Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- tech

- gold

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- china

- russia

- assetmanagement

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

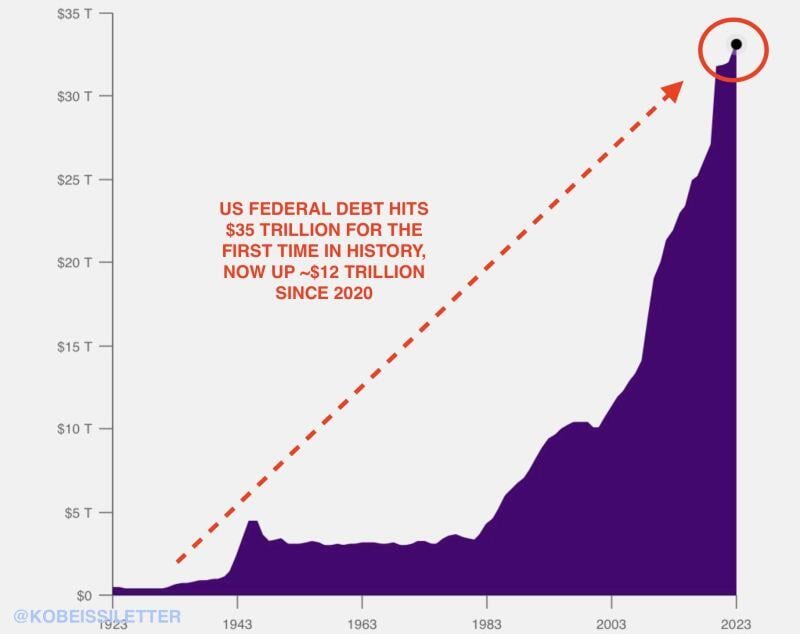

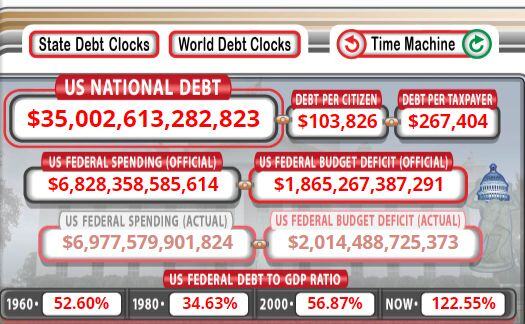

Total US Federal debt has officially hit $35 trillion for the first time in history.

Since 2020, the US has now added ~$12 TRILLION in Federal debt. In other words, the US has added an average of ~$280 BILLION of Federal debt EVERY MONTH since January 2020. This means that the US now has ~$105,000 in Federal debt for every person living in the country. All while deficit spending as a percentage of GDP is currently at World War 2 levels. Source: The Kobeissi Letter

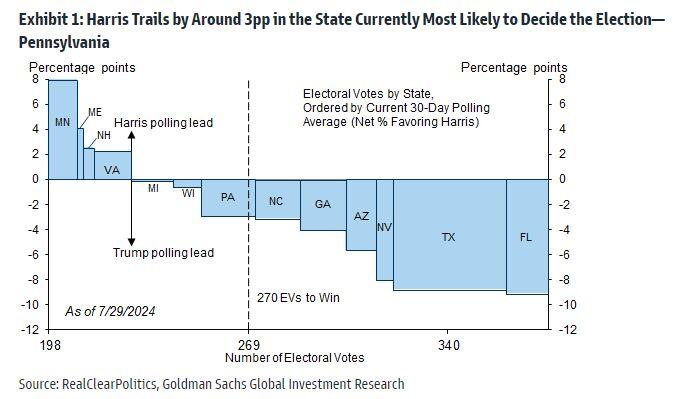

Goldman: Harris Trails by Around 3pp in the State Currently Most Likely to Decide the Election—Pennsylvania

Source: Mike Z., Goldman Sachs

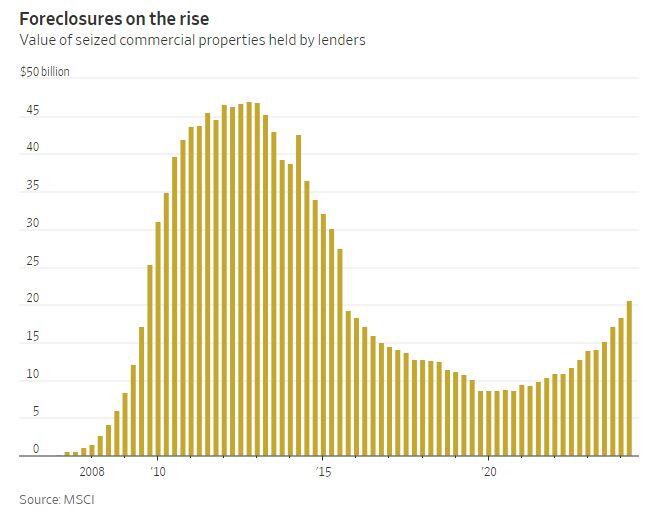

US Commercial Property Foreclosures jump to more than $20 billion during the 2nd quarter, the most in nearly a decade 🚨

Source: Barchart

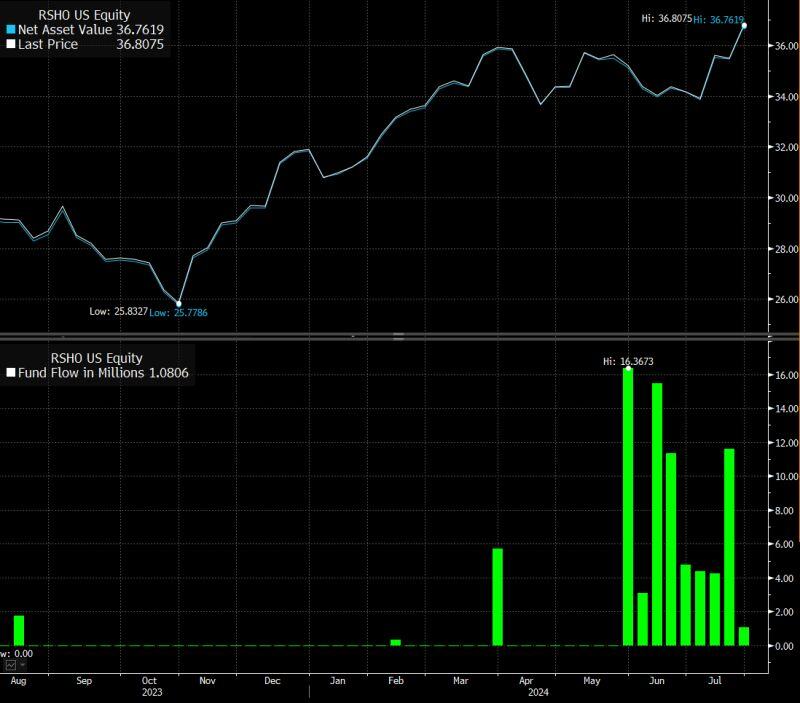

As highlighted by Eric Balchunas

The Reshoring ETF $RSHO is quietly nursing a 9-week flow streak (after being ignored since birth) which boosted its assets under management 7x this year. The American Industrial Renaissance ($AIRR) 3ETF also saw AuM jump by $800m YTD. BlackRock noticed this and launched iShares US Manufacturing ETF $MADE. All these ETFS are exposed to Trump Trade 2.0 but this theme spans beyond politics. Source: Bloomberg, Eric Balchunas

US Presidential elections >>> Are we back to square one?

Source: PredictIt, Bloomberg, www.zerohedge.com

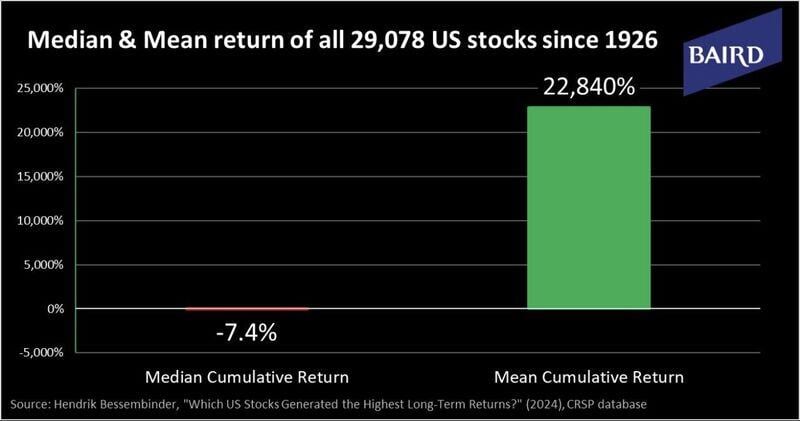

The difference between the MEDIAN and the MEAN CUMULATIVE returns of US stocks since 1926 is amazing...

As mentioned by @SpencerHakimian on X: "Stock returns are so skewed to the 4% of stocks that are responsible for all equity market returns that have occurred in the past 100 years. Statistically, it is virtually impossible to outperform an index over time since you would have needed to specifically own the tiny percentage of stocks that beat the index, and specifically avoid the vast majority of stocks that underperformed the index. Individual stock picking turns investing from a positive sum game to a negative sum game. Index investing is like being the casino. Individual stock picking is like being the gambler". Source: Baird, Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks