Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

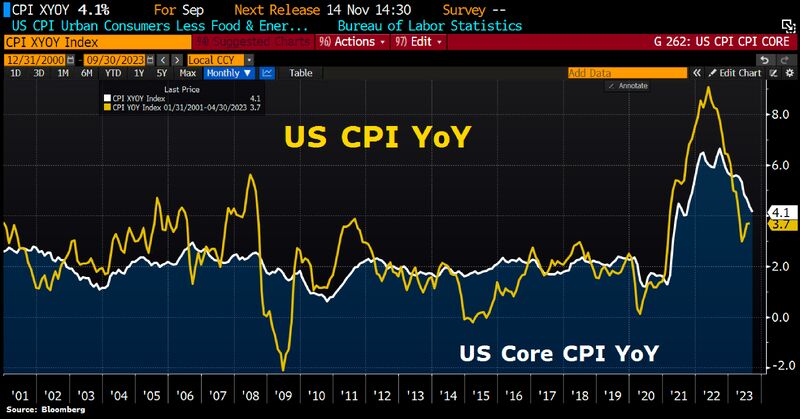

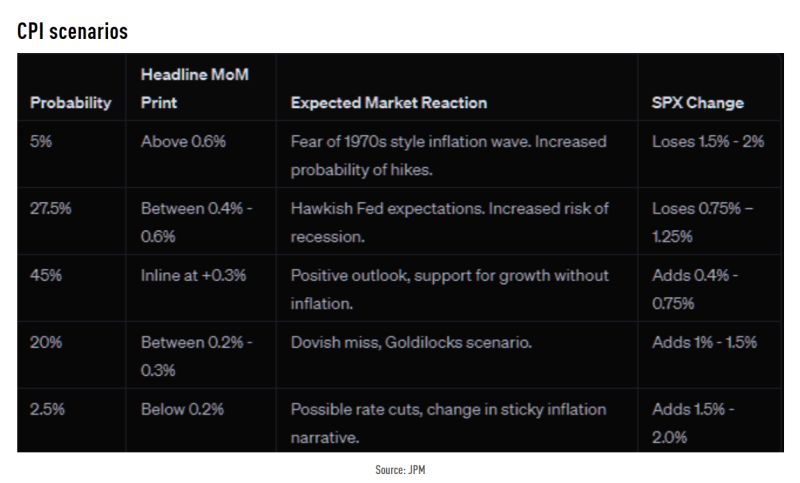

US inflation is cooling, but only slowly

From the perspective of the Fed, the figures are probably not worrying enough to trigger another interest rate hike. However, they are not good enough to sound the all-clear either, CBK says. Source: HolgerZ, Bloomberg

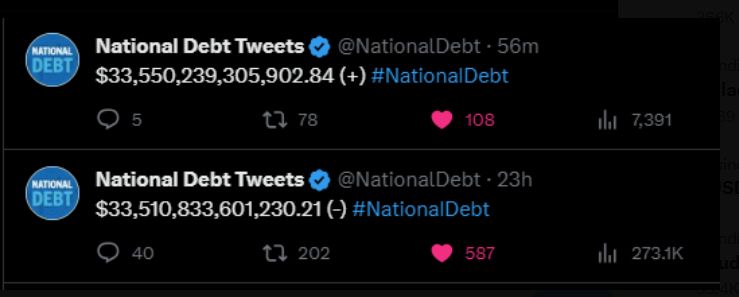

Another $40 billion in US debt today

US national debt has jumped by $550 billion in the past 3 weeks. This is WAY above the pace of $2 trillion per year expected by the government. The US was at $31.4 trillion just 4 months ago. Debt has increased by $2.1 trillion in the past 4 months. Source: WallStreetSilver

Prices paid to US producers rose by more than forecast in September

The PPI for final demand advanced 0.5% from a month earlier, according to the Bureau of Labor Statistics. The cost of gasoline increased 5.4% The biggest driver of today's PPI beat: a near record surge in PPI Deposit Services. In other words high rates (and inflation) lead to higher rates (and inflation) Source: www.zerohedge.com

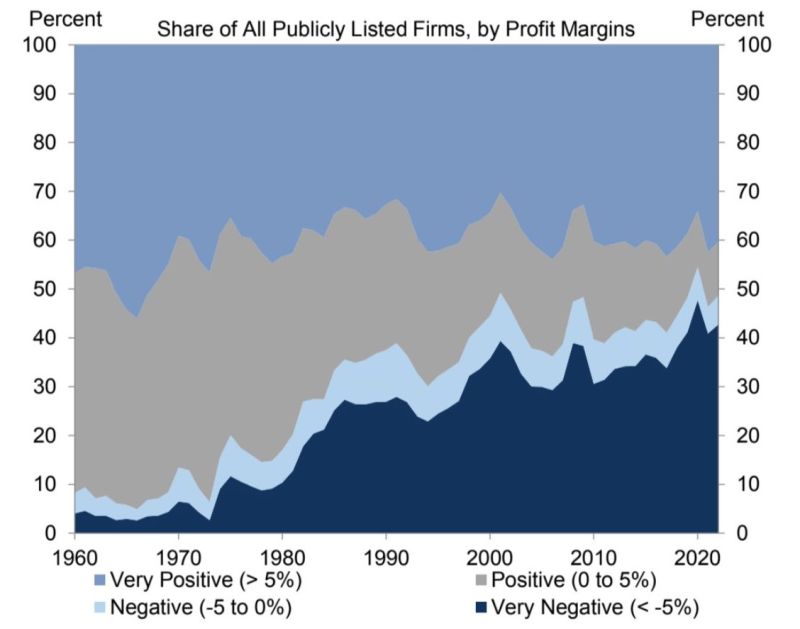

Almost half of US listed firms have negative profit margins

They have been able to survive in artificially low interest rates and ample liquidity environment. Things have changed though. Source: GS, Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks