Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

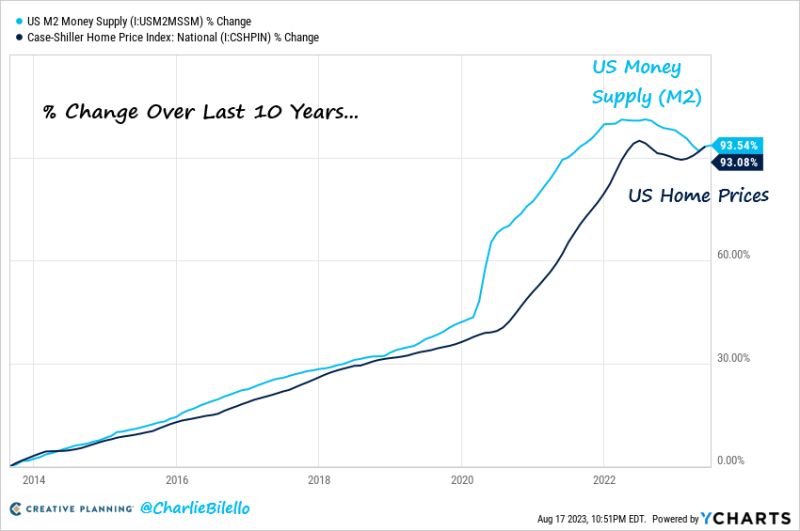

"inflation is always and everywhere a monetary phenomenon." - Milton Friedman

Source: Charlie Bilello

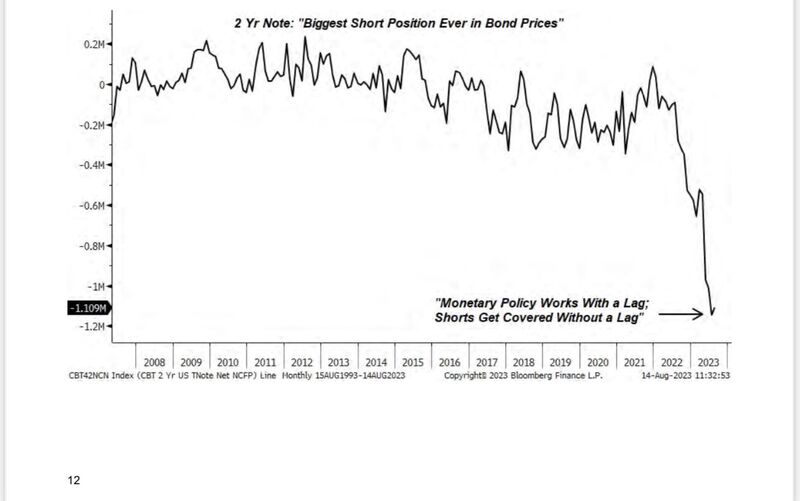

A tricky time for US government bonds...

US Treasuries are facing multiple headwinds - economic strength (Atlanta Fed's real-time GDP growth forecast is tracking close to 4% for the third quarter), an uptick in energy prices and FED QT. But another headwind is fading demand stemming from historical buyers of US Treasuries: 1- China US Treasury holdings just hit a 14-year low at less than $850bn 2- Saudi Arabia’s stockpile of US Treasuries fell to the lowest level in more than six year (less than $100B) 3 - As Japanese long-term yields rose (due to a tweak in their #monetarypolicy), the largest foreign holders of US Treasuries, Japanese investors, became less interested in US bonds and asked for a premium. Source cartoon: GISreportonline

As highlighted by Caleb Franzen, the relative chart of SP500 / M2 money supply is trading at the exact same level as July 2007

This range also coincided with market peaks in: • Feb.'20 • Q4'21 While the S&P 500 itself has gained +181% in the past 16 years, $SPX/M2 has made no progress. Should this be seen as a logical resistance zone?

10-Year Treasury Yield is now 4.28%, the highest level since October 2007

From a total return perspective, the 10-Year Treasury Bond is now down 1% in 2023, on pace for its third consecutive negative year. With data going back to 1928, that's never happened before. Source: Charlie Bilello

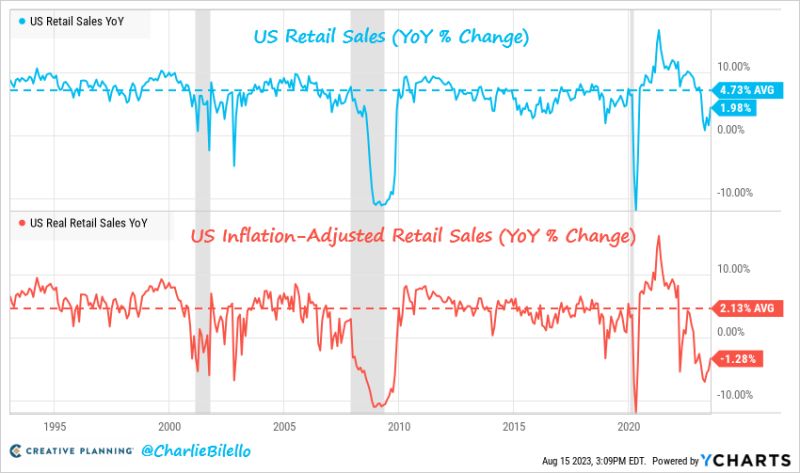

After adjusting for inflation, US retail sales fell 1.3% over the last year, the 9th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 2% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

US stock market current mood in one picture

Source: Heisenberg - Mr_Derivatives

Investing with intelligence

Our latest research, commentary and market outlooks