Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

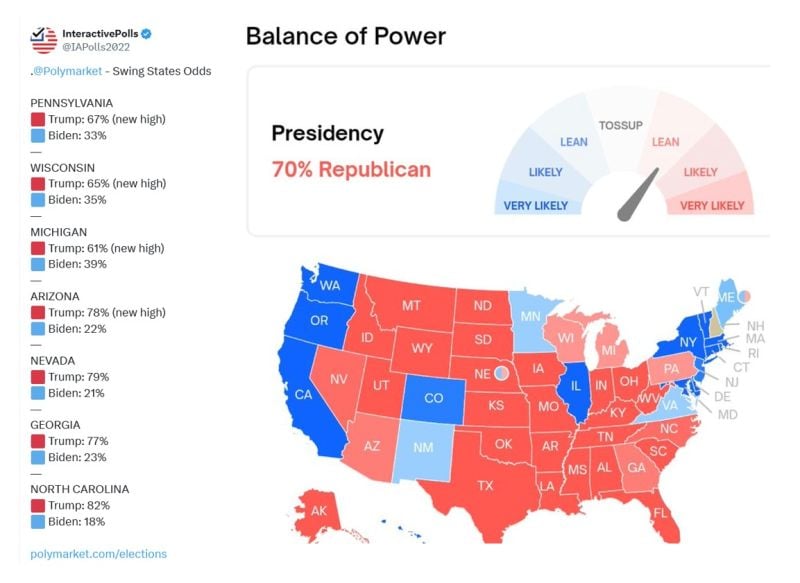

Swing States Odds by https://lnkd.in/eEVhR_yt

Source: Interactive Polls

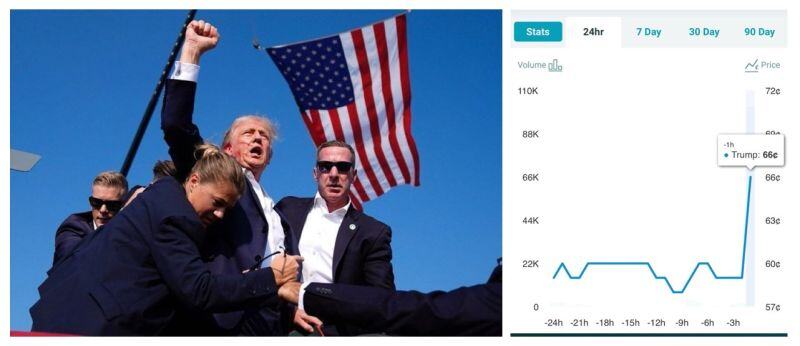

Trump's strength in such a tough moment makes the contrast to Biden even larger...

This assassination attempt (the 1st of its kind in 43 years) took place 4 months before the Presidential election and days before Trump is to be officially named the Republican nominee at his party's convention. It is most likely a boost to his election - just watch the odds on PredictIt on the right. Worldwide, the image of a bloodied 78 years old man raising fist just a minute after the shooting is very powerful. But it also highlights how split America is.

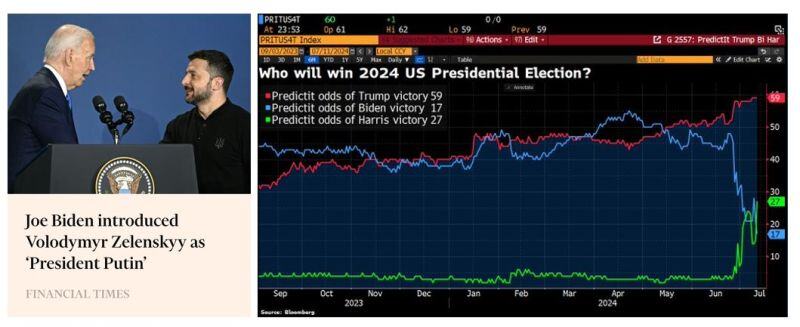

Biden betting odds (blue line) fall after US President calls Ukraine’s Zelensky ‘President Putin’ in latest brutal gaffe, but corrects himself.

Trump odds (in red) now stand at 59% while Harris odds (in green) increased to 27% Source: Bloomberg, HolgerZ, FT

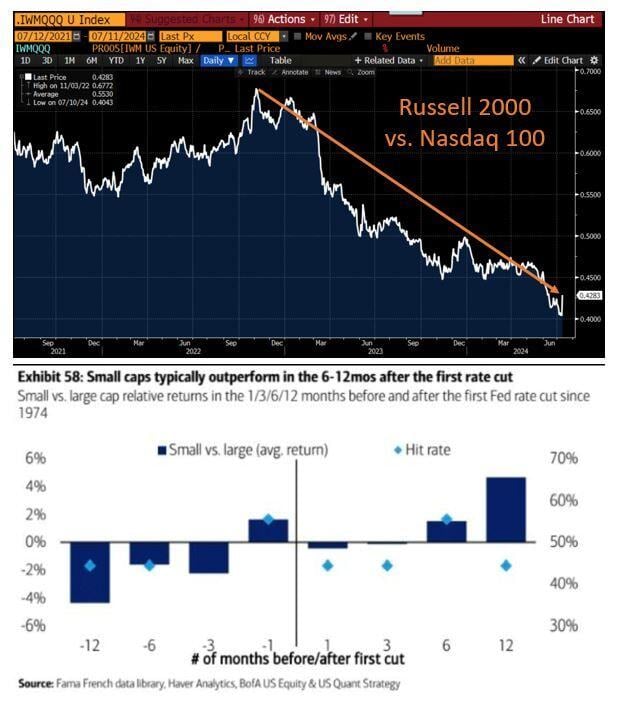

Yesterday was a big ROTATION day on US equities market with small-caps hugely outperforming large-caps

Indeed, small-cap Russell 2,000 gained 3%+ while the S&P 500 fell on the day. The only other day that happened was back on 10/10/2008... Investors probaby have these 2 charts in mind: 1) The HUGE underperformance of small caps vs large aps over the recent years; 2) History showing that Small caps outperform AFTER the first rate cut. The lower than expected US CPI iunflation number for June acted as a trigger for the rotation with hedge funds being forced to cover their long large / short small par trades. Source: Bloomberg, DB, RBC

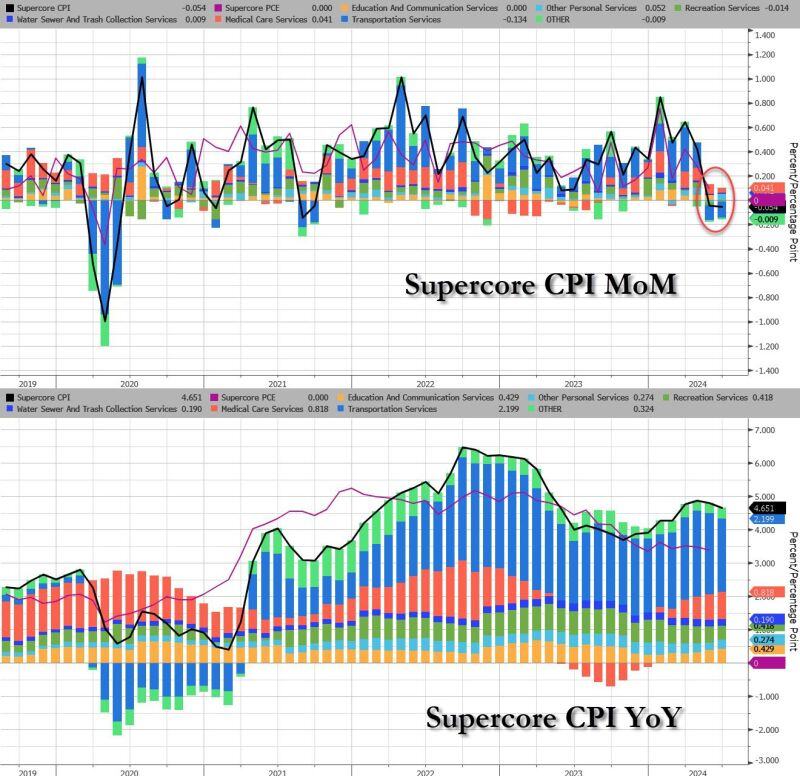

US supercore CPI is negative MoM for the 2nd month in a row

zerohedge.com, Bloomberg

US CPI estimates by firm

TD Securities: 3.0% JP Morgan: 3.1% Wells Fargo: 3.1% Citadel: 3.1% Barclays: 3.1% CitiGroup: 3.1% Goldman Sachs: 3.2% Bank of America: 3.2% Morgan Stanley: 3.5% Previous: 3.3% Median: 3.1% Source: TrendSpider

Investing with intelligence

Our latest research, commentary and market outlooks