Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

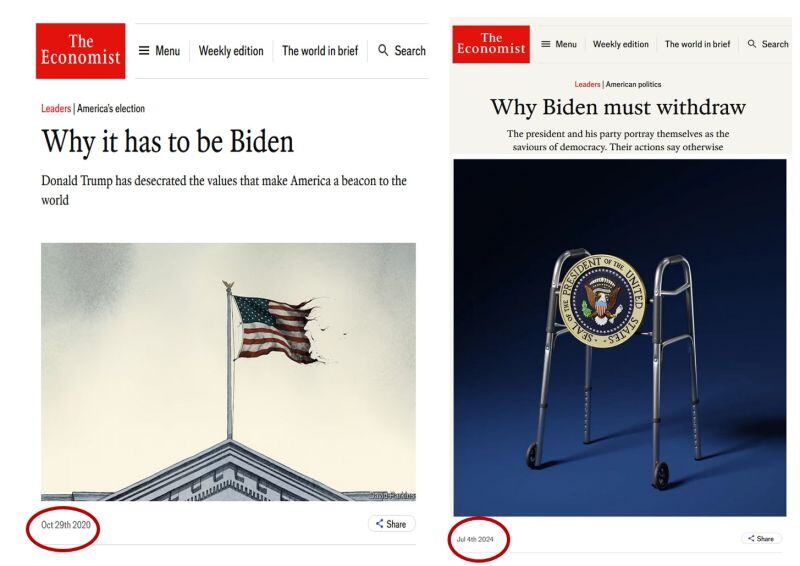

The Economist in October 2020 (left) vs. today (right)

This week in The Economist: "Why Biden must withdraw - The president and his party portray themselves as the saviours of democracy. Their actions say otherwise"

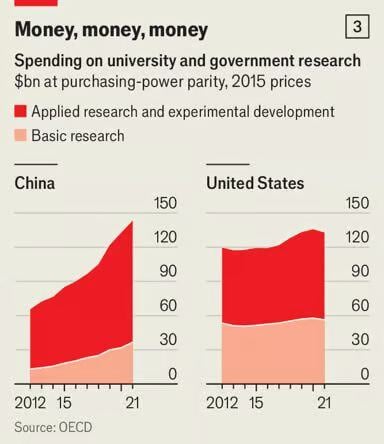

📢 China's public spending on scientific research is now above America's

• Chinese researchers focus mostly on applied fields, whereas US still leads on basic research • Beijing has precise priorities: AI, quantum, chips, neuroscience, genetics, biotech, deep space/oceans Source: Agathe Demarais, OECD

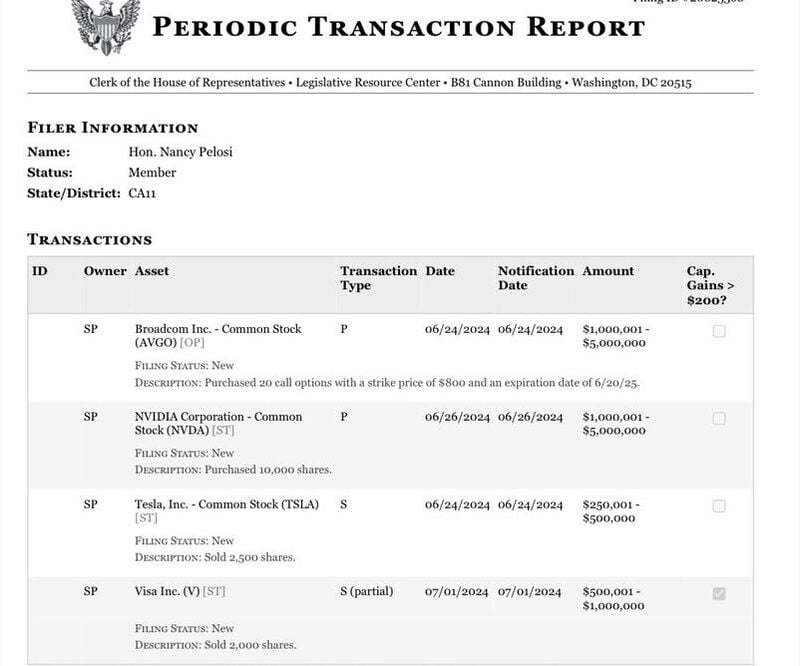

BREAKING: Nancy Pelosi has sold her Tesla, $TSLA, position worth ~$500,000.

She has also purchased an addition $1.2 million of Nvidia, $NVDA, and $5 million of Broadcom, $AVGO. Nancy Pelosi made millions buying nvidia, $NVDA, over the last two years. It appears that she is now doubling down on semiconductors stocks. Are chip stocks setting up for favorable legislation and/or US support ⁉ Source: The Kobeissi Letter

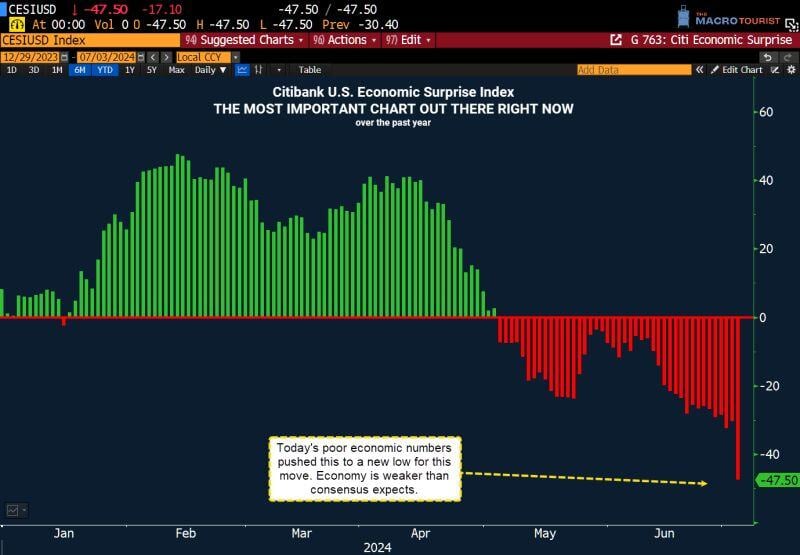

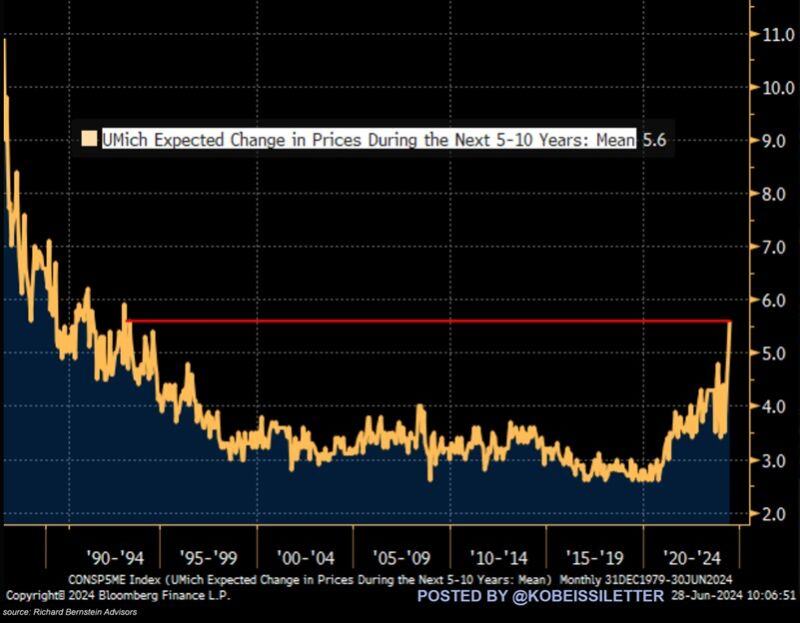

BREAKING: US consumers' average 5-10 year inflation expectations have spiked to 5.6%, the highest in 31 years.

This measure increased by ~2 percentage points in just a few months. By comparison, median inflation expectations are around 3%, in-line with the readings seen over the last 3 years. Meanwhile, CPI inflation has been above 3% for 38 consecutive months, the longest streak since the 1990s. Will inflation stay a major issue in H2 2024? Source: The Kobeissi letter, Bloomberg

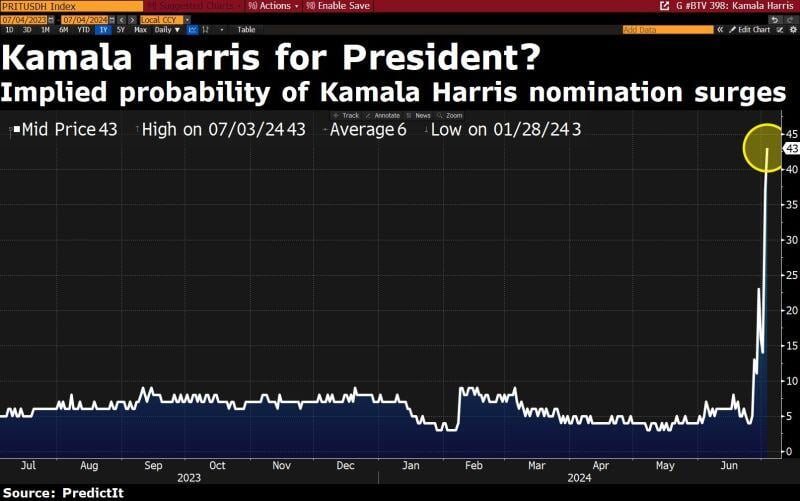

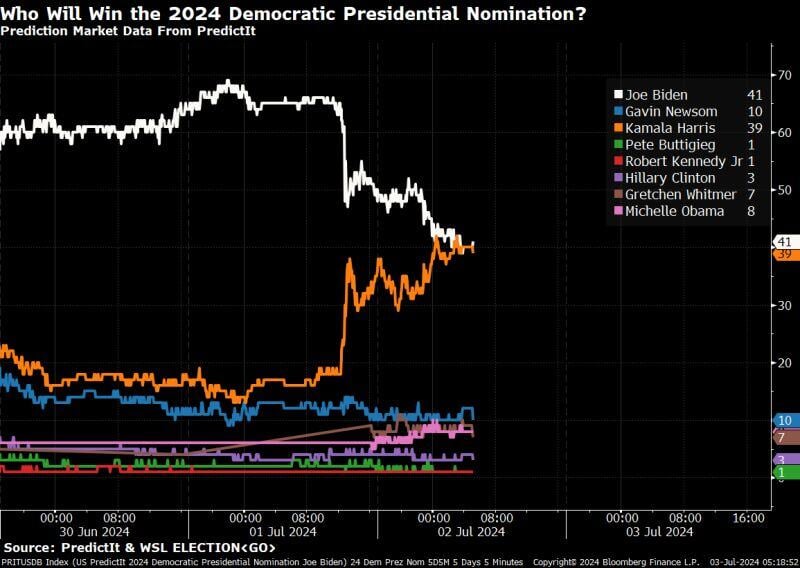

Kamala Harris and Joe Biden's odds of securing the Democratic presidential nomination have converged...

Source: Bloomberg, Michael McDonough

Odds of Biden winning democratic 2024 presidential nominee are collapsing as NYT said Biden told ally he is weighing whether to continue in race

.

Investing with intelligence

Our latest research, commentary and market outlooks