Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

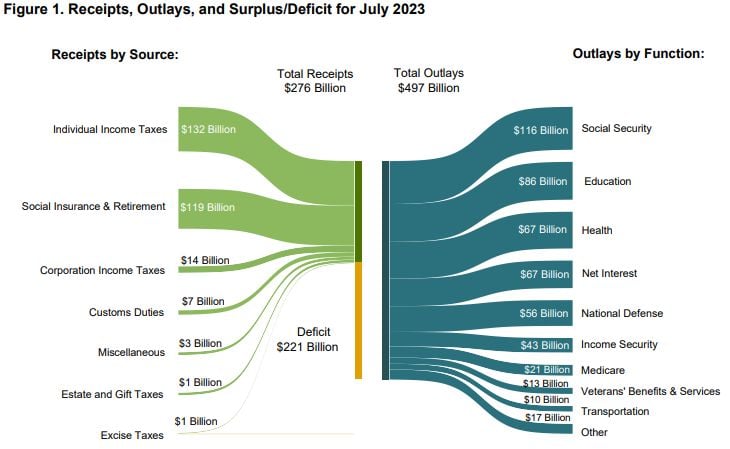

The US just published their budget numbers showing a $221 BILLION deficit in July ALONE

With $276 billion in receipts, the US spent a massive $497 billion last month. Total interest on US debt YTD is now at $726 BILLION. US spending problem is getting worse. Source: The Kobeissi Letter

The decoupling between US money market fund inflows (in green) and bank deposits (in red) continues.

Source: www.zerohedge.com, Bloomberg

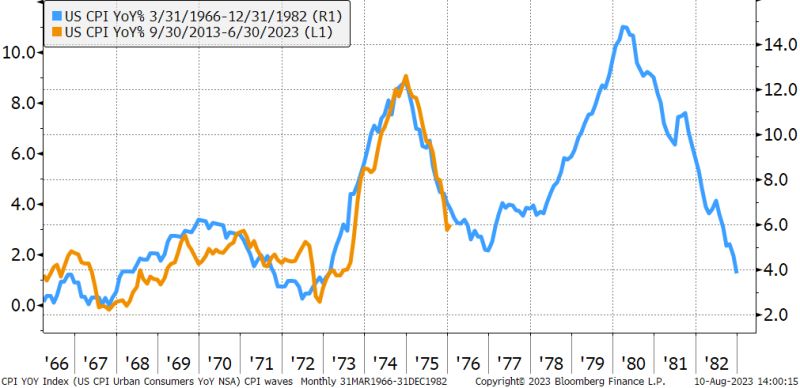

Will US inflation move in waves as it did in the 70's?

Source: Bloomberg, www.zerohedge.com

Short Sellers have lost a combined $175.2 Billion by betting against the market this year

Source: barchart

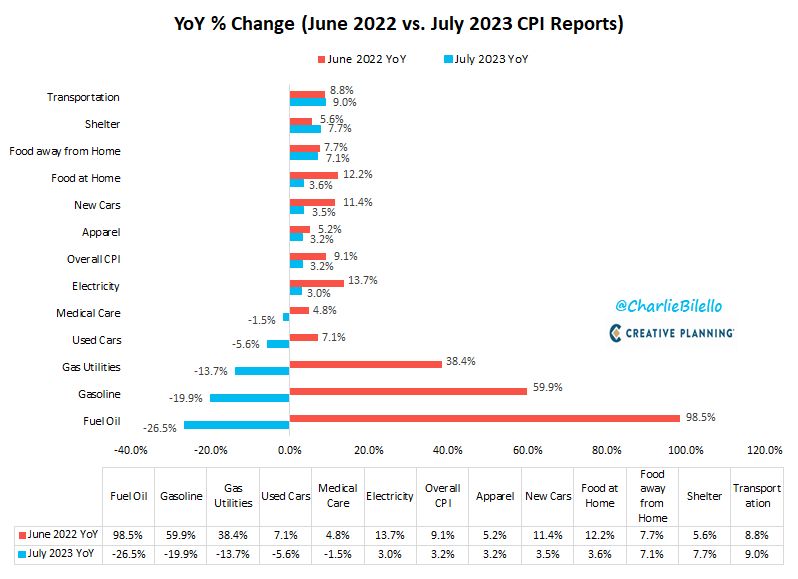

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today. What's driving that decline?

Lower rates of inflation in Fuel Oil, Gasoline, Gas Utilities, Used Cars, Medical Care, Electricity, Apparel, New Cars, Food at Home, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate than June 2022. Source: Charlie Bilello

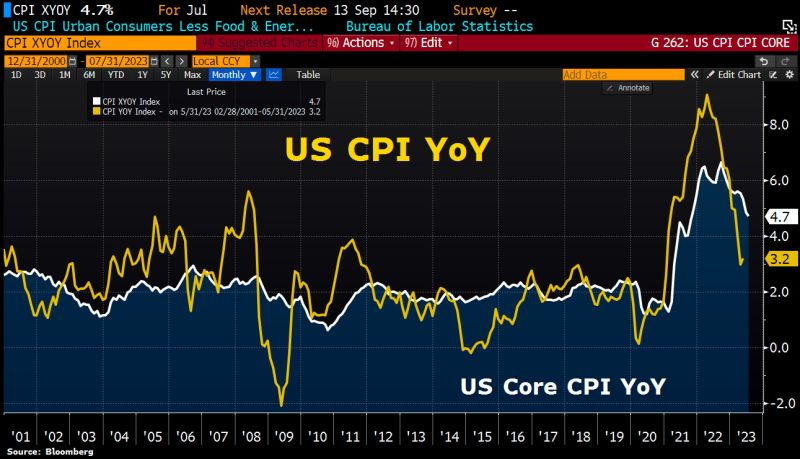

US inflation a tad lower than what economists expected: US July CPI accelerates to 3.2% YoY from 3% in June vs 3.3% expected, BUT the first acceleration after 12 consecutive months of decline

Both Goods and Services inflation (YoY) slowed in July - but Services remain extremely high at +6.1%... Core CPI slows to 4.7% YoY from 4.8% in June as expected. Shelter costs contributed to about 90% of the increase in July CPI. Note that #Fed's favorite inflation indicator - Core Services CPI Ex-Shelter - remains sticky' as it reaccelerated in July (+0.2% MoM, and from +3.9% to +4.0% YoY)... Fed Swaps price in lower odds (20%) of another rate hike this year. Source: Bloomberg, HolgerZ, www.zerohedge.com

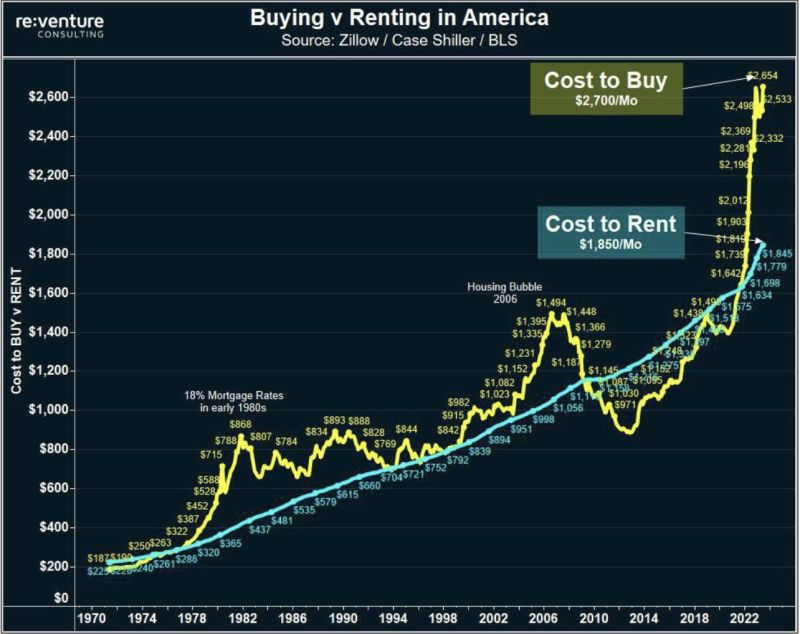

The cost of both buying and renting a house in America has skyrocketed since 2020

Buying a house now costs $2,700/month on average, up an alarming ~86% in 3 years. Renting a house now costs $1,850/month on average, also up ~25% in 3 years. Owning a home has become a luxury. Source: The Kobeissi Letter

The U.S. Now Has:

1. Record $17.1 trillion in household debt 2. Record $12.0 trillion in mortgages 3. Record $1.6 trillion in auto loans 4. Record $1.6 trillion in student loans 5. Record $1.0 trillion in credit card debt Total mortgage debt is now more than double the 2006 peak. Meanwhile, 36% of Americans have more credit card debt than savings while student loan payments are set to resume for the first time since 2020. This is all while mortgage rates just hit 7.1% and credit card debt rates hit a record 25%. Source: The Kobeissi Letter, Hedgeye

Investing with intelligence

Our latest research, commentary and market outlooks