Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

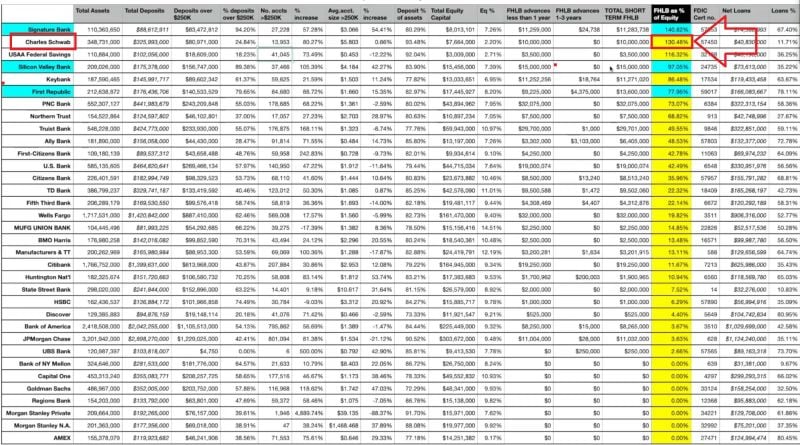

In case you missed it... Charles Schwab owes 130% of their total equity capital to short duration FHLB* loans that have to be paid back soon

Total assets $350 billion... Source: FinanceLancelot * What Is the Federal Home Loan Bank System (FHLB)? The Federal Home Loan Bank System (FHLB) is a consortium of 11 regional banks across the U.S. that provide a reliable stream of cash to other banks and lenders to finance housing, infrastructure, economic development, and other individual and community needs. (source: Investopedia)

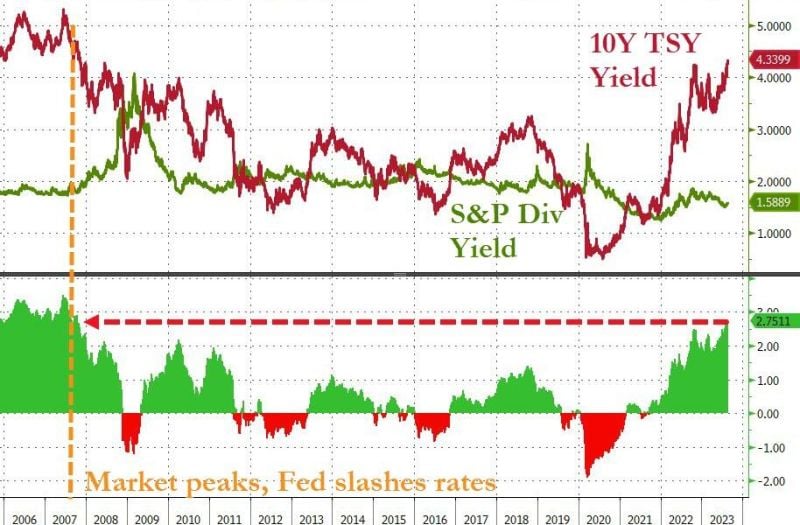

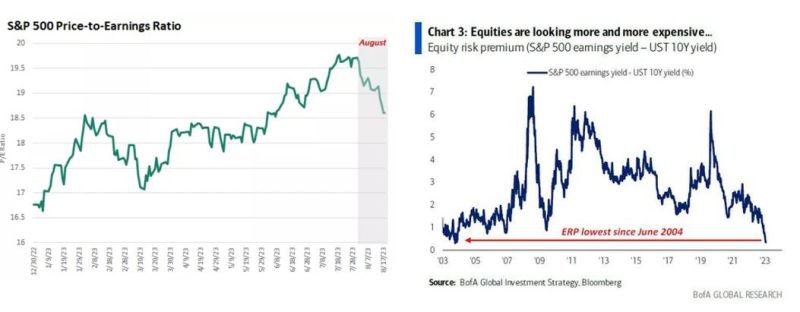

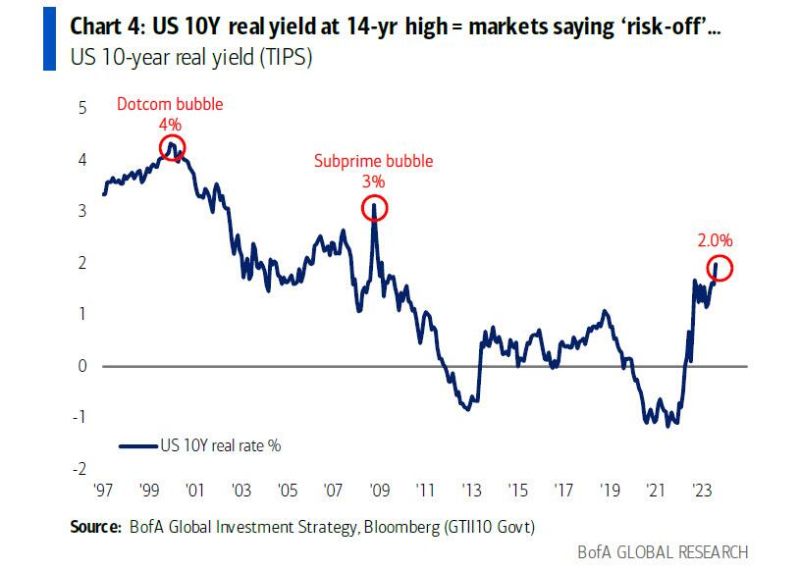

US equities: absolute & relative valuations offer a different perspective

•On the positive side, market (absolute) valuations have improved as stock prices have dipped and earnings have held up •On the negative side, the rise in bond yields imply a lower Equity Risk Premium (ERP), now at 39bps (19-year low), i.e equities are more expensive vs. bonds than at the start of the Summer... Source: Edward Jones, BofA

