Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

APPLE IS EXPECTING BIG IPHONE 16 SALES, BASED ON CHIP ORDERS.

STOCK CLOSED UP NEARLY 3% Apple $AAPL has reportedly increased its chip order with TSMC $TSM, With the increased order in place, Apple is supposedly preparing to sell between 90M and 100M units of the iPhone 16 - Apple Insider

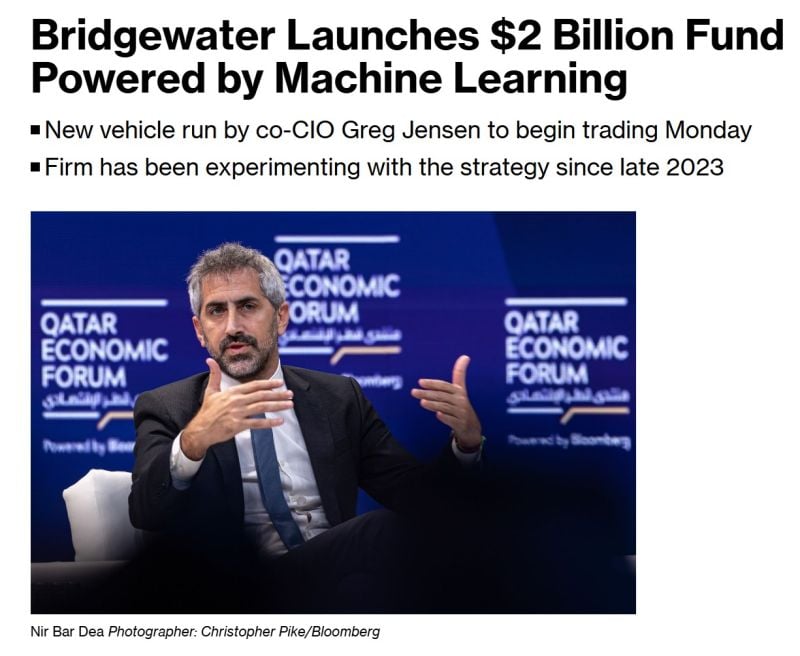

Bridgewater Associates is launching a fund that uses machine learning as the primary basis of its decision-making.

The vehicle will debut with almost $2 billion of capital from more than a half-dozen clients and begin trading Monday, according to people familiar with the matter, who asked not to be identified discussing the strategy. Source: Bloomberg

The US Treasury market remains volatile

The 10-year note yield is now up over 20 basis points in since Friday's intraday low. That's 20 basis points in a matter of hours without any material news? Or is it a Trump effect? UST over-supply? Whatever the reason, for the first time in almost 5 weeks, the 10-year note yield is set to break above 4.50%... Source: The Kobeissi letter

US Poll: Majority believe Biden's cognitive health doesn't qualify him for presidency

A new CBS News/You Gov poll reveals that 72% of Americans doubt Biden's "mental and cognitive health" meets the standards required for the presidency. Of those surveyed, 46% of Democratic voters believe Biden should consider withdrawing from the race due to health concerns. The poll also asked respondents about former President Donald Trump's fitness for office, with 50% expressing confidence in his mental and cognitive abilities, while 49% disagreed. Source: https://www.albawaba.com/

Investing with intelligence

Our latest research, commentary and market outlooks