Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

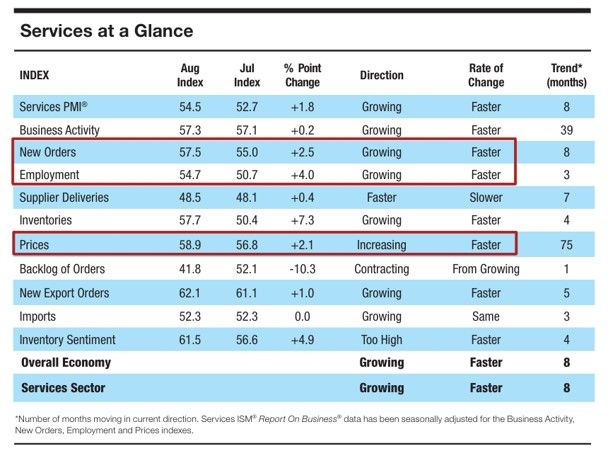

One key development of the week (beyond brent hitting $90) has been stronger than expected macroeconomic data - e.g the ISM services (see data table below from Markets & Mayhem)

Indeed what we are seeing in the last ISM Services PMI reading may not be the best news for the inflation situation: 1) New orders growing faster 2) Employment growing faster (from being nearly flat m/m) 3) Prices rising faster And the market reaction - stocks pulling back - means that good macro news is bad news for the market again. Indeed, while a growing economy supports rising corporate profits (which is a positive), a too strong economy would imply a more hawkish FED than it is currently anticipated by the market.

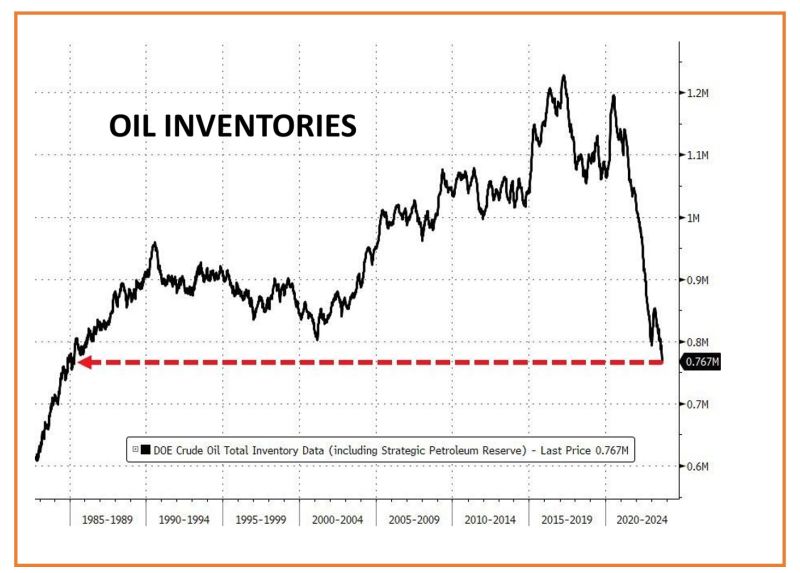

Is oil going to $100?

U.S Crude inventories fell by WAY more than expected ( -6.3mm (-2.1mm expected) to their lowest since early December - and are well below their five-year average for this time of year as the summer driving season ends. Including the SPR (Strategic Petroleum Reserve), this is the lowest level of total crude inventories in America since 1985... Source: Bloomberg, www.zerohedge.com

Regulation: this is where Europe want to take lead globally...

the rest of the world (especially the #us) wants to lead on #innovation and #growth but Europe wants to become the champion of #regulation... Indeed, U.S. tech giants are facing stricter rules in Europe with more regulation (the Digital Markets Act or DMA) announced this week. The European Commission, the executive arm of the EU, named six “gatekeepers” on Wednesday — these are companies that have an annual turnover above 7.5 billion euros ($8 billion) or 45 million monthly active users inside the bloc. They are Amazon, Alphabet, Apple, Microsoft, Meta and ByteDance, who now have six months to comply with stricter market rules — such as not being able to prevent users from uninstalling any pre-installed software or apps, or treating their own services more favorably. Source: CNBC, politic.eu

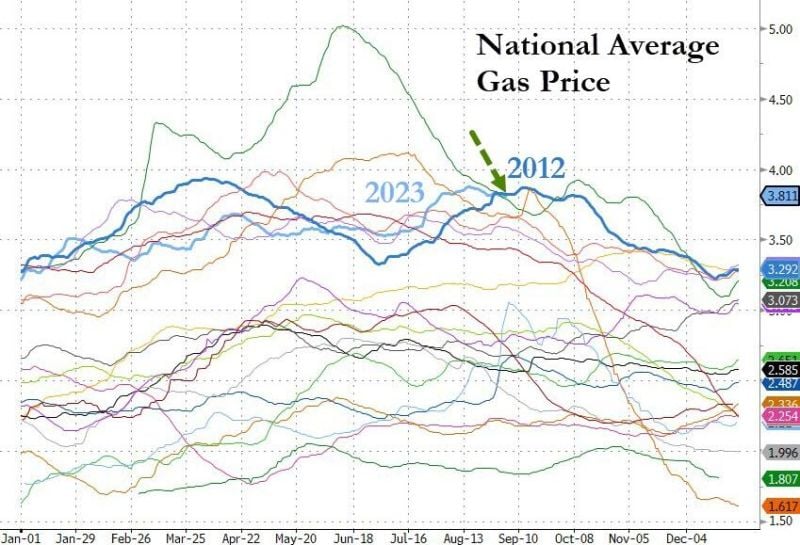

An immediate consequence of soaring oil prices mean -> Soaring gas prices in the US

Now at their highest for this time of year since 2012 (and 2nd highest ever)... not great for headline inflation and consumer purchasing power Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks