Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

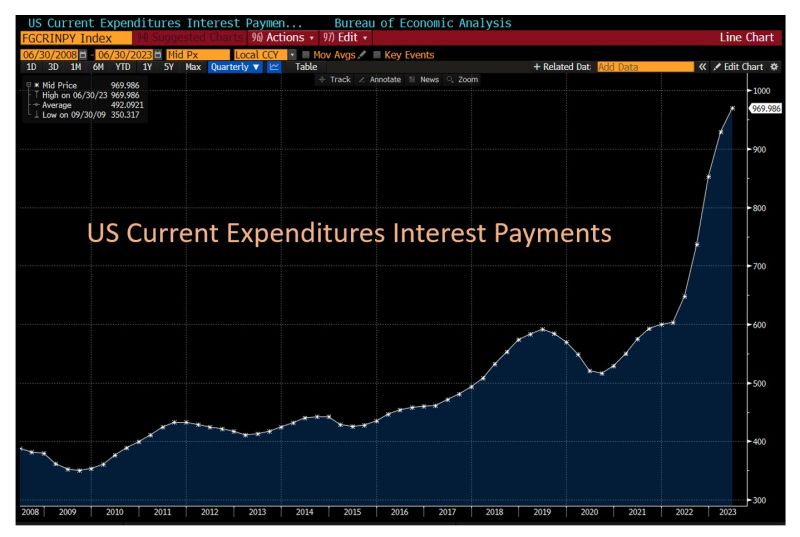

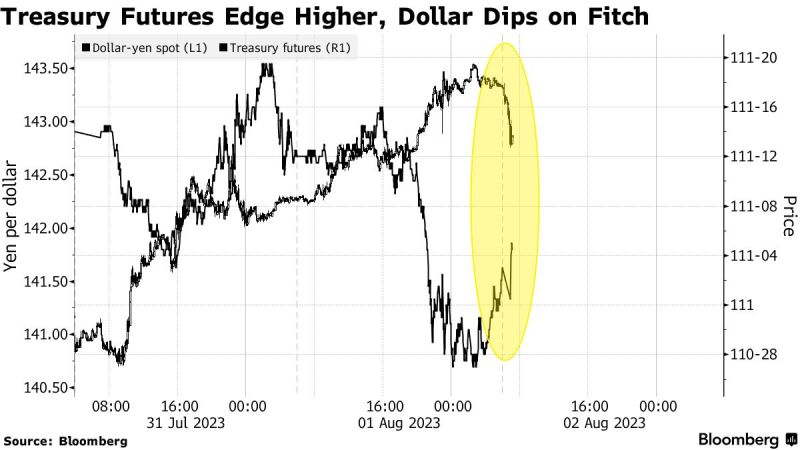

US interest expenses have surged by about 50% in the past year, to nearly $1 trillion on an annualized basis

Source: Lisa Ambramowicz, Bloomberg

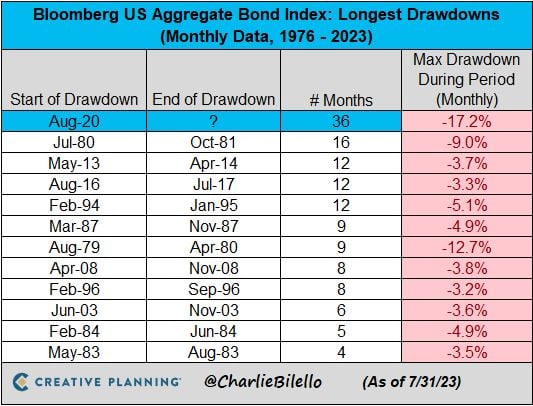

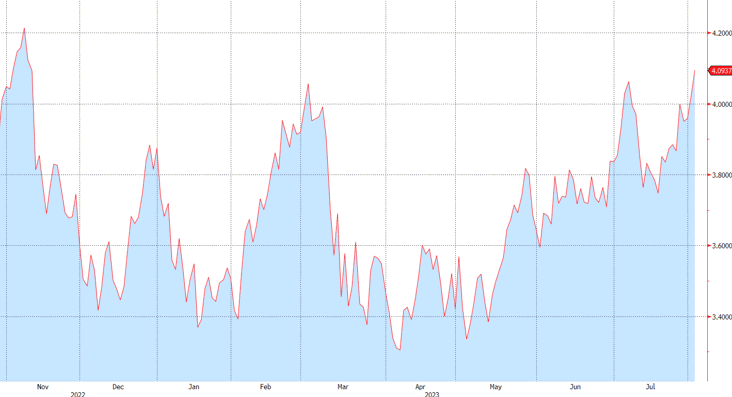

US Treasury 10-Year yield increases to highest level since november 2022

Treasuries fell across the curve, pushing the 10-year yield to the highest level since November as traders digest an uptick in US government issuance, a sovereign credit downgrade and a stronger-than-expected private job report.

Source: Bloomberg

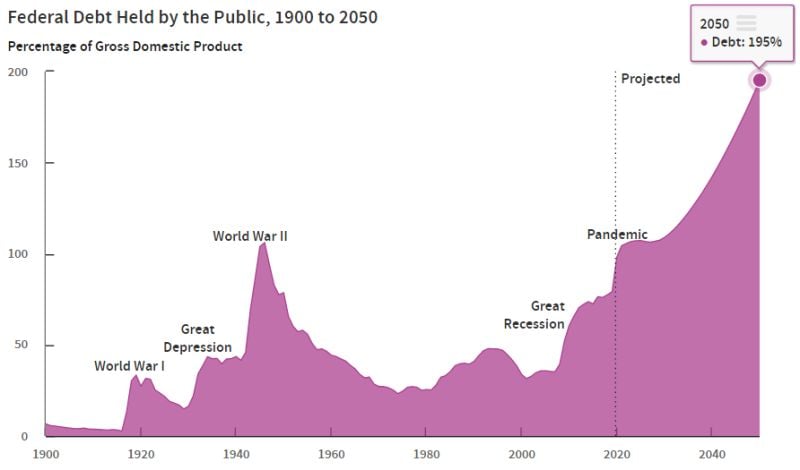

Total US debt levels are expected to rise from 98% of GDP in 2023 to 118% of GDP in 2033

By 2053, Debt-to-GDP in the US is expected to hit an alarming 195%. Hopefully yesterday's downgrade of the US credit rating brings some more attention to this topic. Source: The Kobeissi Letter

