Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

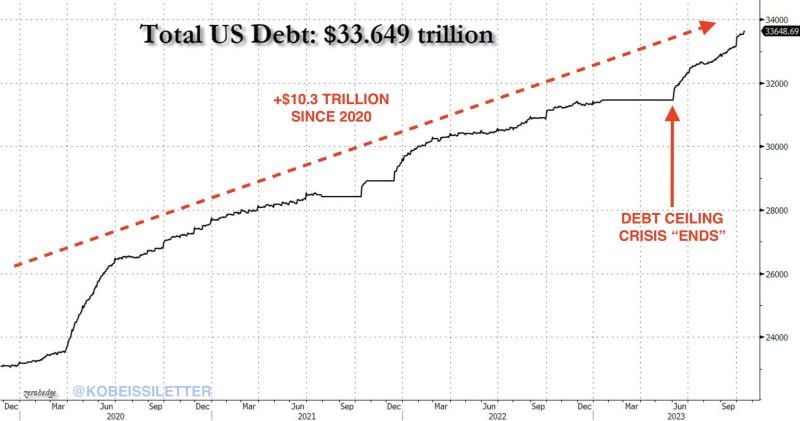

Total US debt is now up ~$650 BILLION since it crossed $33 trillion exactly 1 month ago, according to Zerohedge

Yesterday alone, total US debt jumped by another $58 billion. Total US debt has grown by ~$22 billion PER DAY for the last month. In other words, the US has added ~$915 million in debt every hour for the last month. Since the debt ceiling "crisis" ended, total US debt is up over $2 trillion. Since 2020, total US debt is officially up more than $10 TRILLION. Source: The Kobeissi Letter

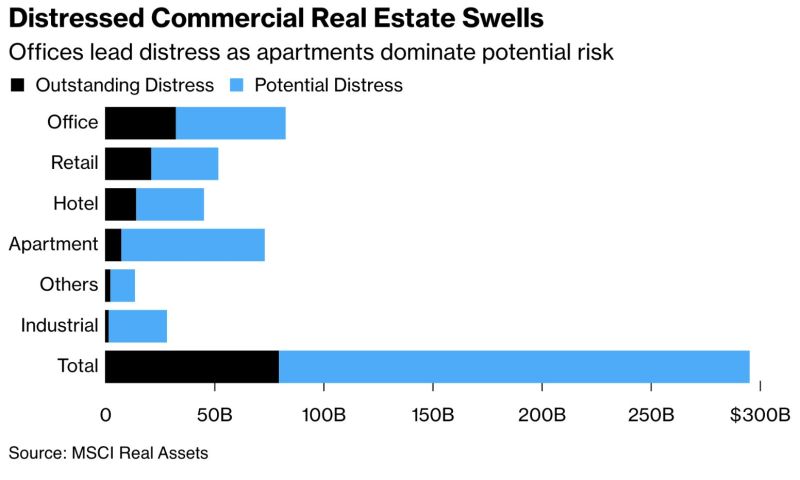

JUST IN: The Value of US Distressed commercial real-eestate is approaching $80 billion, the highest level in a decade Now less than HALF the 2008 financial crisis levels

Blackstone, Brookfield and Goldman Sachs have defaulted or relinquished offices to lenders this year. Today, Pimco walked away from 20 hotels with +$240MM in debt. Over $1.5 trillion of commercial real estate loans will mature over the next 3 years. Source: Bloomberg, Genevieve Roch-Decter, CFA, Barchart

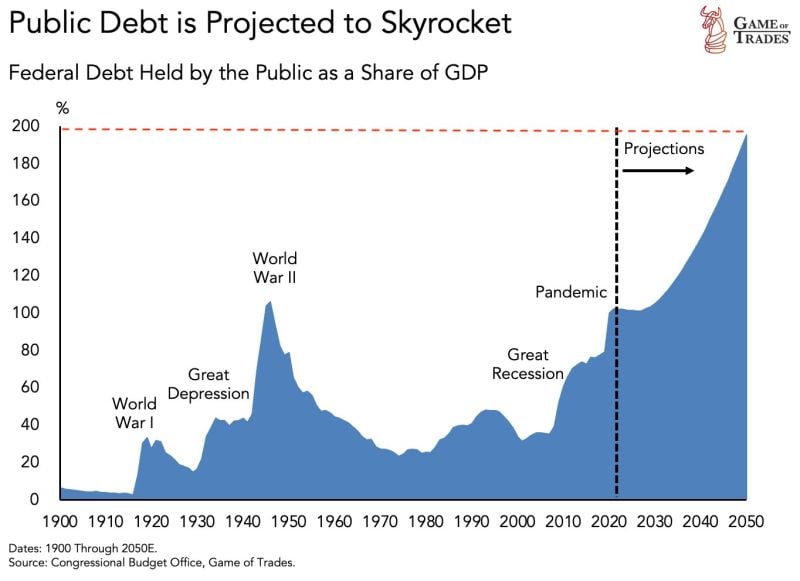

The US government has consistently shown fiscal irresponsibility

Debt-to-GDP is projected to reach 200% by 2050. The government is going to face a major problem with the amount of money they will have to pay in interest. Everybody, except the US government, seems to understand the unsustainability of this path. Source: Game of Trades

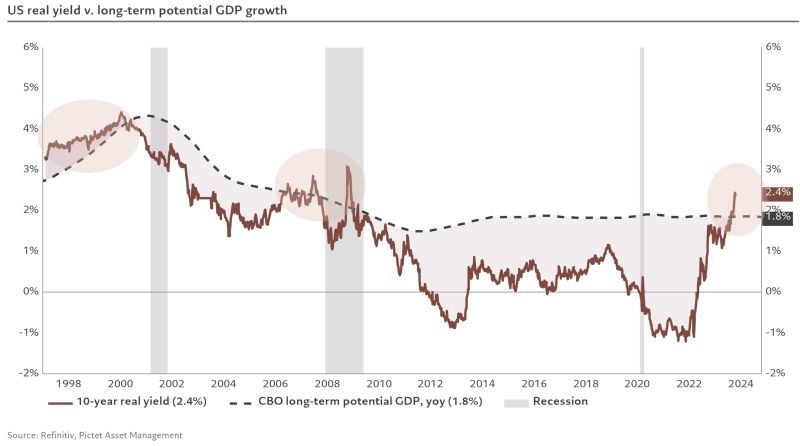

The US 10-year note yield is now officially above the median cap rate for the first time since 2008, according to Reventure Consulting

In simple terms, the return on an investment property is now BELOW the 10-year note yield. It should be no surprise that investor house purchases are now down a massive 45% this year. Source: The Kobeissi Letter

After adjusting for inflation, US retail sales fell 0.7% over the last year, the 11th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 3.0% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

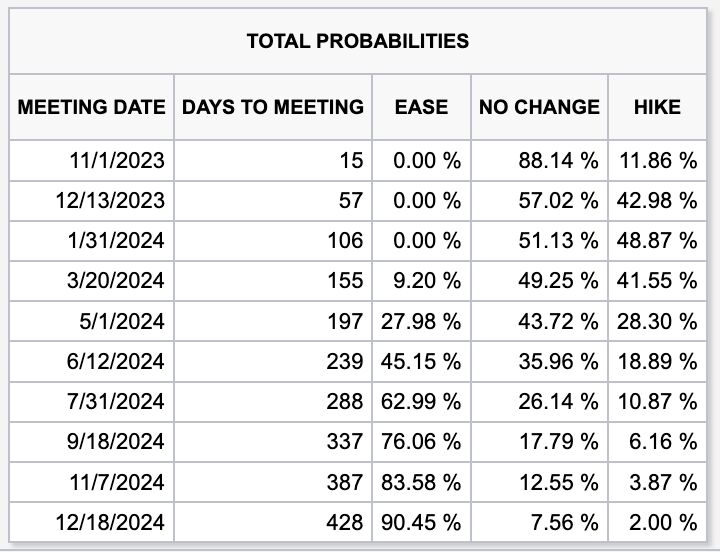

Stunning to see that markets are beginning to price-in chances of rate HIKES all the way until December 2024

There's now a ~49% chance of a rate hike by January 2024. There is even an 11% chance of a rate hike in July 2024... Meanwhile, the 10-year note yield is nearing 4.90% right now. Will 8% mortgages soon going to look like a good deal? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks