Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

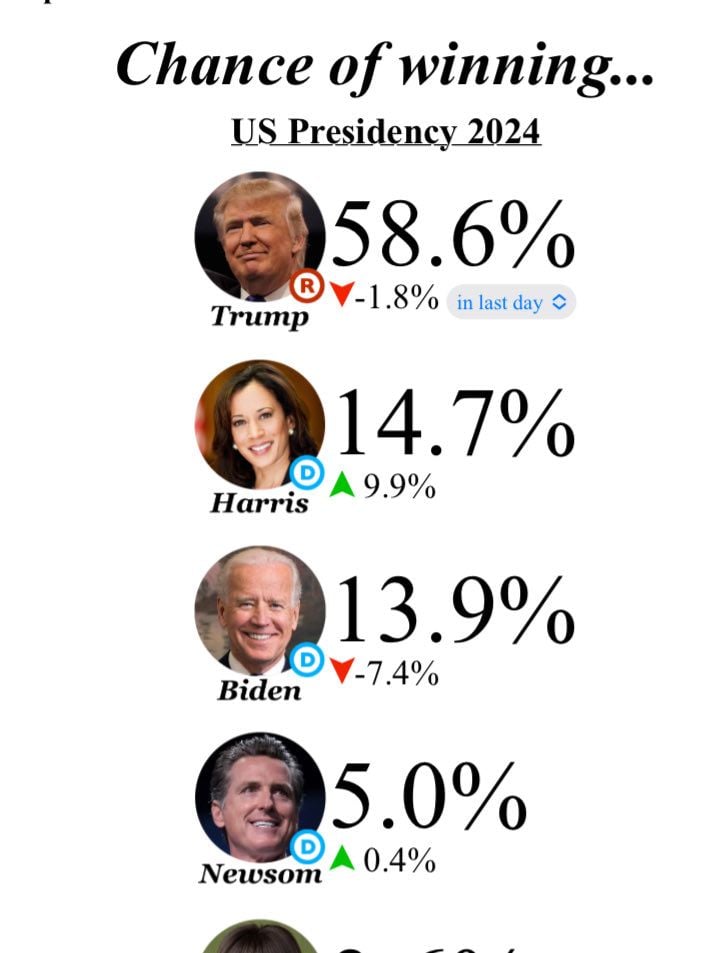

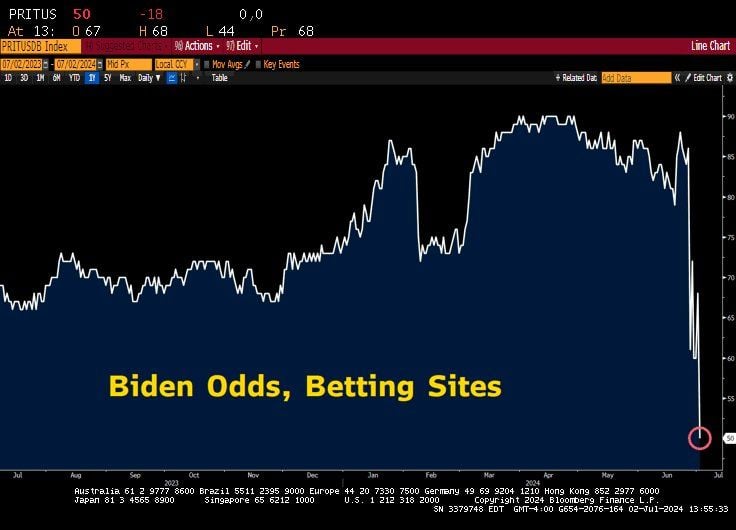

As of this morning, betting markets are giving VP Harris higher odds of being President after the 2024 Election than current President Biden.

The cross has happened. Source: Bespoke

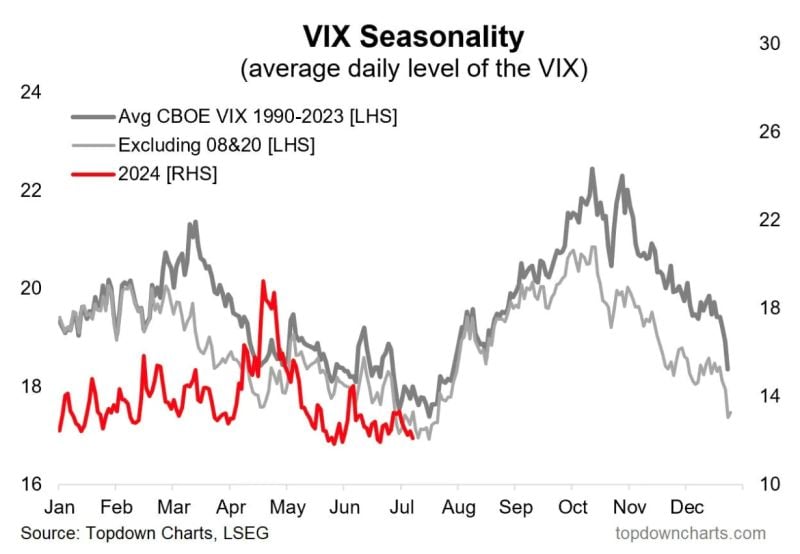

During Presidential election years, volatility tend to pick up EXACTLY at this time of the year

Source: Topdown Charts

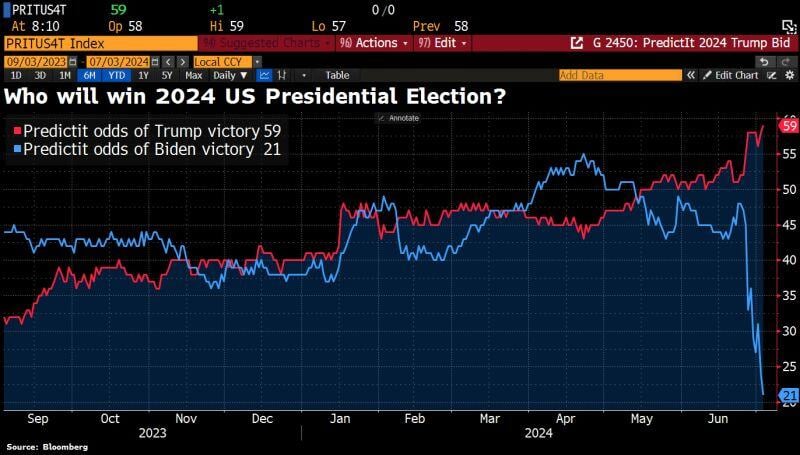

Biden betting odds in free fall as support within the Democrats crumbles.

Source: HolgerZ, Bloomberg

SUMMARY OF FED CHAIR POWELL'S COMMENTS (7/2/24):

1. The trend of disinflation appears to be resuming 2. Need to be more confident before reducing rates 3. Fed doesn't see 2% inflation "this year or next year" 4. Budget deficit is very large and unsustainable 5. 4% unemployment is still a very low unemployment rate 6. Moving too fast creates risk of inflation returning The Fed needs more data before rate cuts can begin. Source: The Kobeissi Letter

Odds of Biden being nominated as Democrat candidate are plummeting today (Betting sites).

What's going on? Source: Bloomberg, Lawrence McDonald

Investing with intelligence

Our latest research, commentary and market outlooks