Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

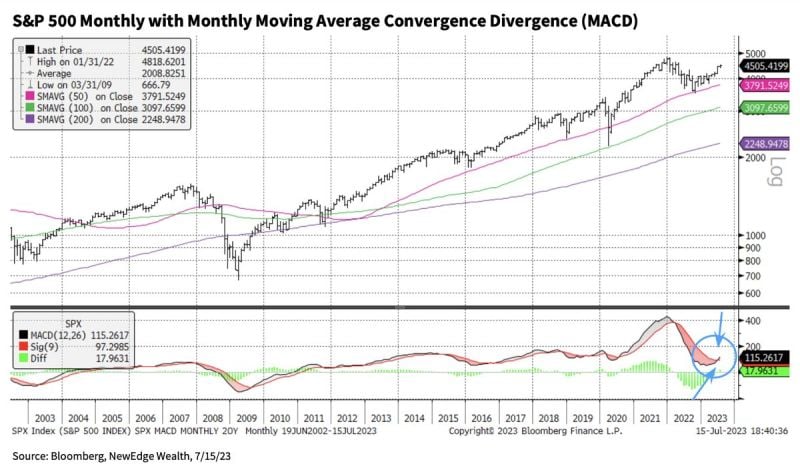

S&P 500 technical analysis -> The $SPX has finally and for the first time since the bear market began in 2022 and bull market began on Oct. 2023, executed a bullish Monthly MACD Crossover.

Source: Seth Golden

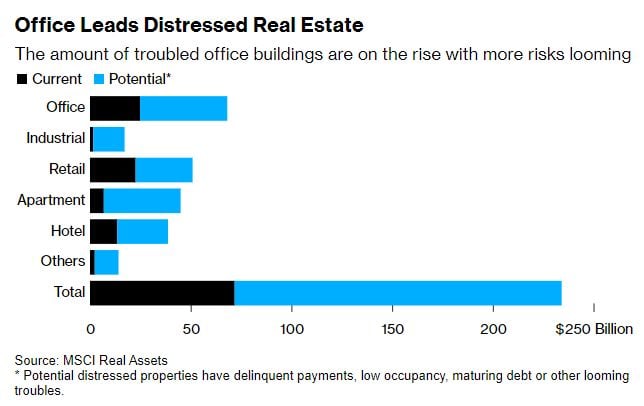

Distressed US Offices Jump to $24.8 Billion, More Than Malls

Source: Bloomberg, C.Barraud

Fun fact is that Japanese inflation is now higher than that in the US for the first time since October 2015.

Source: Bloomberg, www.zerohedge.com

Credit Suisse raised its S&P 500 Year-End target to 4,700, becoming most Bullish Wall Street Bank

But as shown below, majority of Wall Street strategists have revised upwards their estimates for 2013. Source: TME, Bloomberg

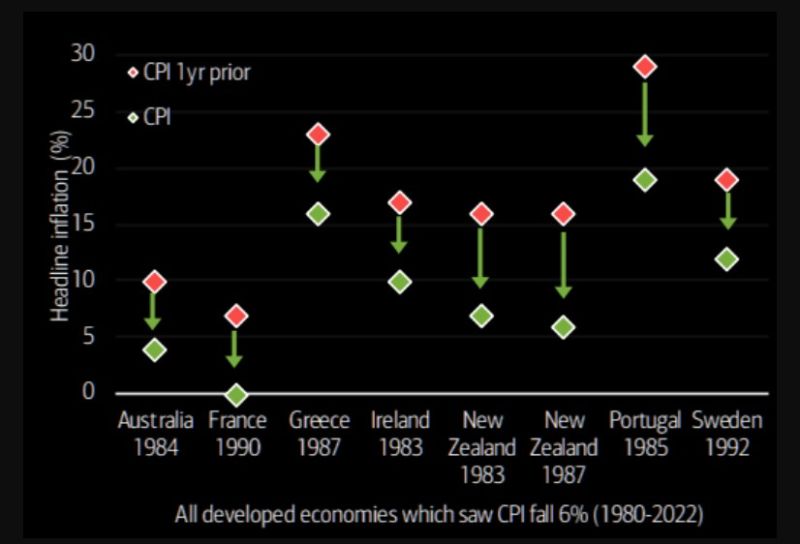

What goes up must come down...

The collapse in US CPI over the past year is extreme, falling from 9.1% to 3%. BofA writes: "...since 1980, only in 8 cases had inflation fallen by more than 6% in a year, and only in France in 1990 from a starting point lower than 10%." Source: TME, BofA

The hype surrounding "Threads," the new social network launched by Meta CEO Mark Zuckerberg, has collapsed

Threads has unraveled so quickly that new data shows active users have been halved. Threads launched in the US on July 5 and reached over 100 million sign-ups by that weekend. Shortly after, Zuckerberg wrote in a post, "Can't believe it's only been five days!" Zuckerberg appears to have prematurely taken a victory lap because early last week, data from SensorTower and SimilarWeb showed an exodus of users and a plunge in engagements. The note was titled Threads Unravels: So-Called 'Twitter Killer' App Sees Exodus Of Users, Plunge In Engagement. New data from SimilarWeb shows the exodus has worsened. As of last Friday, daily active users on the app collapsed from 49 million to 23.6 million in a week. Usage in the US peaked on July 7 at about 21 minutes of engagement. By Friday, that number plunged to just six minutes. SimilarWeb said the app lacks basic features that "offer a compelling reason to switch from Twitter or start a new social media habit." Also, some users found Threads has been dominated by censorship.

Investing with intelligence

Our latest research, commentary and market outlooks