Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

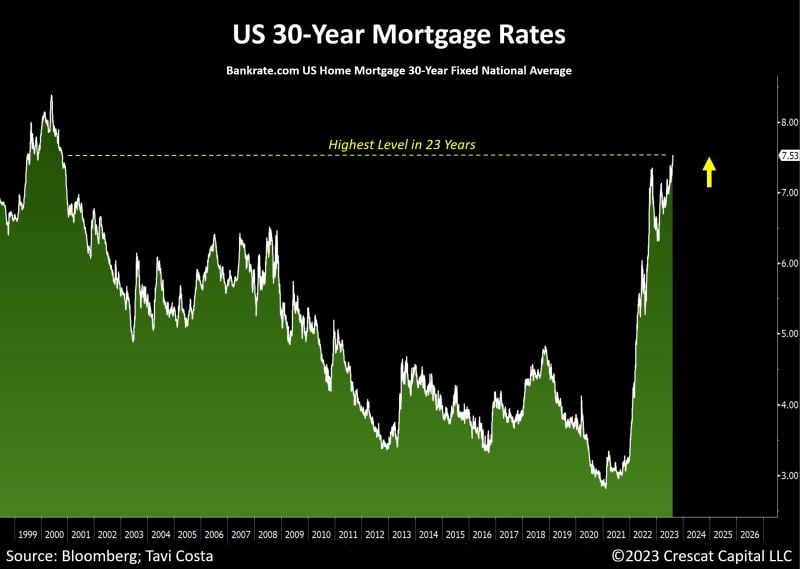

US average mortgage rates just surged above 7.5% for the first time in 23 years

There are some reasons why US house prices haven’t crashed: 1. Buyers can’t afford the rates; 2. Sellers would be insane to sell a home with a significantly lower rate to buy another at 7.5%. Market is frozen. The economy is currently experiencing a significant tightening of financial conditions, largely driven by the persisting fragility in the Treasury market. The bill will come due at some point. Source: Crescat Capital, The Wolf of All Streets

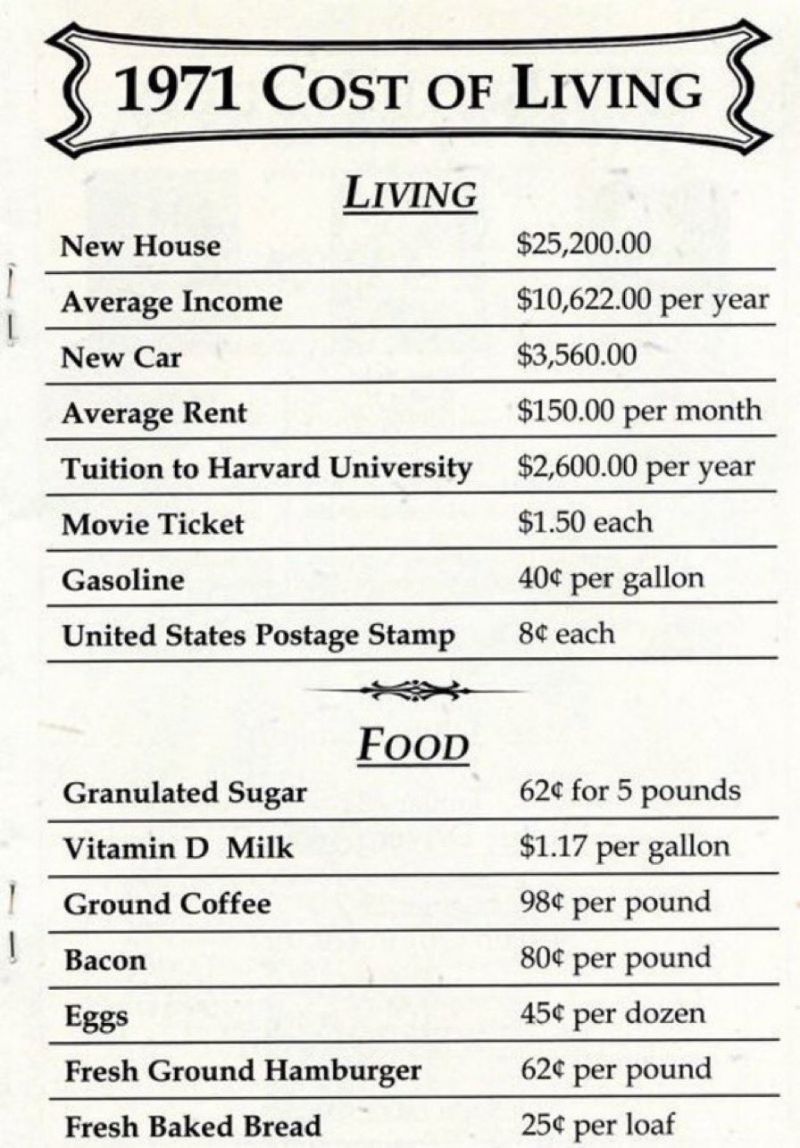

1971 vs NOW

The average U.S. annual income in 1971 paid off a house in ~2.5 years, could buy 3 new cars in a year, send 4 kids to Harvard in a year and easily afford food, shelter, necessities and entertainment. Does the older generation understand the difficulties the young face today? Source: Gabor Gurbacs

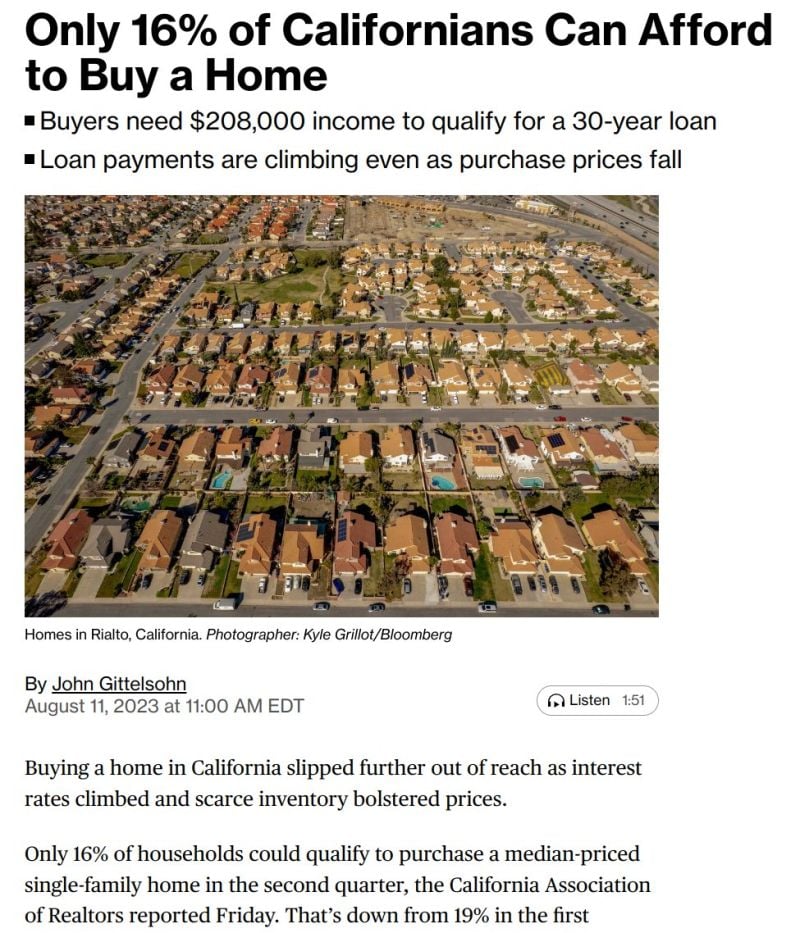

Only 16% of Californians can afford to buy a home, a situation that is unfortunately not unique to the state, but where they are leading the way

Source: Markets & Mayhem, Bloomberg

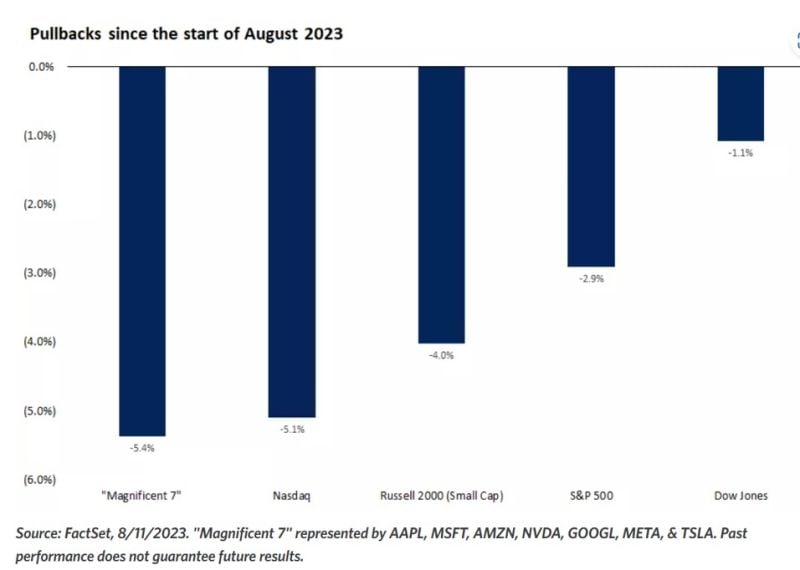

Within US equities, Large-cap technology stocks have corrected the most since the start of August as shown by declines in the "Magnificent 7" and NASDAQ index.

Source: Edward Jones

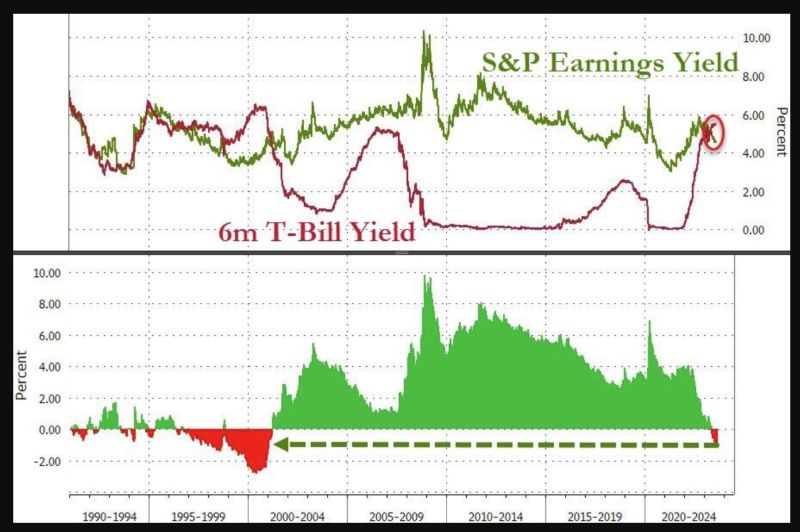

US money-market assets have reached a new record of $5.5 trillion

US Treasuries are on course for a record year of inflows as investors chasing some of the highest yields in months pile into #cash and #bonds, according to Bank of America Corp. strategists. Cash funds attracted $20.5 billion and investors poured $6.9 billion into bonds in the week through August 9, strategists led by Michael Hartnett wrote in a note, citing data from EPFR Global. Meanwhile, US #stocks had their first outflow in three weeks at $1.6 billion. Flows into Treasuries have reached $127 billion this year, set for an annualized record of $206 billion, BofA said. The buoyant demand shows how alluring fixed-income markets remain even as the bond rally and economic slowdown many were predicting last year has failed to materialize. The yield on 10-year US Treasuries was trading at around 4.09% on Friday, up from a low of around 3.25% in April, and near a 15-year high touched last year. Source: Bloomberg, Lisa Abramowicz

Investing with intelligence

Our latest research, commentary and market outlooks