Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Median US home prices are now contracting at a level only seen 2 times in the last 60 years:

- 1970 - 2008 Both ended in severe recessions Source: FRED, Game of Trades

In case you missed it...

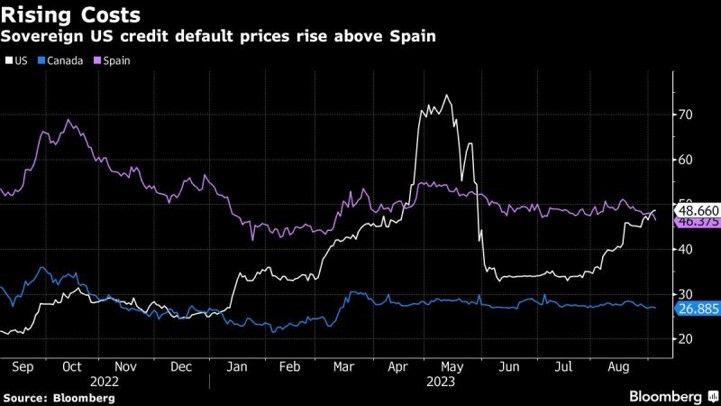

The credit default swap (CDS) prices for the US rose sharply during the small banks crisis back in spring, and then went down as the crisis subsided quickly. These prices have been rising steadily since early summer. US CDS are now above Spain, which is considered a higher risk country from a sovereign credit risk perspective. Source: Bloomberg

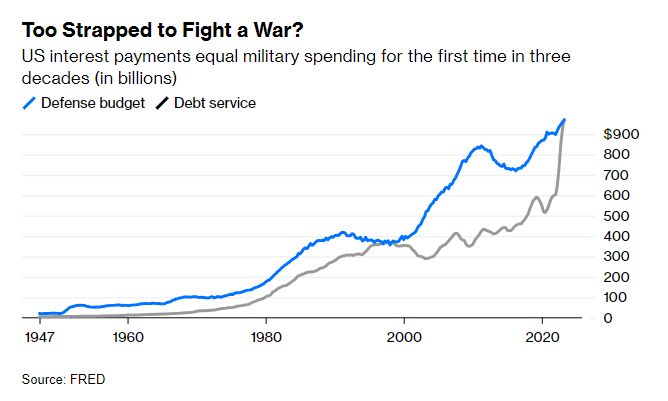

U.S. interest payments equal military spending for the first time in 3 decades (~1.9 Trillion combined)

Source: Barchart, FRED

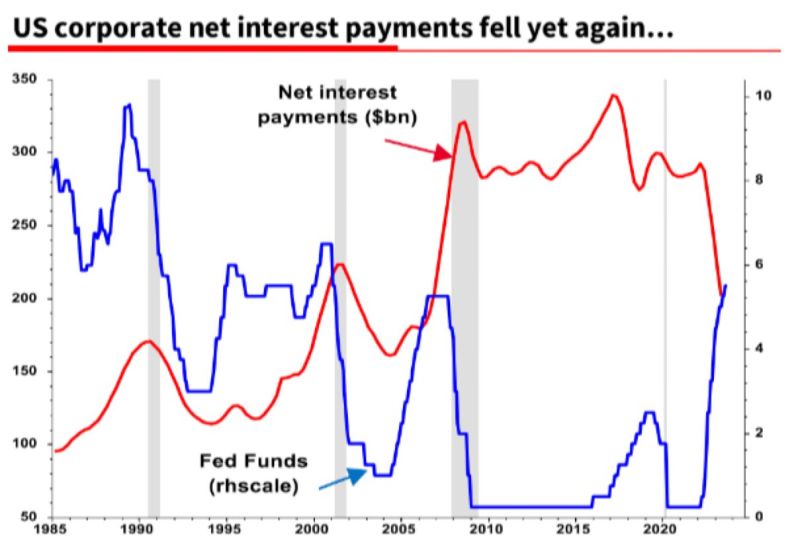

One of the reasons we are not in recession yet. Despite rate hikes US corporate net interest payments are going down so far👇

Source: Michel A. Arouet

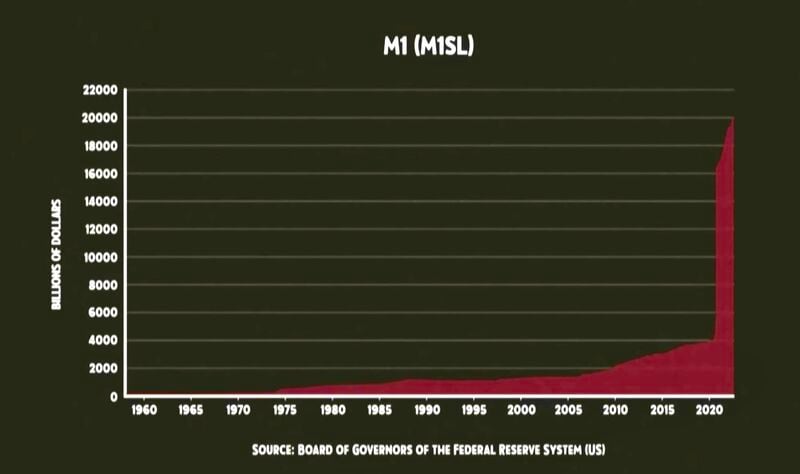

Over 80% of all US money created (US Dollars printed) took place between 2020 and 2023

Source: Win Smart

The sp500 P/E ratio used to be tightly correlated to the US 2 year yield (inverted on the chart), i.e the lower the 2 year yield, the higher the P/E ratio and vice versa

Well, this is no longer the case as a giant crocodile jaw has been forming. Which of the 2 will bind firts? Source. Jeroen Blokland, True Insights

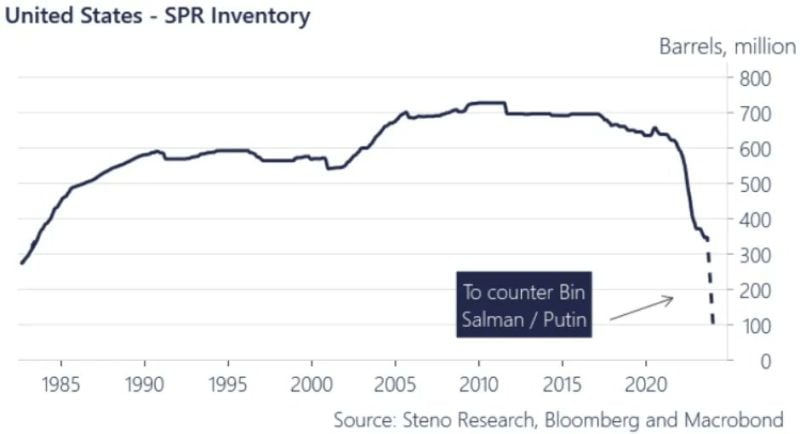

With a supply deficit of more than 2.5mn barrels a day through Q4, it is probable that Biden administration will not draw on the SPR so far ahead of the actual election date

Especially given the fact that SPR (Strategic Petroleum Reserve) are already running low. It seems more plausible that Joe Biden will concentrate the SPR ammunition around Q2-Q4 next year. This creates another supply risk in the short-run for the oil market Source: Andreas Steno

Investing with intelligence

Our latest research, commentary and market outlooks