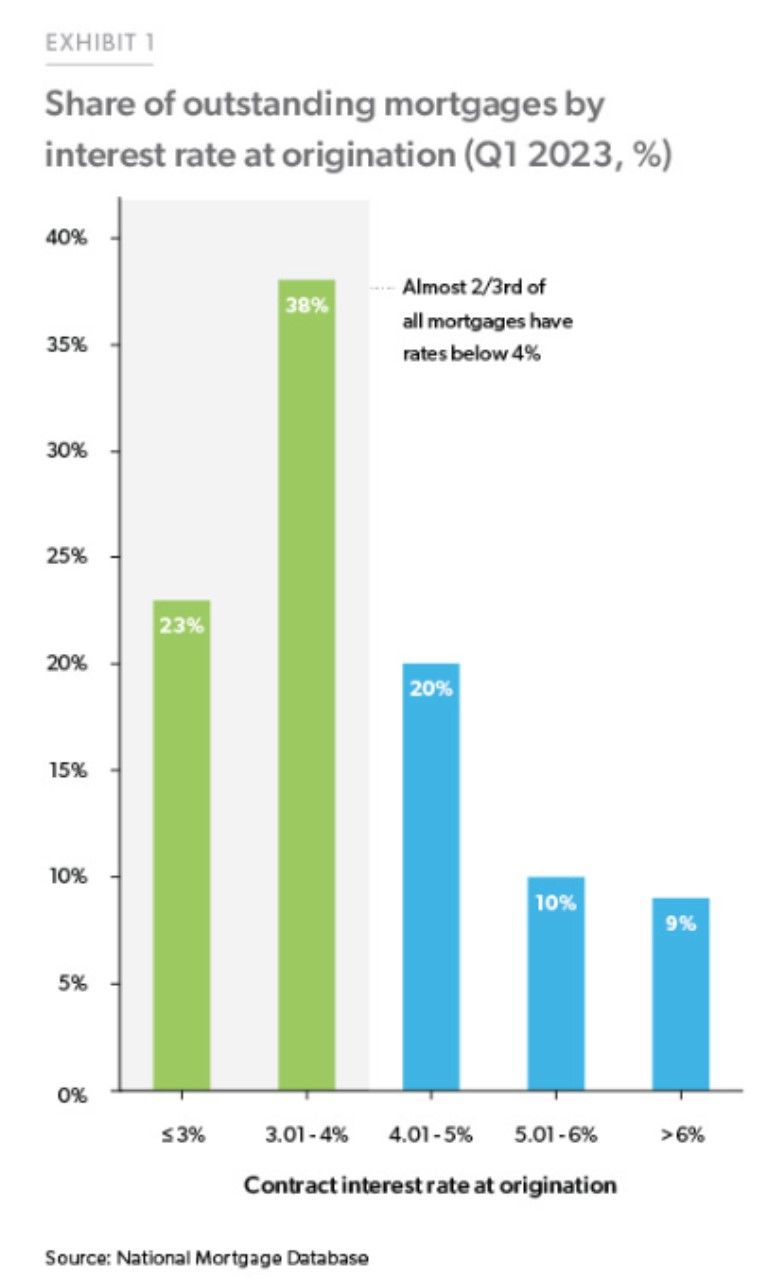

Over 60% of outstanding US mortgages have an interest rate below 4%. Current average 30y mortgage rate is north of 7.5%...

This is the 1 factor driving the limited housing supply as many of these homeowners can't afford to move... Source: Charlie Bilello, National Mortgage Database

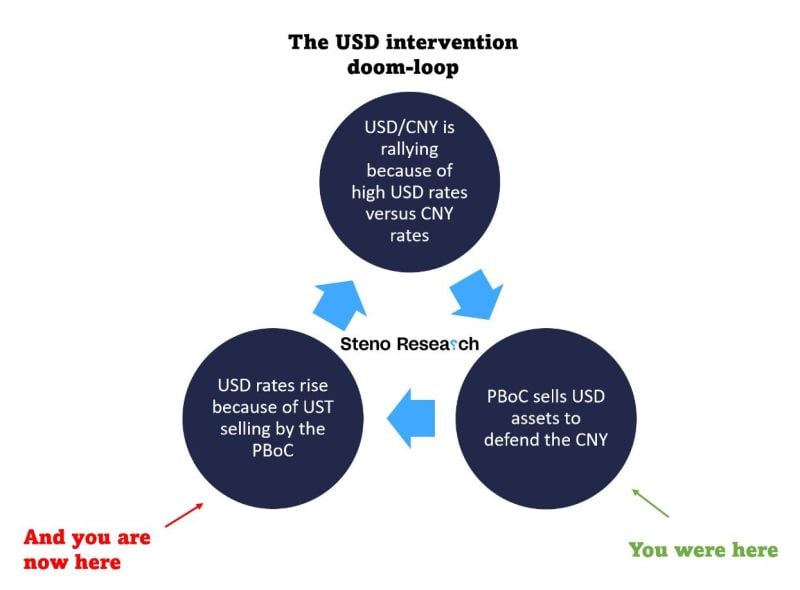

Nice one by Steno research

While there are some fundamental reasons for US Treasury yields to keep rising (check out the Atlanta Fed Nowcast model poiting towards nearly 6% annualized real GDP growth in 3Q), what is currently going in China probably has some impact as well Source: Stenio research

Investing with intelligence

Our latest research, commentary and market outlooks