Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

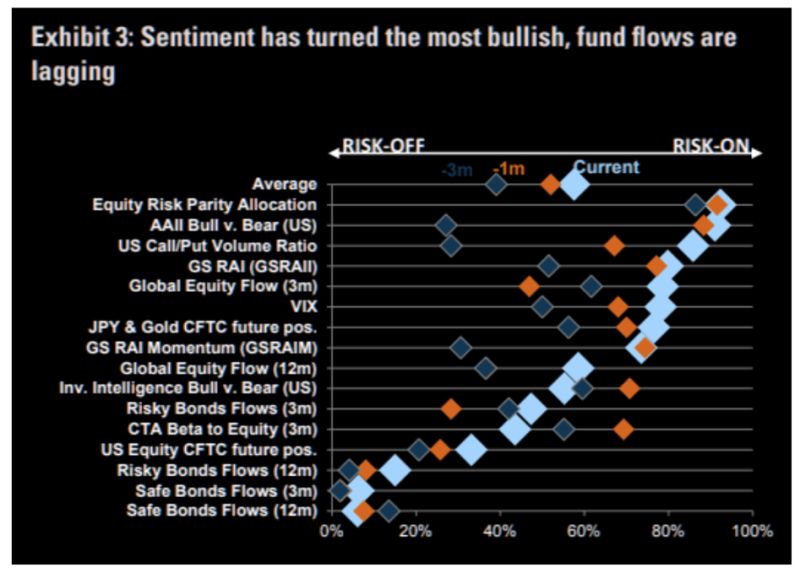

Bullish sentiment on equities is getting even more bullish

Bullish sentiment on equities is getting even more bullish. Source: TME, Goldman Sachs

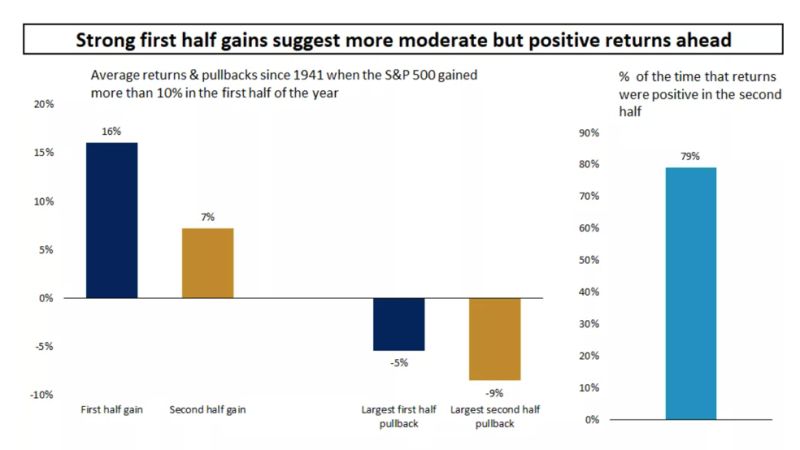

Since 1941 strong first half S&P 500 performance has been associated with further gains in the second half of the year, though with more volatility

Since 1941 strong first half S&P 500 performance has been associated with further gains in the second half of the year, though with more volatility. Past performance does not guarantee future results... Source: Edward Jones

The S&P 500 is currently trading ~12.5% above its 200-day Moving Average

The S&P 500 is currently trading ~12.5% above its 200-day Moving Average. We haven't seen $SPY this far above its 200-day since August of 2021, nearly two years ago. While it looks over-extended, it is not unsustainable. For instance, study the left side of the chart from Nov '20 - Aug '21 Source: Grayson Roze

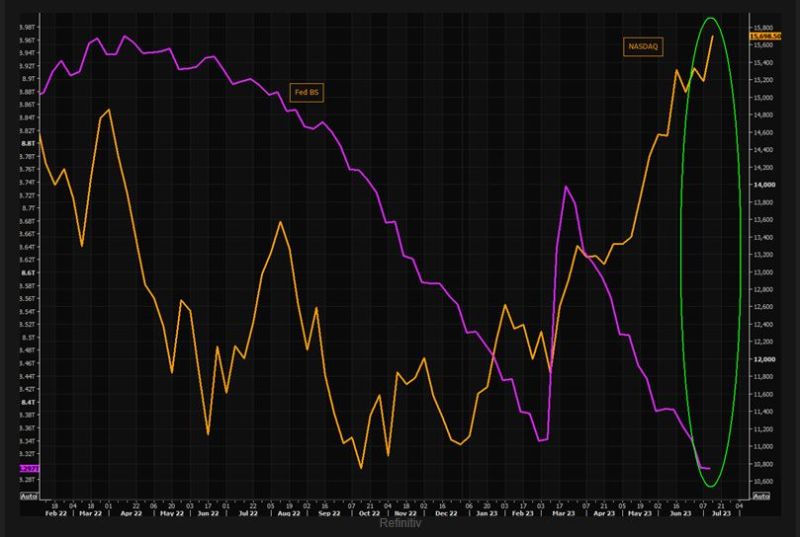

NASDAQ is trading in the upper part of the steep trend channel

NASDAQ is trading in the upper part of the steep trend channel. Note the shooting star candle today, a classical candle that should be observed closely post strong short term trends. One candle doesn't make a "case", but watch for a possible confirmation session. Source: TME, Refinitiv

The Biden administration announced it would automatically cancel education debt for 804,000 borrowers

The Biden administration announced it would automatically cancel education debt for 804,000 borrowers, for a total of $39 billion in relief. The debt cancellation is a result of the administration’s fixes to repayment plans, which included updated counts of borrowers’ payments. Source: CNBC

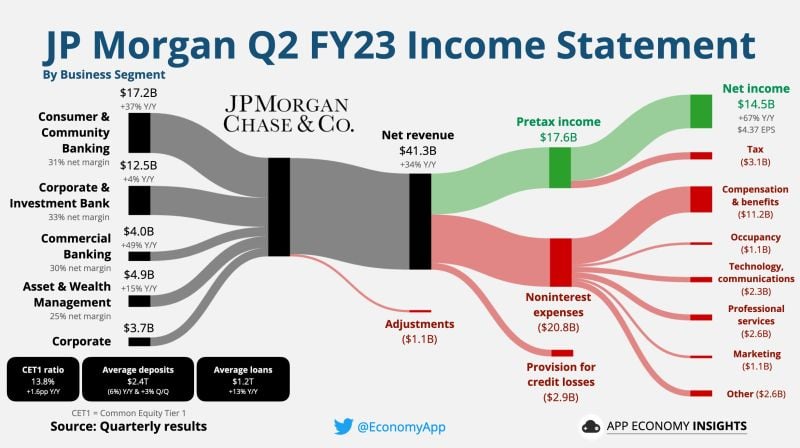

$JPM JP Morgan Chase Q2 FY23 numbers

$JPM JP Morgan Chase Q2 FY23 numbers • Net revenue +34% Y/Y to $41.3B ($2.5B beat). • Net Income $14.5B. • EPS: $4.37 ($0.61 beat). • CET1 ratio of 13.8%. $2.7B First Republic bargain purchase gain in Corporate. Source: App Economy Insights

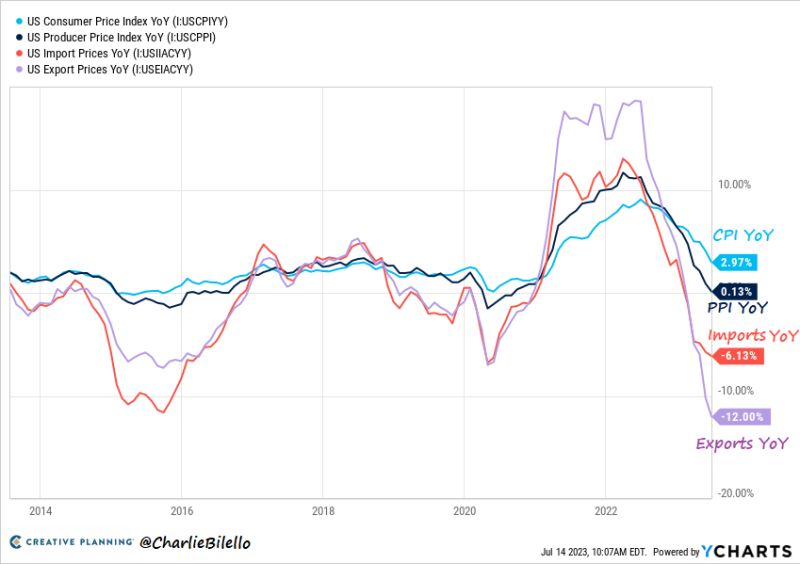

Disinflationary trends in the US

Disinflationary trends in the US 1) CPI Inflation: 3.0%, Lowest since March 2021. 2) PPI Inflation: 0.1%, Lowest since August 2020. 3) Import Prices: -6.1%, Lowest since May 2020. 4) Export Prices: -12%, Lowest on record. Source: Charlie Bilello

The NASDAQ (in yellow) has been massively decoupling from the FED balance sheet (in purple)

Source: The Market Ear, Refinitiv

Investing with intelligence

Our latest research, commentary and market outlooks