Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

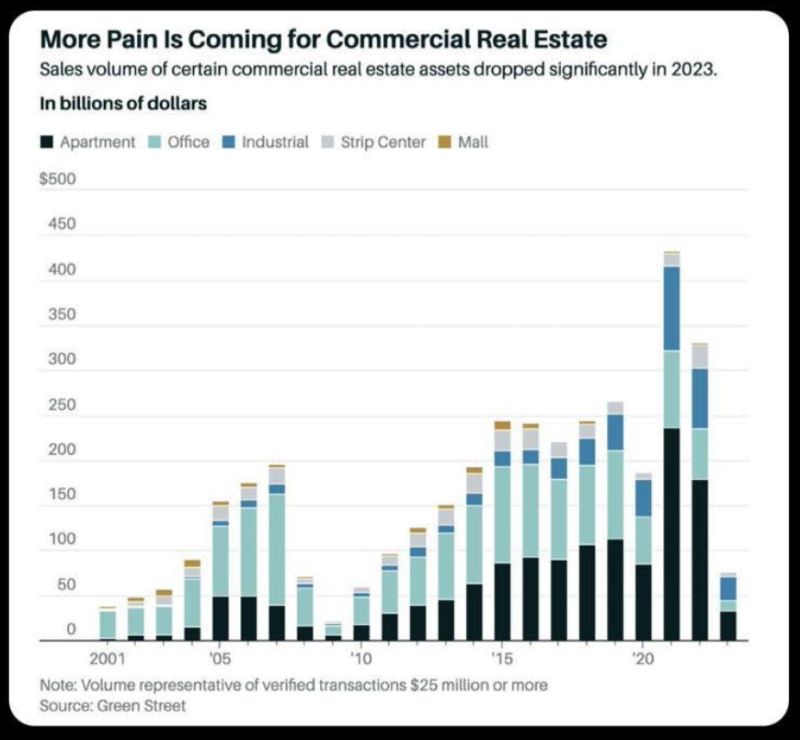

US Commercial real estate sales volume have fallen to the lowest level in 13 years