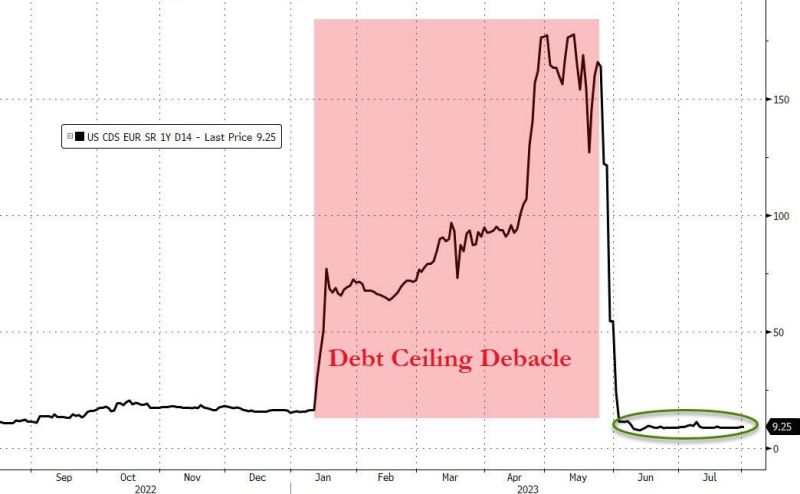

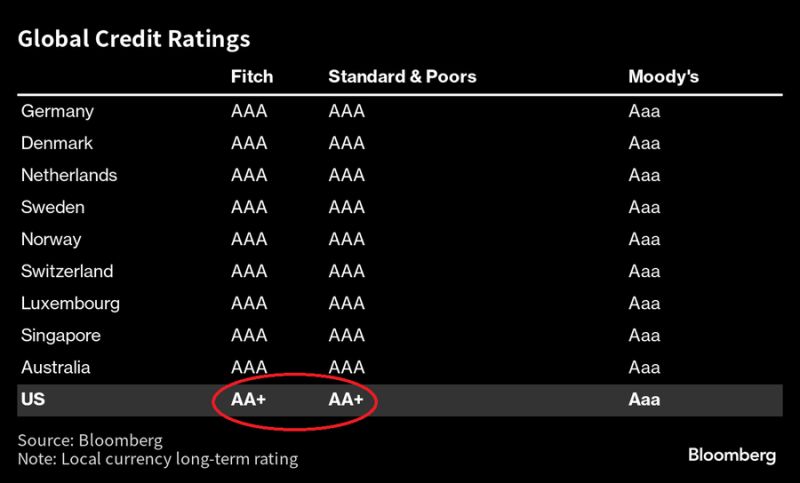

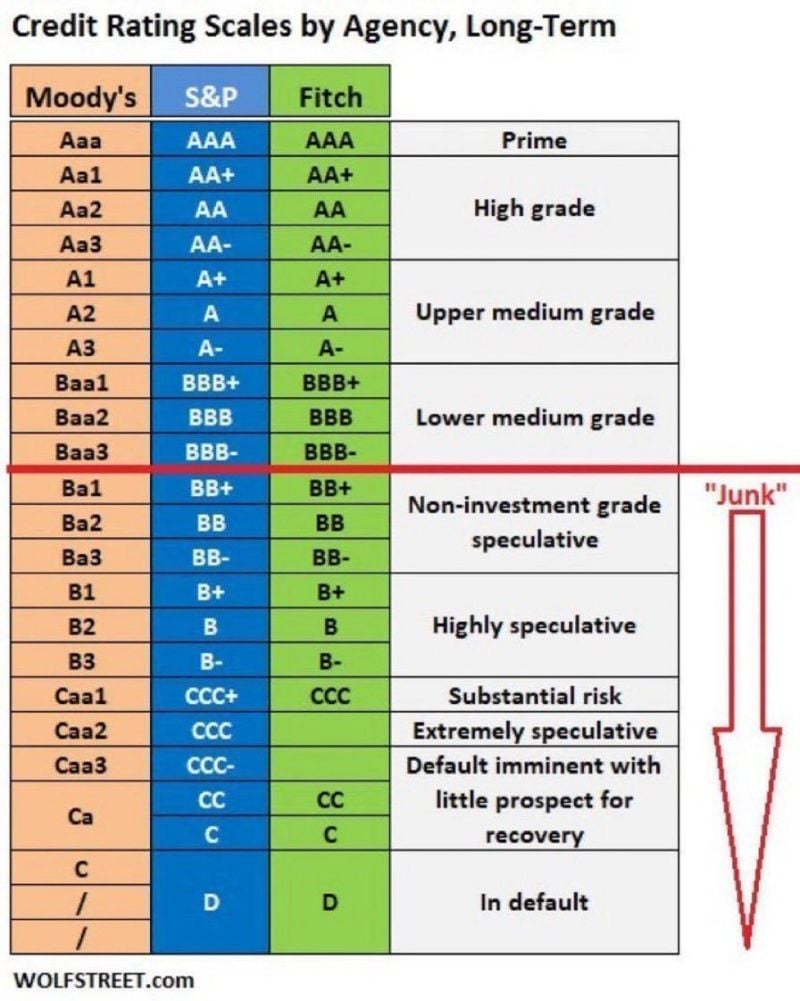

BREAKING: Fitch downgrades the United States' long-term credit rating from AAA to AA+

Fitch says that "repeated debt-limit political standoffs and last-minute resolutions" are to blame. They note that debt-ceiling standoffs have "eroded" confidence in fiscal management. Source: The Kobeissi Letter, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks