Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

P/E Forward for the largest US companies - Magnificent 7

$TSLA Tesla 62 $AMZN Amazon 58 $NVDA NVIDIA 40 $MSFT Microsoft 30. $AAPL Apple 28 $GOOGL Alphabet 24 $META Meta 23 Source: Vlad Bastion

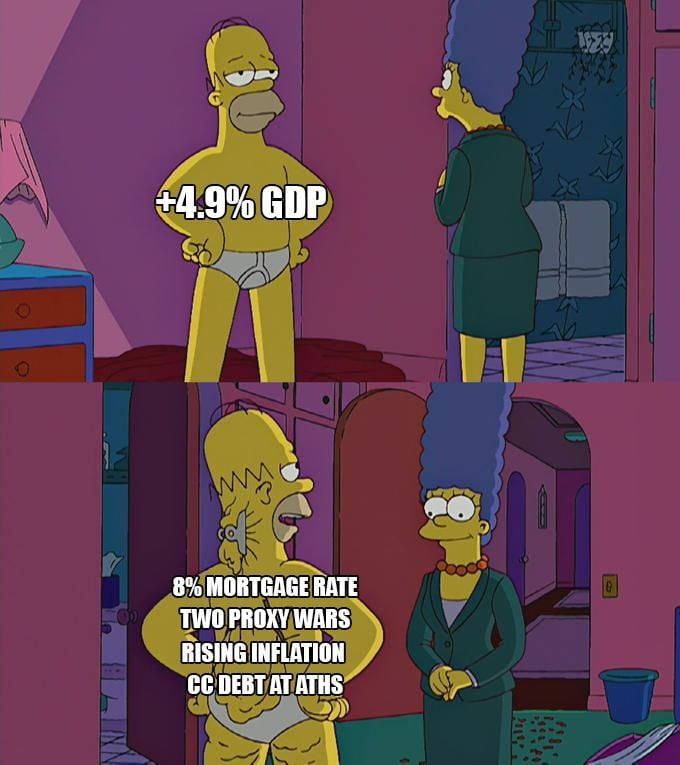

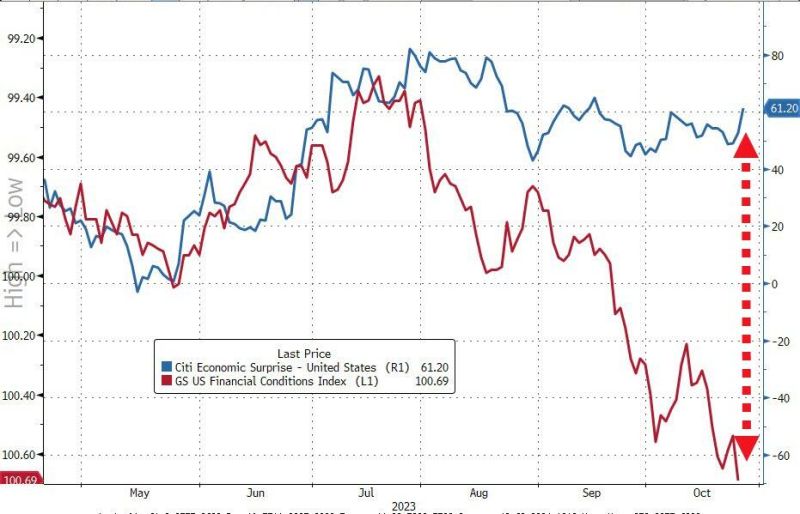

For now, the monetary policy transmission route of tightening US financial conditions are NOT reaching the economy...

Indeed, an avalanche of US macro data on Thursday presented a positive blend of updates across growth (better), inflation (lower), and labor markets (looser/worse). - Economic Growth: Real GDP rose 4.9% in 3Q (consensus 4.5%) driven by strong demand across consumer and federal/state government, and inventories. However, a major contribution from inventories could in turn weigh significantly on growth in 4Q - Manufacturing: Orders for Durable and core capital goods also grew by more than expected... thanks to a massive surge in non-defense aircraft orders (so don't expect it to last). - Housing: Pending home sales rose 1.1% month over month in September, above expectations for a decline... but brace for October to be a bloodbath as mortgage rates re-accelerated. - Inflation: Core PCE prices component of the GDP report rose less than expected. - Labor: Initial and continuing jobless claims both increased by more than expected -- a positive for markets which are focused on labor market re-balancing (i.e., could benefit from less wage inflation).

US GDP grew 4.9% in Q3 QoQ annualized, way faster than +4.3% expected

However, bond yields dropped in the afternoon session. This Bloomberg US GDP chart shows why. Indeed, US GDP growth in Q3 was mainly driven by private consumption & inventories. This may not last. Source: Bloomberg, HolgerZ

US stocks now account for 61% of the $60 Trillion MSCI All-Country World Index, the highest level in history

Source: FT, Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks