Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

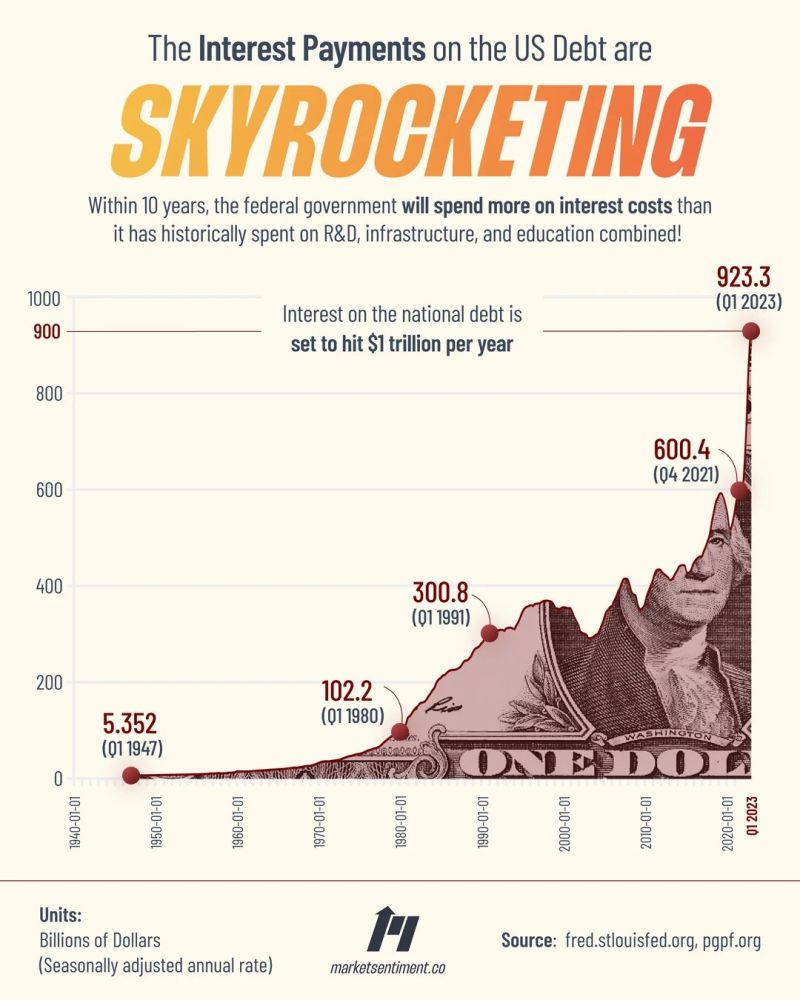

Interest payments on US government debt are soaring

source: Markets & Mayhem

Fed QT accelerates. Fed balance sheet shrank $91bn in July, -$759bn from peak, biggest drop ever to $8.2tn, lowest level since July 2021

Fed has now shed 22.3% of the Treasury securities it bought during pandemic QE. Fed's total assets now equal to 30.6% of US's GDP vs ECB's 53%, BoJ's 130%. Source: HolgerZ, wolfstreet.com

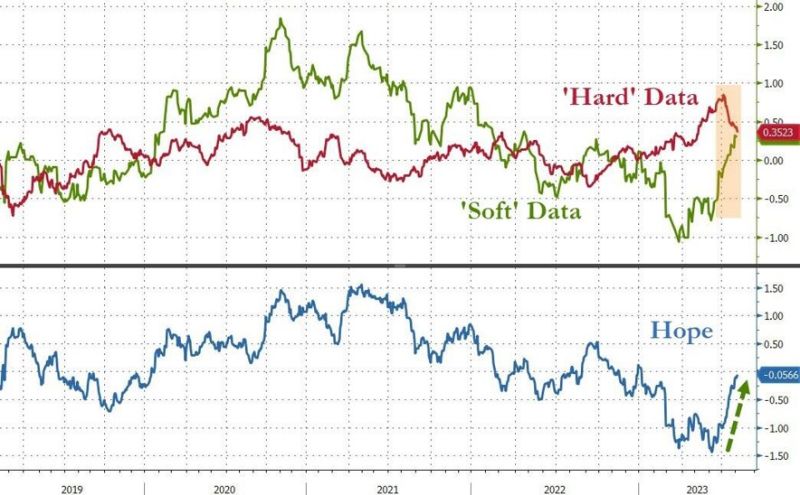

The Citi US Economic Surprise Index is at the highest levels since early 2021

That being said, there has been some divergence recently between "hard" and "soft" data. Indeed, 'Hope' has been in charge of macro data recently with 'soft' survey data surging back in its mean-reverting manner as 'hard' real data has been fading (led down by industrial, personal finance, and housing data)... Source: Bloomberg, www.zerohedge.com

Another big week ahead for us earnings

$PLTR $DIS $BABA $RIVN $AMC $UPST $SMCI $UPS $LCID $LLY $TWLO $PLUG $MARA $TTD $NVO $DDOG $RBLX $NVTA $CELH $SOUN $IONQ $TSN $GOLD $SWKS $WYNN $LAZR $MGNI $APPS $CHGG $ARRY $SONY $DNA $BRK.B $MPW $TOST $PARA $LYFT $BROS $LI $SWAV $FIVN $CYBR $CPA $CGC $VTRS $PENN $RNG $NVEI $CLOV $OKE Source: Earnings Whispers

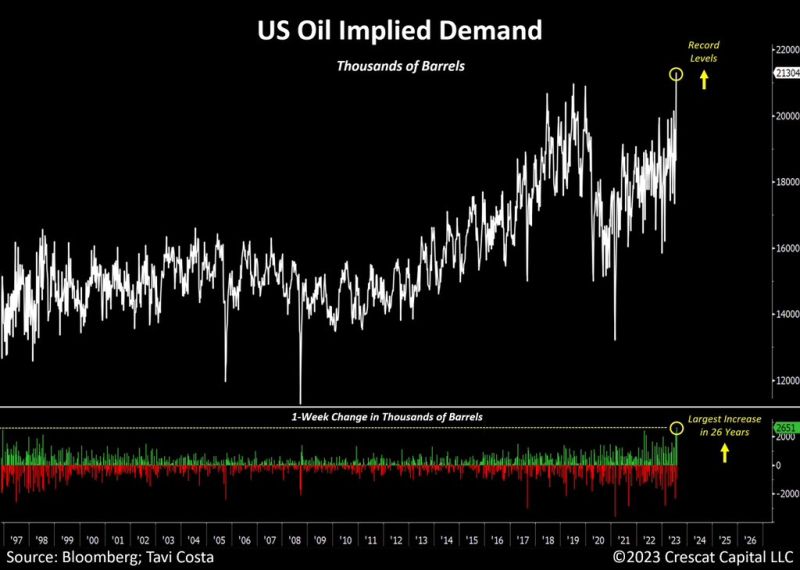

As highlighted by Tavi Costa, the implied demand for oil just surged to all-time highs

It was the largest weekly increase in 26 years. Meanwhile, US oil production remains ~7% below pre-pandemic levels with total operating rigs starting to contract for the first time in 3 years. Source: Bloomberg, Crescat Capital

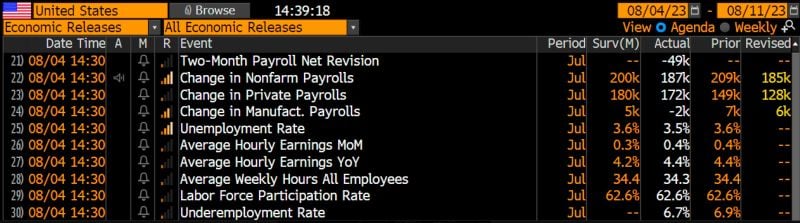

A mixed message from the July US jobs report: the US economy added 187k jobs according to Establishment survey, a tiny bit below Street’s +200k forecast

According to the Household survey, the number of employed people rose by 268k. Because of this 268k number, unemployment rate dipped to 3.5%, down from 3.6% in June and below estimated 3.6%. Wages ran hot, coming in at +4.4% YoY (vs Street +4.2% and vs +4.4% in June). Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks