Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

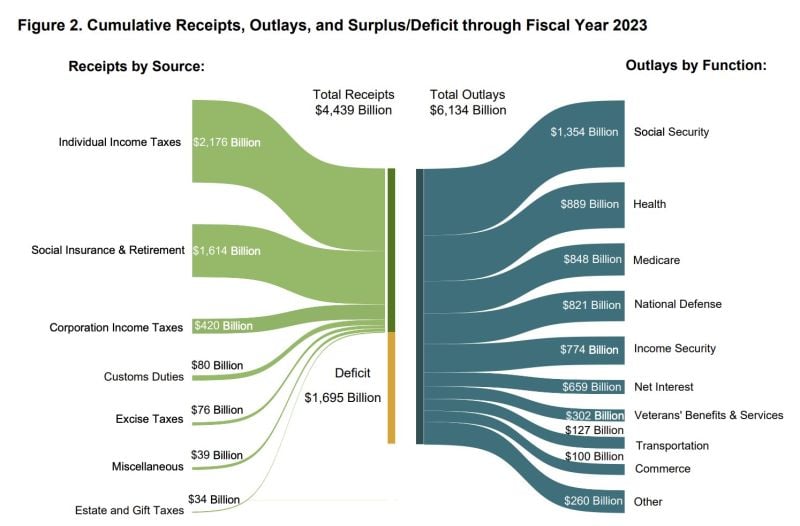

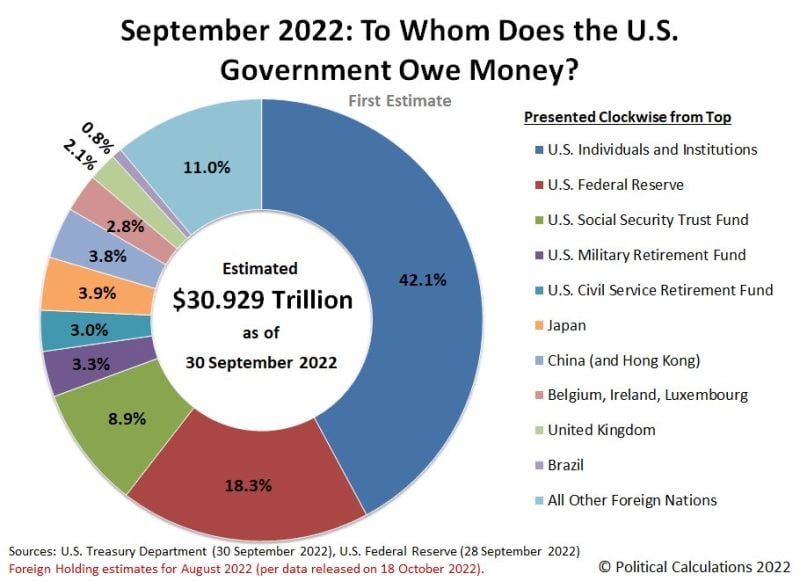

The Kobeissi Letter >>> In fiscal year 2023, the US ran a deficit of $1.7 trillion

If you add back the student loan forgiveness program adjustment, the deficit was actually $2 trillion. To put this in perspective, the annual US deficit is roughly equal to total individual income tax collected. It also means that the 2023 deficit is nearly 5 TIMES as large as corporate income taxes. The 2023 deficit as reported is ~25% larger than total Social Security outlays. Net interest was $659 billion and should soon pass the national defense budget. What's the long-term plan here?

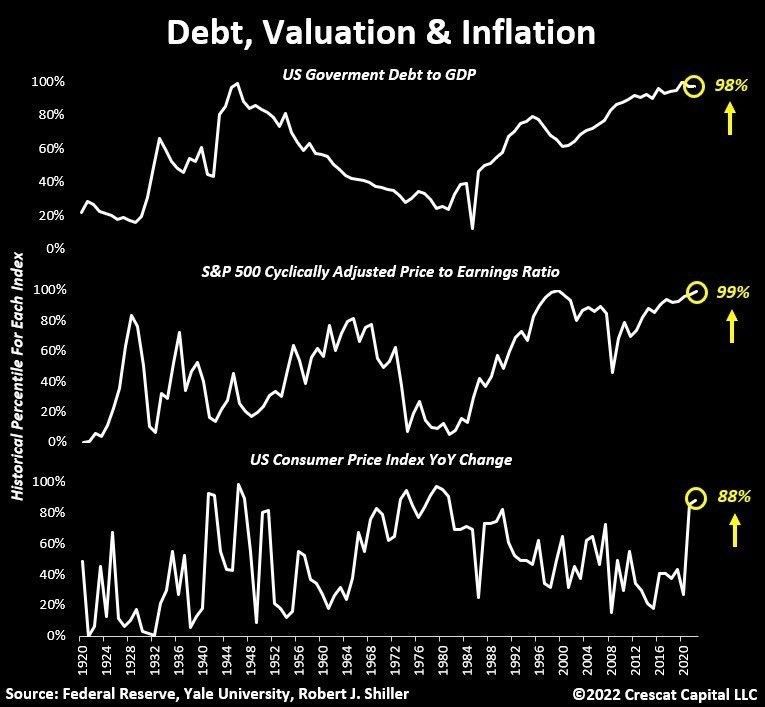

Where do we stand in terms of percentile each year for the below aggregates in the US:

- US Government Debt to GDP = 98th percentile - SP500 Cyclically-adjusted-PE ratio = 99th percentile - US Consumer Price Index YoY change = 88th percentile Sounds like an interesting trifecta... Source: Crescat Capital

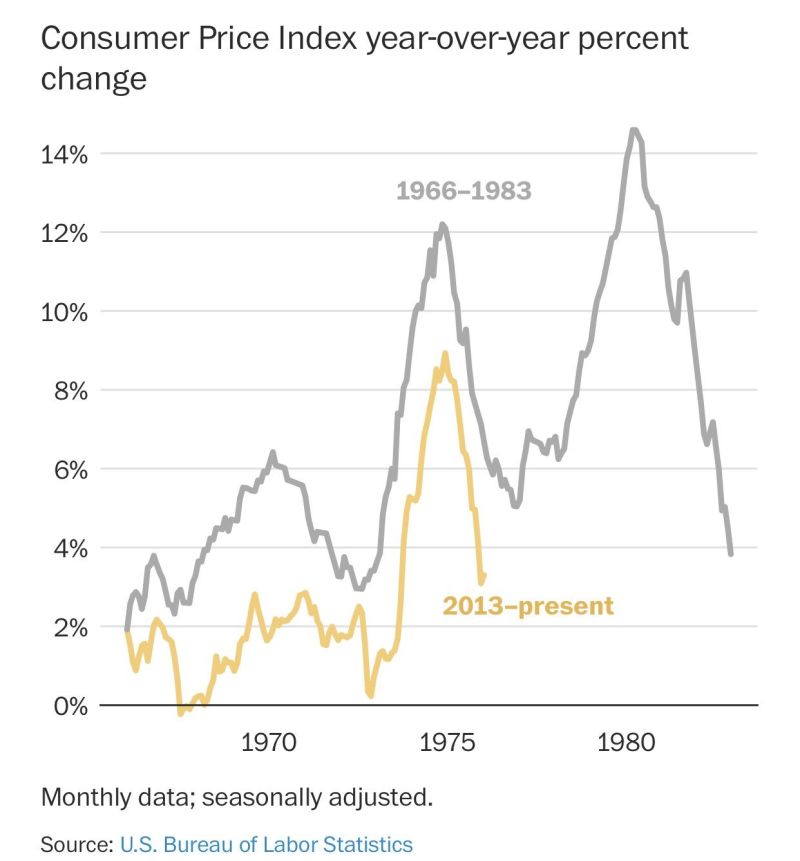

Is US inflation following the footsteps of the 1970s?

Source: Game of Trades

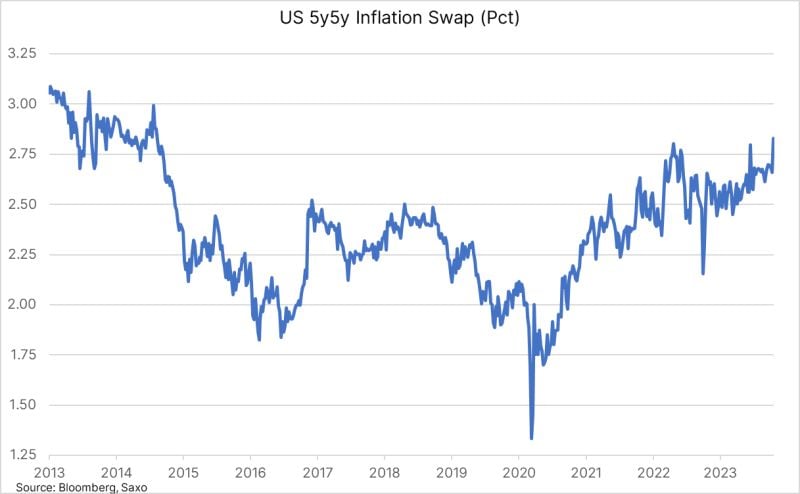

BREAKING >>> Powell says inflation is still too high and lower economic growth is likely needed to bring it down

US 10-year is just 3bp shy of 5%... Federal Reserve Chairman Jerome Powell acknowledged recent signs of cooling inflation, but said Thursday that the slowing in price increases was not enough yet to determine a trend and that the central bank would be “resolute” in its commitment to its 2% mandate. “Inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” Powell said in prepared remarks for his speech at the Economic Club of New York. “We cannot yet know how long these lower readings will persist, or where inflation will settle over coming quarters.” Source: CNBC, Ole S.Hansen, Bloomberg, Saxo

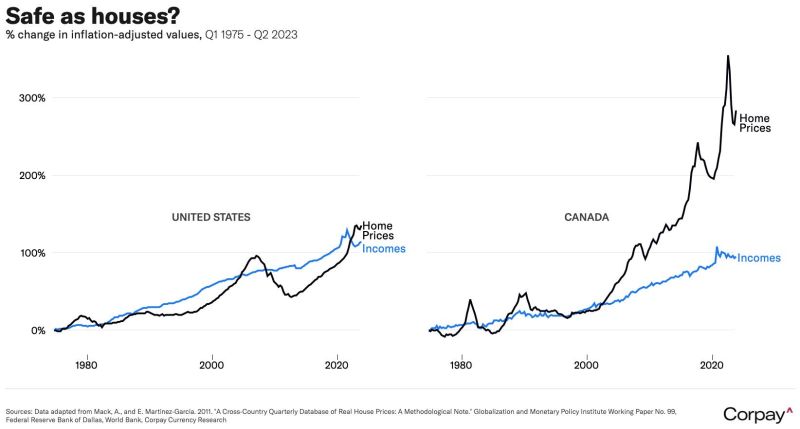

Amazing chart about Canada housing market (on the right) vs. US housing market (on the left).

Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks