Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

The US equity market ultra-dominance

Source: Michel A.Arouet, Bloomberg, Goldman Sachs

US To Borrow $1.5 Trillion In Debt This & Next Quarter, After Borrowing A Massive $1 Trillion Last Quarter

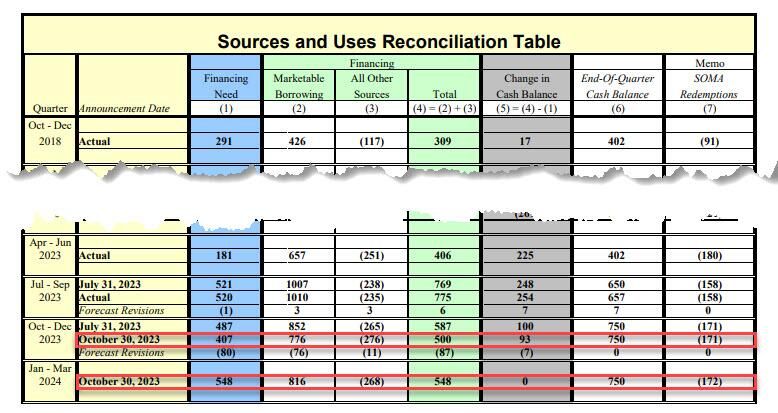

During the October – December 2023 quarter, Treasury expects to borrow $776 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion. The borrowing estimate is $76 billion lower than announced in July 2023, largely due to projections of higher receipts somewhat offset by higher outlays. During the January – March 2024 quarter, Treasury expects to borrow $816 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion. Source: www.zerohedge.com

The US treasury curve is going in all directions

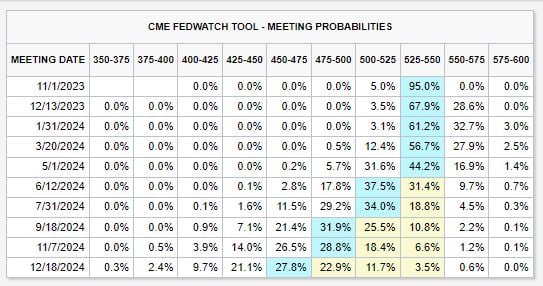

Interest rate futures are beginning to price-in a potential rate CUT this week, at a 5% chance. Meanwhile, the base case still shows rate cuts beginning in June 2024. However, odds of another HIKE in January 2024 are now up to ~36%... Source: The Kobeissi Letter

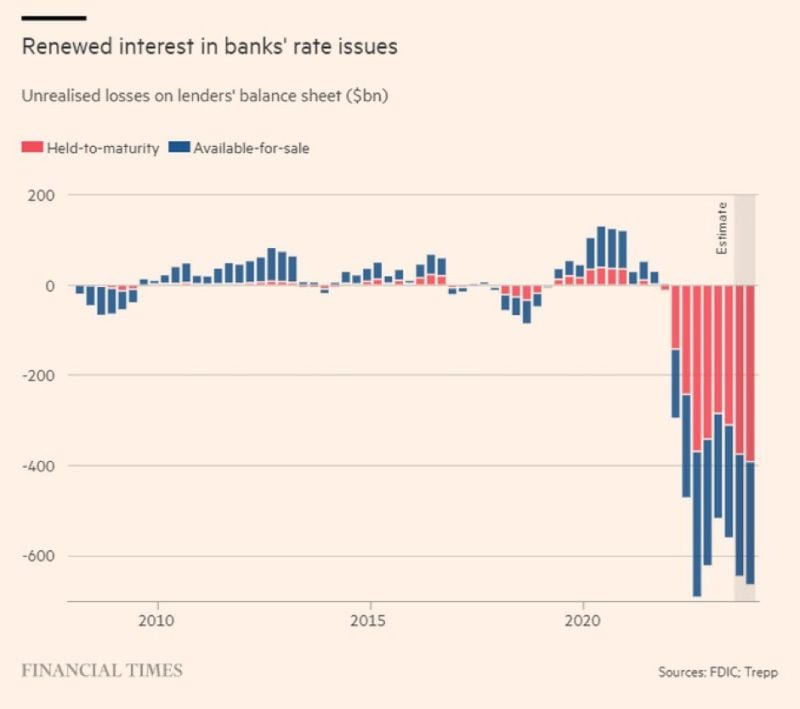

With the US 10-year yield close to 5%, long duration bonds start to look attractive

There is one issue though: sentiment on long-dated bonds look too optimistic E.g 1/ not a single sell-side analyst does have a 10-year target yield above 5% for the next 6 months; 2/ Long-dated bonds funds are enjoying record inflows; 3/ Magazine cover pages look upbeat on bonds (source: J-C Parets). The consensus is not always wrong but so much optimism is usually not a good sign from a contrarian perspective.

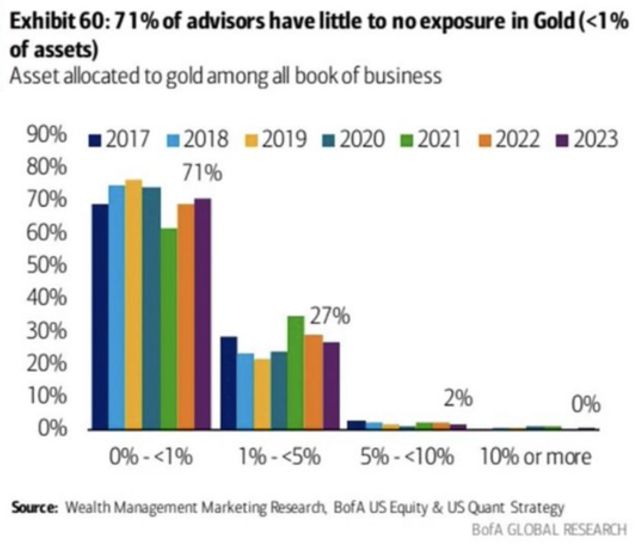

As highlighted by Tavi Costa, despite the recent push toward new highs, gold remains severely under-allocated

In fact, 71% of US advisors have little to no exposure to the metal. Similar to how Central banks continue to aggressively accumulate the metal, conventional investment portfolios have yet to take steps to find true diversifiers. Sources: Tavi Costa, BobEUnlimited

Investing with intelligence

Our latest research, commentary and market outlooks