Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Despite weak US retail sales, yesterday was another strong session for us stocks after Microsoft $MSFT announced new pricing for its AI offerings...

For context, $MSFT and $NVDA have added $175BN market cap today, more than the mkt cap of 462 S&P companies, and more than the value of Nike, Wells Fargo, Walt Disney, Morgan Stanley, Intel, etc This ai related news drove value back near its record lows relative to growth... Source: Bloomberg, www.zerohedge.com

First ETF with 100% protection against losses launches in US

Is it the perfect product? The world's first ETF to offer 100% protection against losses (not including management and transaction fees) launched today in the U.S. The Innovator Equity Defined Protection ETF $TJUL will focus on the SP500 and use options to shield investors from losses. The fund, which requires investors to forgo some potential gains, is aiming to disrupt the annuities market. Source: Barchart, FT

After adjusting for inflation, US Retail Sales fell 2.5% over the last year, the 8th consecutive YoY decline.

That's the longest down streak since 2009. Nominal retail sales increased 0.5% YoY vs. historical average of 4.7%. Source: Charlie Bilello

Nice look at just how powerful the "Super 7" stocks have been to $SPY and $QQQ, contributing to 75% of their YTD gains.

This has sparked a torrent of flows into equal-weighted SPX ETF $RSP, which has blown away all other smart-beta #ETFs in flows this summer w/ +$6b, Sourc: Eric Balchunas, Bloomberg via JSeyff

Commercial real estate prices are still expected to crater, Morgan Stanley warns

Prepare for pain in the #us #commercial #realestate market warns Morgan Stanley which believes that prices could drop by as much as 27.4% from peak to trough by the end of 2024. And McKinsey believes prices could slide by as much as 42% in a worst case scenario. Source: barchart

So far, in fiscal year 2023, the US government has a total deficit of $1.393 TRILLION.

In June 2023 alone, the deficit was $228 billion, up from just $88 billion in June 2022. On average, the US deficit has risen by ~$155 billon per MONTH in FY2023. At the current rate, total US debt would rise by $18.5 TRILLION in 10 years. Source: The Kobeissi Letter

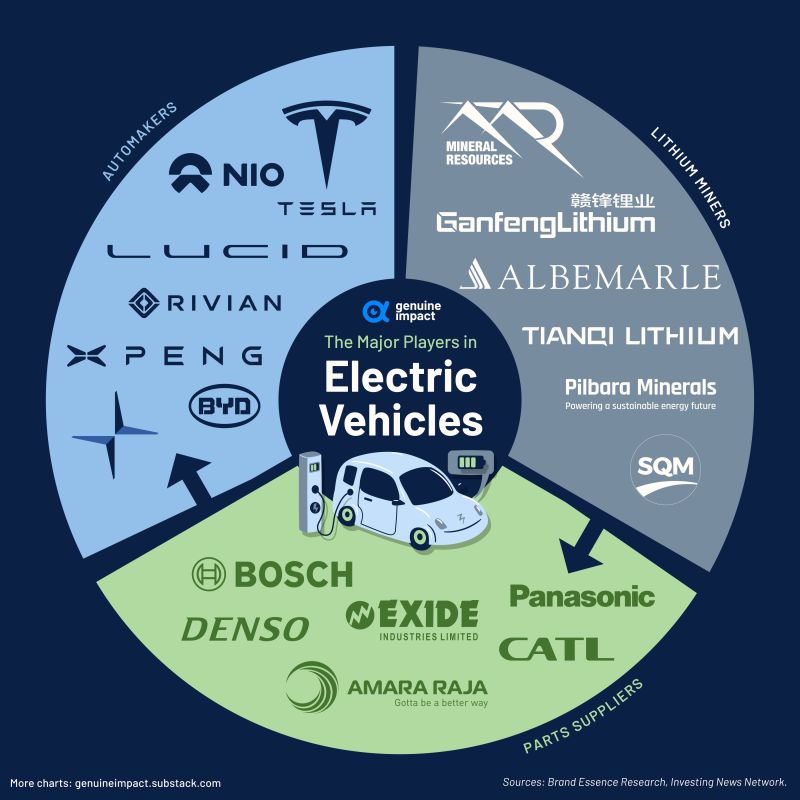

The EV industry comprises three essential components: lithium producers, parts manufacturers, and EV manufacturers.

Looking ahead, it is likely that electric motors and lithium batteries will become prevalent in all cars. Source: Genuine Impact

Investing with intelligence

Our latest research, commentary and market outlooks