Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

From Wall Street to Main Street (aka workers want a bigger piece of the cake) => UAW members go on strike at three key auto plants after deal deadline passes

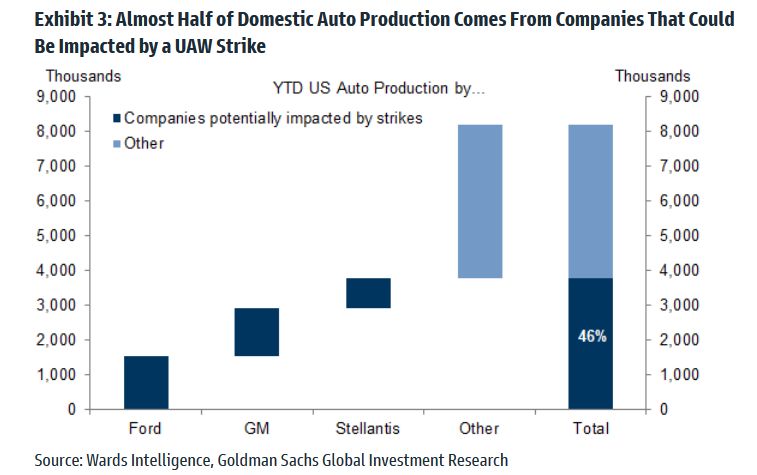

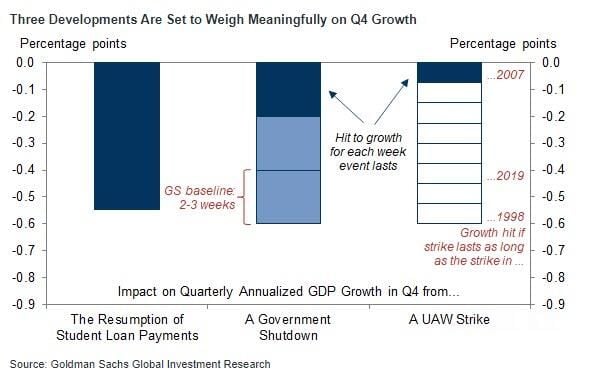

Half of US auto production is going offline tomorrow. - Thousands of United Auto Workers members went on strike at three key plants, after Detroit automakers failed to reach deals with the union by a Thursday night deadline. - The selected plants produce highly profitable vehicles for the automakers that largely continue to be in high-demand. About 12,700 workers – 5,800 at Stellantis, 3,600 at GM and 3,300 at Ford – will be on strike at the plants in total, the union said. The UAW represents about 146,000 workers across Ford, GM and Stellantis. Source: Goldman, CNBC

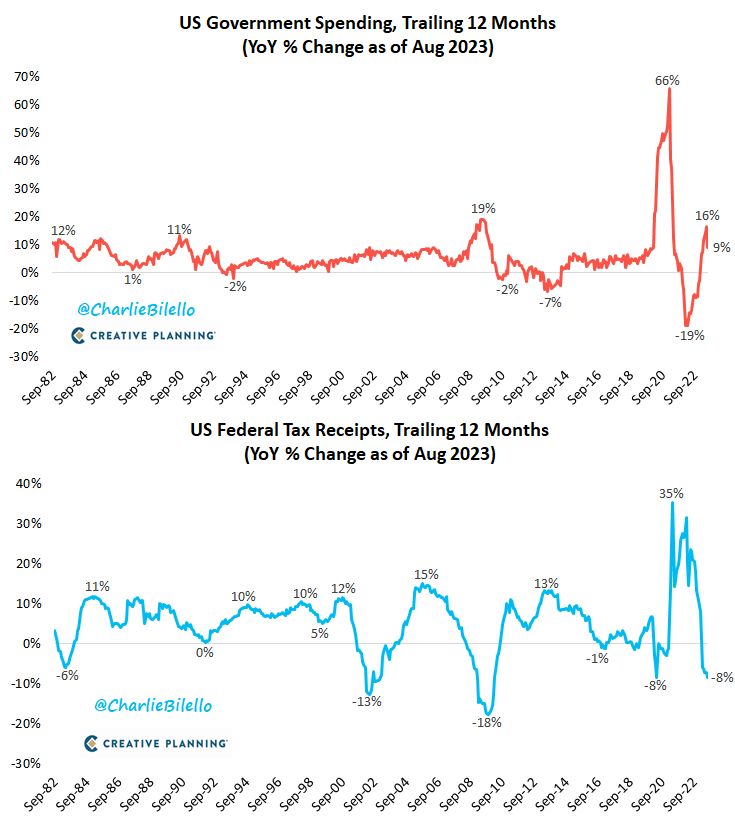

US government spending increased 9% over the last year while tax receipts declined 8%. What a luxury...

Source: Charlie Bilello

While China has been offloading US Treasuries for 10+ years, the rate has accelerated

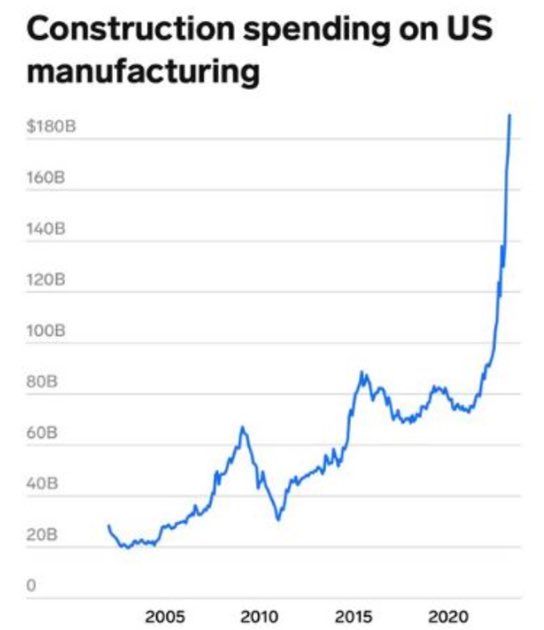

Both Canada and Mexico also now account for a higher % of US imports than China. These stories belong to the "new normal": the East-West divide, reshoring / nearshoring / friendshoring, etc. Source: Tavi Costa, Bloomberg, The Kobeissi Letter

Thankfully, the US is a country where the President has very little impact on the stock market

Stocks tend to go up during most presidencies, regardless of who is in power. Key takeaway: Don't mix politics with your portfolio. Source: Charlie Bilello

US CORE CPI LITTLE HOTTER THAN EXPECTED => A FED PAUSE IS LIKELY BUT NO RATE CUT ANYTIME SOON

Consensus expected a reacceleration of Headline inflation (+0.6% MoM after +0.2% in July) and a stabilisation of “core” inflation (+0.2% MoM after +0.16% in July). Key actual numbers are the following: ON A SEQUENTIAL BASIS (MoM) Headline inflation numbers are in-line with expectations (+0.6%). That is the biggest MoM since June 2022 and the second straight monthly increase in CPI...The energy index rose 5.6% in August after increasing 0.1% in July. There was a big turn-around in airline fares. They rose 4.9% after dropping 8.1% in each of the previous two months. But the gasoline index dominated with an increase of 10.6 percent in August, following a 0.2% increase in the previous month.

Investing with intelligence

Our latest research, commentary and market outlooks