Source: Green Street

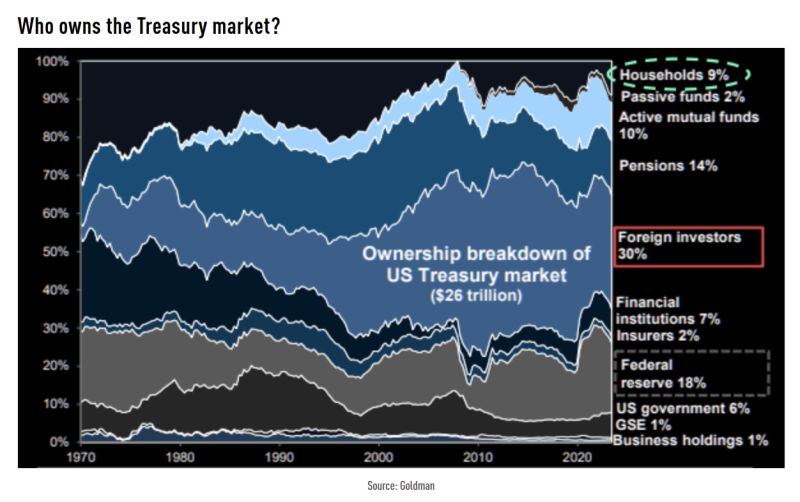

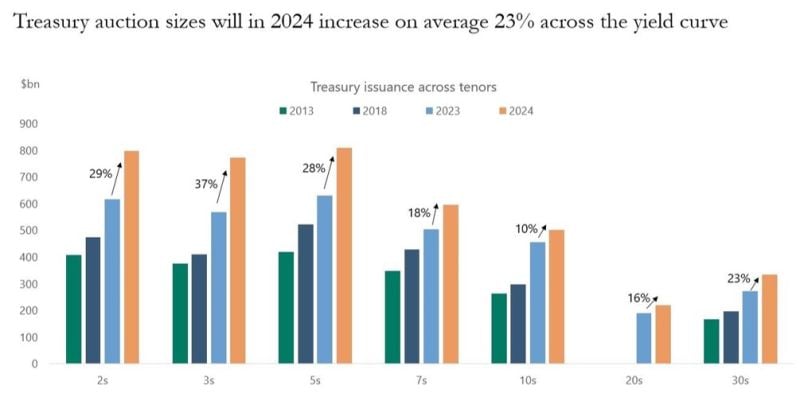

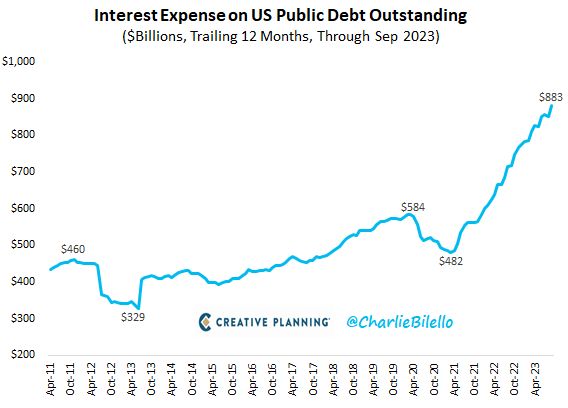

Heavy Supply remains a risk for US Treasuries

How long will the Fed be able to continue with QT? Source: Michel A.Arouet

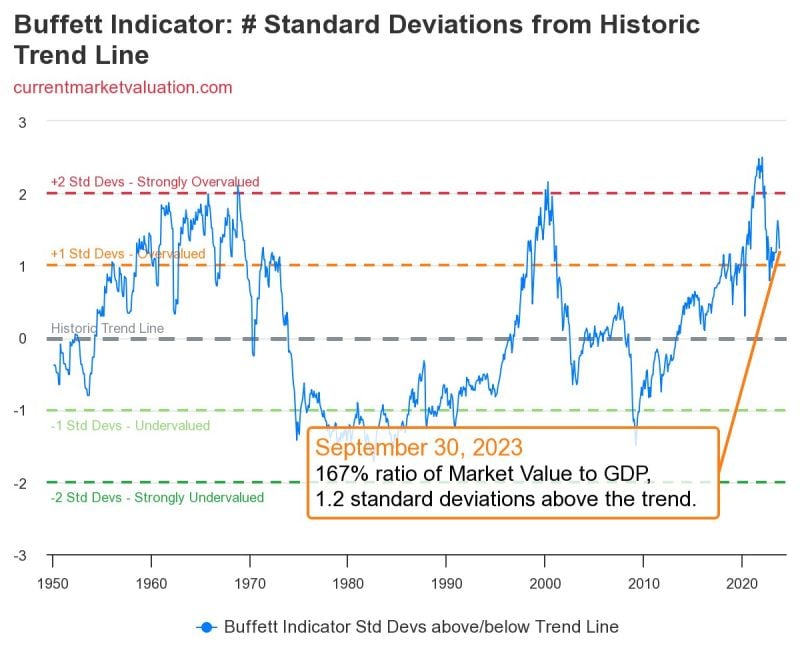

Where we are on the Buffett indicator

(The ratio of the total United States stock market value to GDP) Source: Brian Feroldi

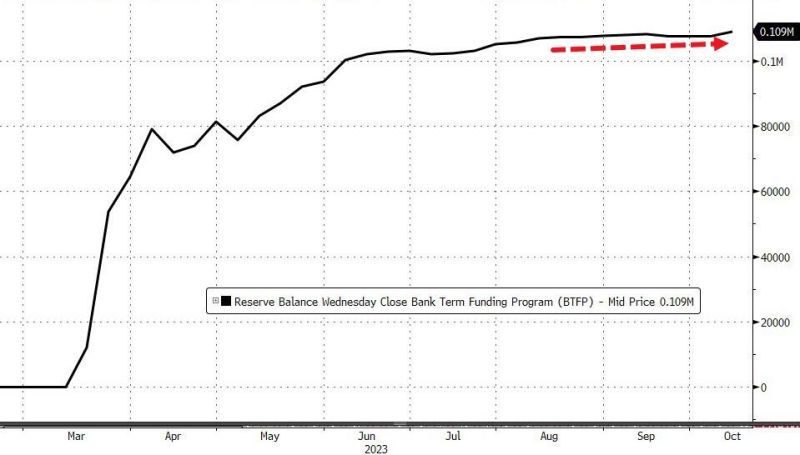

Usage of The Fed's emergency funding facility rose to a new record over $109BN...

This week saw the biggest jump in the BTFP since July. Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks