Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

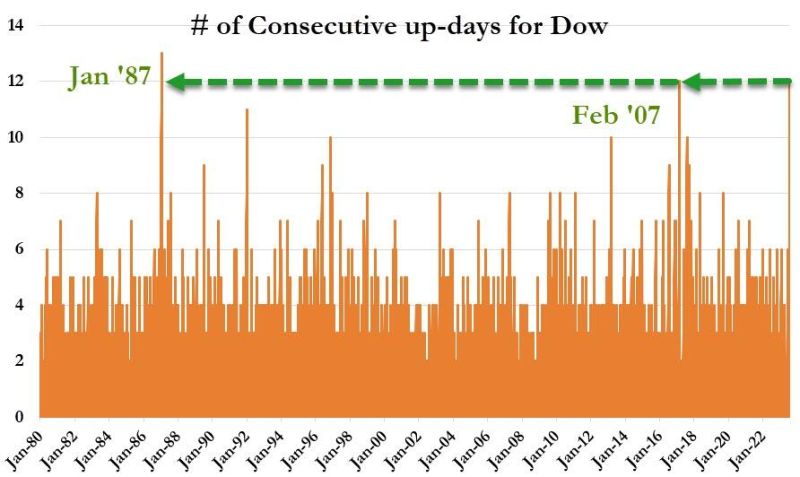

The last time The Dow had a longer winning streak than this (12 straight days) was in Jan 1987 (13 days - the all-time record win streak)...

Source: Bloomberg, www.zerohedge.com

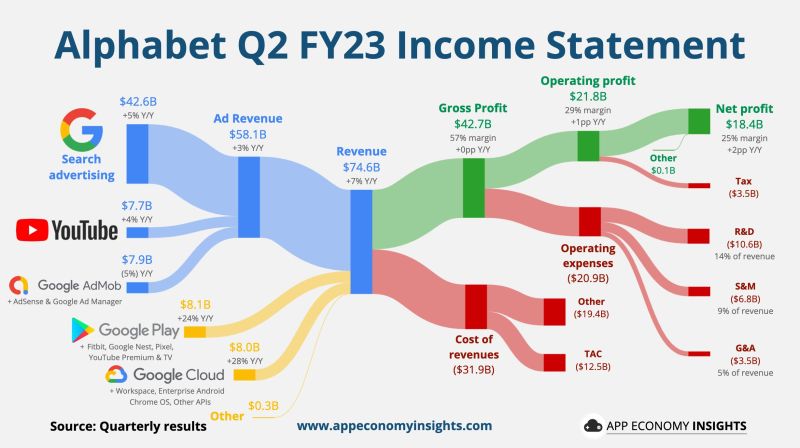

Alphabet shares rose about 7% in extended trading on Tuesday after the company reported better-than-expected revenue and profit, driven by growth in its cloud-computing unit.

For the fourth straight quarter, Google’s parent company reported growth in the single digits as it reckons with a pullback in digital ad spending that reflects concerns about the economy. Analysts don’t expect growth to hit double digits again until the fourth quarter. $GOOG Alphabet Q2 FY23 details by App Economy Insights • Revenue +7% Y/Y to $74.6B ($1.8B beat) • Operating margin 29% (+1pp Y/Y) • EPS $1.44 ($0.10 beat) ☁️ Google Cloud: • Revenue +28% Y/Y to $8.0B. • Operating margin 5% (+14pp Y/Y). ▶️ YouTube ads +4% to $7.7B. Source: App Economy Insights, CNBC

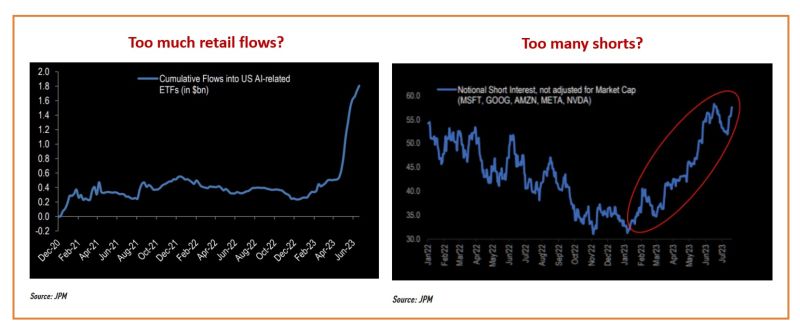

When it comes to the rush into AI stocks, these 2 charts are not easy to interpret from a contrarian perspective

On one hand, record inflows into AI etfs could mean there is too much "hot money" = BEARISH from a contrarian perspective. On the other hand, shorts continue to accumulate positions betting on a collapse of AI-related mega-caps tech stocks. This is BULLISH from a contrarian perspective. Source chart: JPM, TME

US credit delinquencies including housing have now risen above 2009 levels.

Source: Sven Henrich

Something very unusual has been taking place since the start of the 2Q earnings season

US stocks that beat earnings are being sold... very unusual. Source: www.zerohedge.com

The median price of an existing home sold in the US is up 14% from the January low, now less than 1% below its all-time high from June 2022.

How could it be? Consider the #chart below courtesy of Charlie Bilello: The US Population is 19% higher than where it was in January 2000 while the inventory of Existing Homes for sale in the US is 37% lower. Economics 101 -> higher demand and lower supply drive prices higher.

Investing with intelligence

Our latest research, commentary and market outlooks