Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

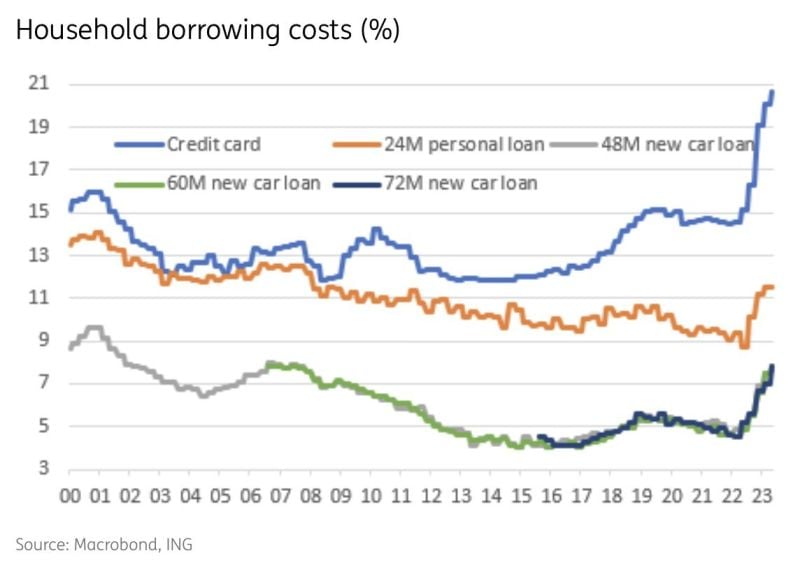

In the US, interest rates on household items are skyrocketing

In just 1 year, the average interest rate on credit card debt has gone from 14% to 21%+. New car loan rates went from 4% to 8% while used car loan rates are at 12%+. Mortgage rates are at a fresh high of 7.2%, up from 2.7% in 2021. Will the US consumer be able to absorb all these debt servicing costs? Source: The Kobeissi Letter, Macrobond, IN

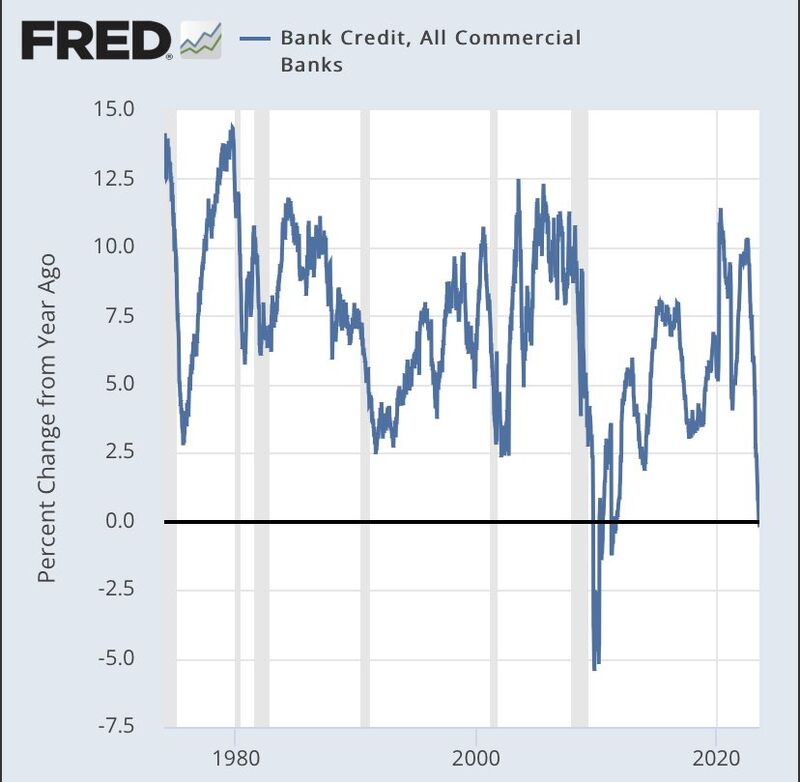

Moody's has cut credit ratings of several small to mid-sized US banks on Monday

Moody's said it may downgrade some of the nation's biggest lenders, warning that the sector's credit strength will likely be tested by funding risks and weaker profitability. This does not come as a surprise to us as US banks are facing several headwinds at the time being: 1) Inverted yield curve and lower trading / M&A activity weighing on profitability; 2) Deteriorating loan book quality due to Commercial real estate exposure but also US consumers starting to being hit by rising debt costs (credit card, mortgages, etc.); 3) Deposits withdrawals. Source: reuters

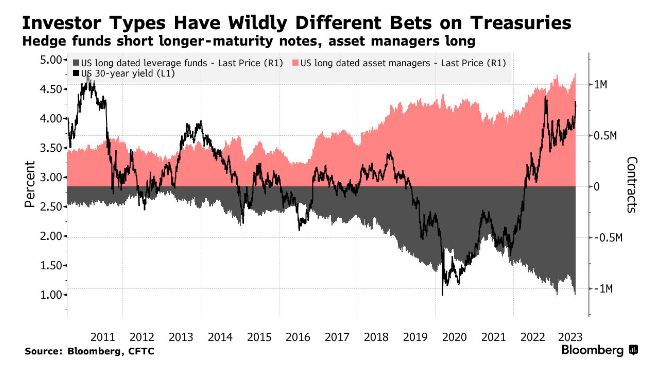

One asset class - two different bets => hedge funds are shorting US treasuries at historic levels while asset managers are doing the exact opposite 👀

Source: Barchart, Bloomberg

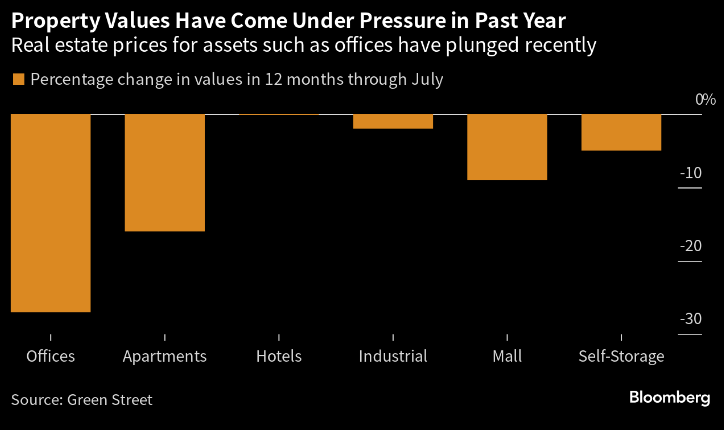

US Property loans are so unappealing that banks want to dump them

Lenders including GS and JPM. have been trying to sell debt backed by offices, hotels and even apartments in recent months, but many are finding that tidying up loan books is no easy feat when concerns about commercial real estate have surged.

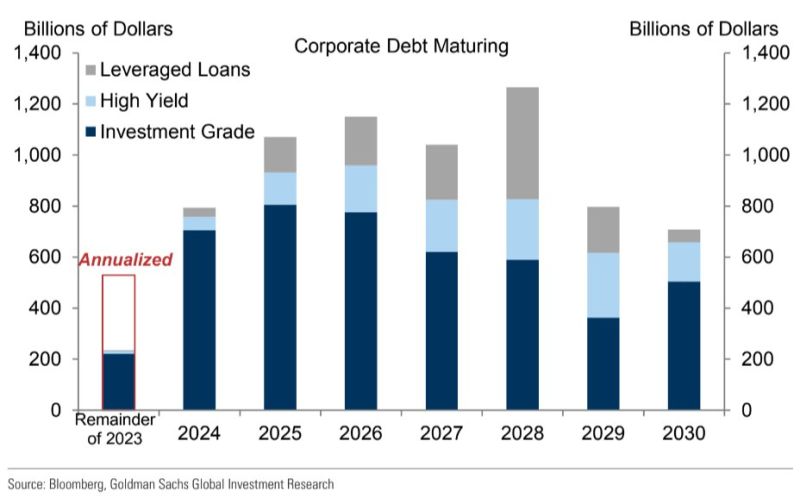

Maturing loans that will need to be refinanced is a major concern in a high-interest-rates environment. Source: Bloomberg, Green Street

US Bank credit YoY is now -0.2% YoY. First time negative since 08 (Keep in mind that in the US about 25% of credit is securities and the other 75% loans)

Source: FRED, Adem Tumerkan

Investing with intelligence

Our latest research, commentary and market outlooks