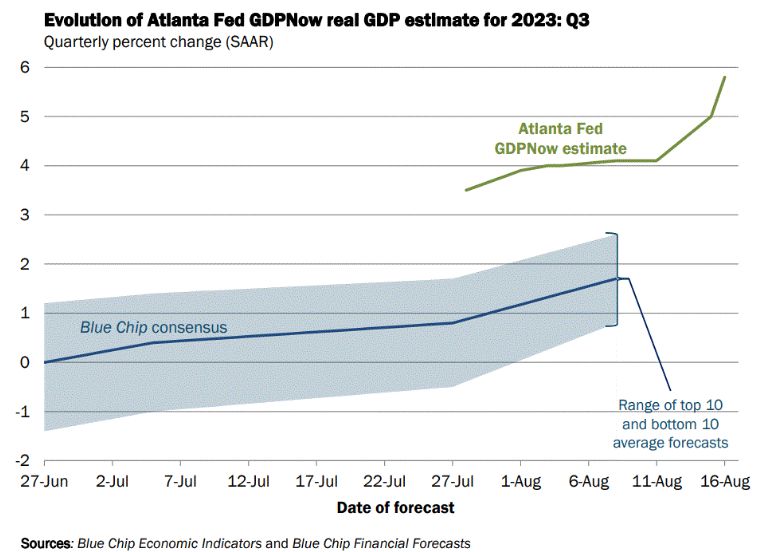

Ahead of Jackson Hole this week, Atlanta Fed GDP Now for US real GDP in 3Q is at 5.8%...

Way ahead of Street consensus and with a clear acceleration since early August...

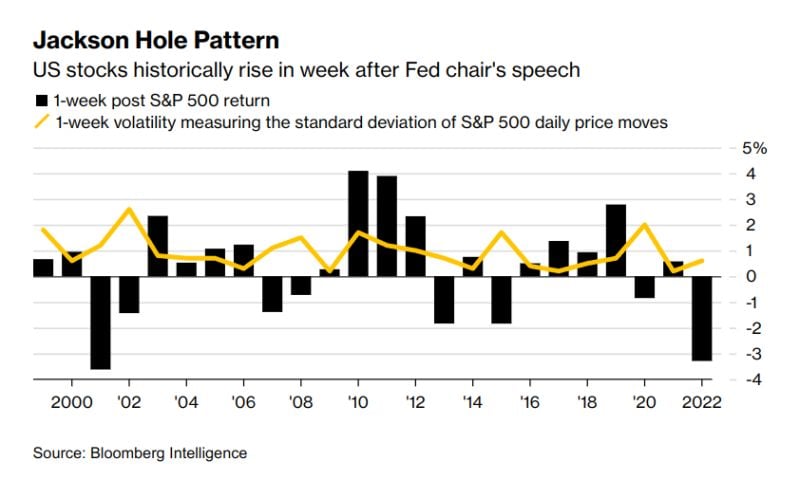

More often than not, stocks rise the week after Jackson Hole Will this year follow the pattern, or will it be one of the outlier years with a sell-off?

Source: Markets & Mayhem, Bloomberg

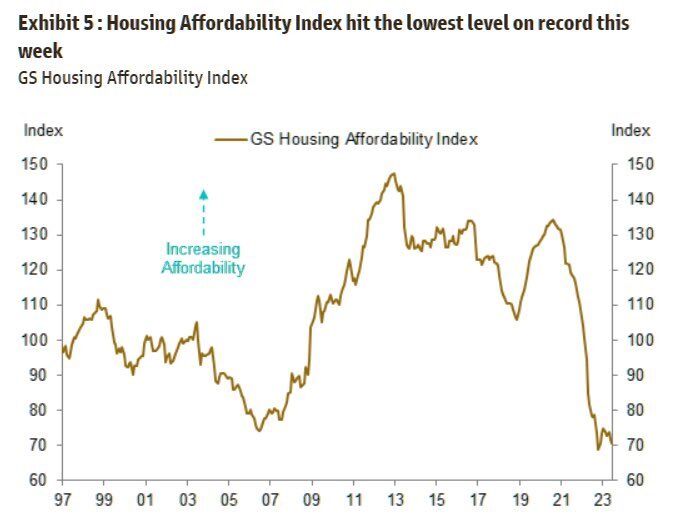

The US housing market affordability index is now ~10% BELOW the 2006 lows.

Even if prices fell 30%, housing affordability would still be above pre-pandemic levels. It’s a tough time to be a homebuyer in the US. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks