Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

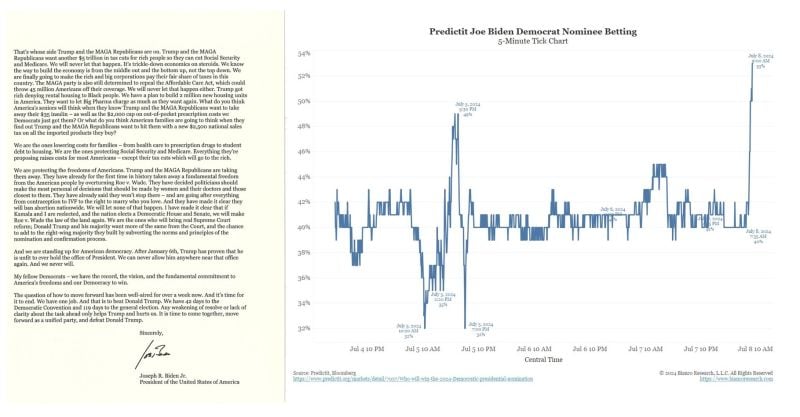

Biden sent this letter to congressional Democrats on Monday morning saying he is 'firmly committed to staying in this race.'

Here is the reaction (this is a 5-minute chart of Predictit betting that Biden is the nominee) Source: James Bianco, Bianco Research

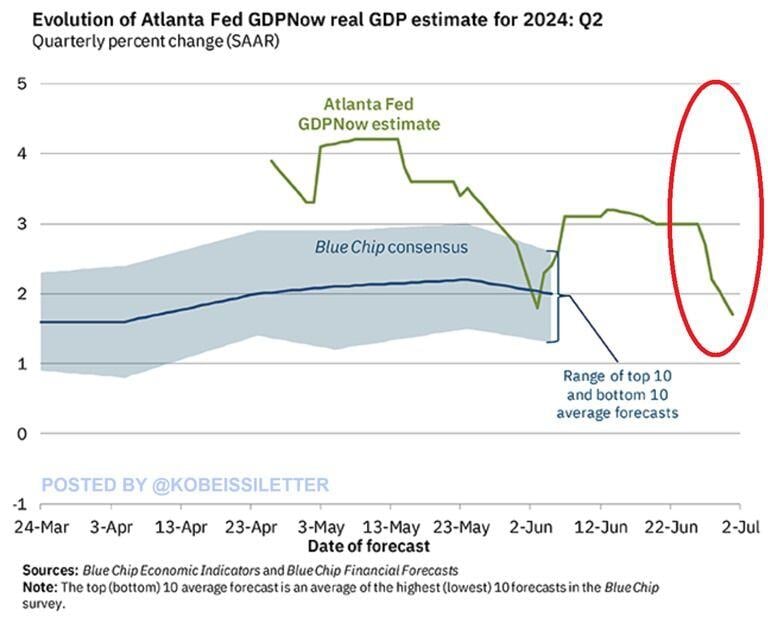

US GDP growth estimates are plummeting: The most recent Atlanta Fed estimate for real US GDP quarterly growth in Q2 2024 is down to 1.7%.

This estimate is down from 4.2% seen in mid-May and from 2.2% seen on June 28th. If this estimate turns out to be correct it will be the 2nd consecutive quarter of GDP growth below 2.0% after Q1 2024 GDP of 1.4%. Is the US economy finally slowing down? Source: The Kobeissi Letter

The combined annual revenue of the 5 highest earnings 🇺🇸 companies is higher than the GDP of Brazil, Italy and Canada

Top 5 US companies based on Revenue (TTM) 🥇 Walmart $WMT: $657.3B 🥈 Amazon $AMZN: $590.7B 🥉 Berkshire Hathaway $BRK.B: $410.9B 4) Apple $AAPL: $381.6B 5) UnitedHealth $UNH: $379.5B Source: Evan

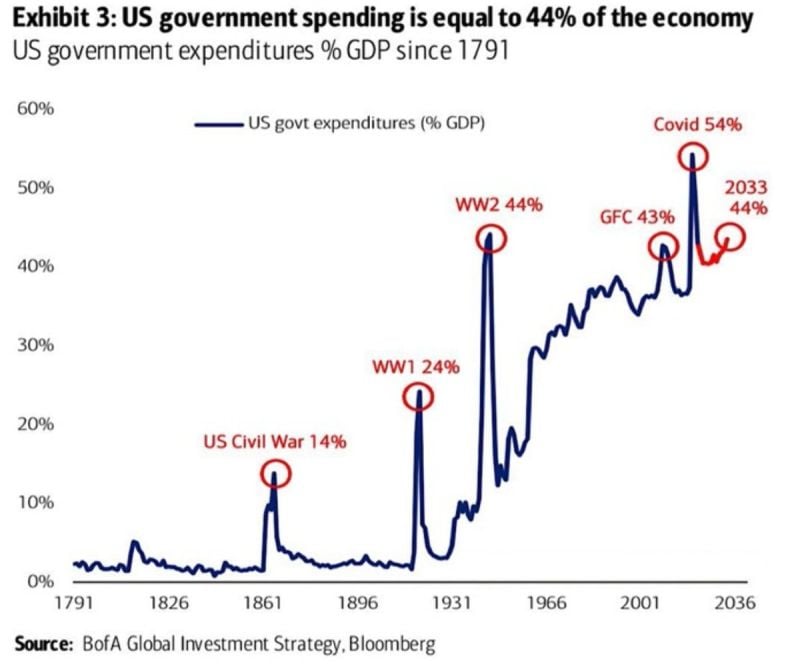

US GOVERNMENT SPENDS MONEY AS IF THERE IS A CRISIS:

US government spending as a % of GDP is now ~43%, in line with THE GREAT FINANCIAL CRISIS. This is just 1 % below World War II levels. Only the COVID crisis saw higher expenditures as a share of GDP of 54%... Source: BofA, Global Markets Investor

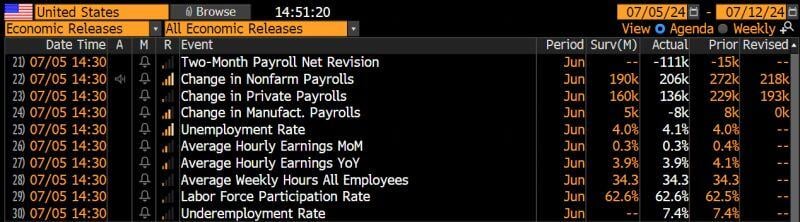

Latest US jobs numbers show economic momentum keeps cooling: Non-farm-payrolls rose by 206k jobs in June, ahead of 190k forecast.

However, 2 months net revisions were NEGATIVE with -110k. Moreover, government employment rose by a whopping 70k while PRIVATE employment with 136k was below estimates. Unemployment rate rose to 4.1% from 4.0% due to higher labor participation rate. Wage rose 3.9% YoY in line w/estimates. Bottom-line: these numbers seem to confirm our thesis that the US job market is NORMALIZING hence reinforcing the disinflation trend which will ultimately enable policy makers to NORMALIZE. More to come from our Chief Economist Adrien Pichoud... stay tuned... Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks