Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

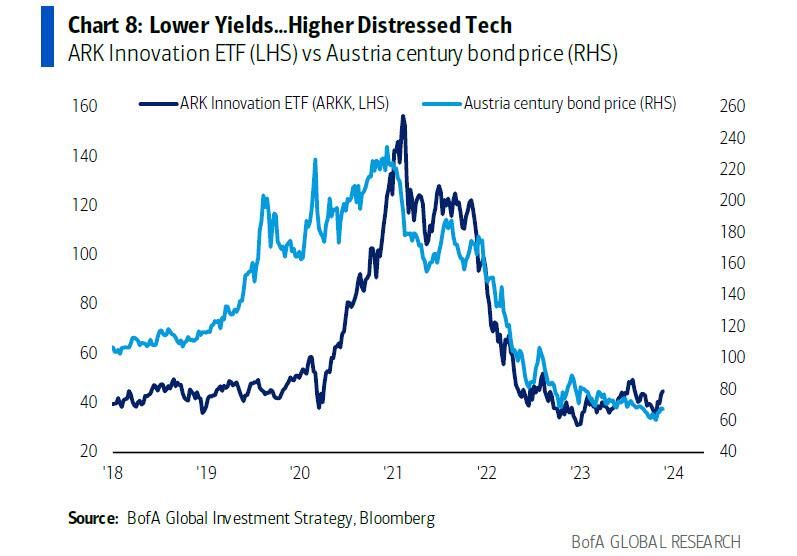

A BofA report shows the remarkable correlation between the Austria government 100-year bond and Ark Invest Innovation ETF

Their point: if bond yields are going "tactically" lower, "distressed tech" is set for a big rally... Source: BofA, www.zerohedge.com

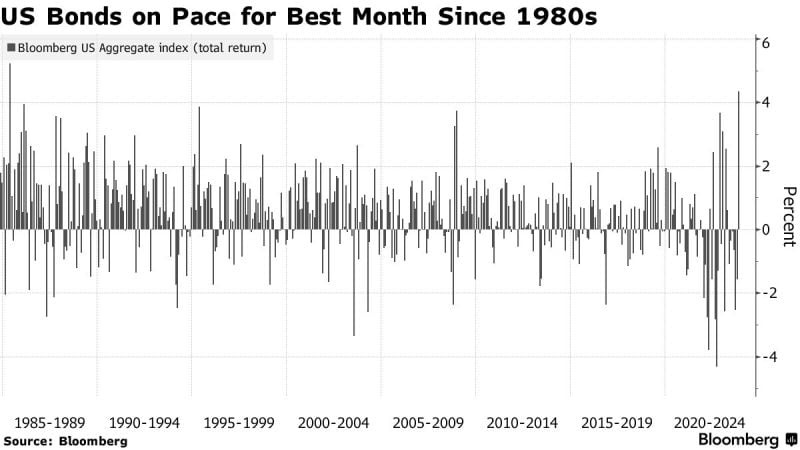

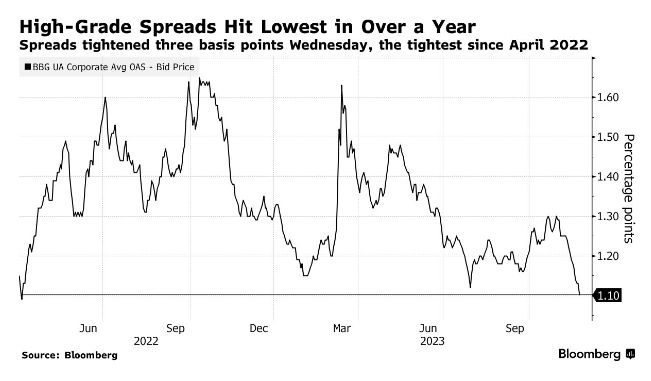

Bond Market's Best Month Since 1980s Sparks Cross-Asset Rally

In a year in which little has gone right in the US bond market, November turned out to be a month for the record books. Investors frantically bid up the price of Treasuries, agency and mortgage debt, sparking the best month since the 1980s and igniting a powerful pan-markets rally in everything from stocks to credit to emerging markets. Source: Bloomberg

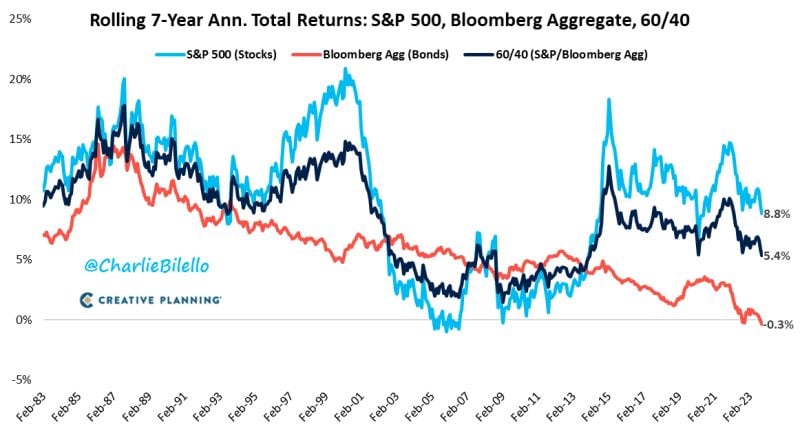

Per Bloomberg, US Treasury issuance next year is expected to reach $1.9 trillion...

Excess supply of US Treasuries remains a key downside risk for bonds (and thus for equities given the still high correlation between the 2). Note that every Treasury auction is now very closely monitored by investors with some immediate consequences on market returns (e.g last week: strong auction triggered a drop in US Treasury yields on Wednesday and a rise in sp500). Source picture: Markets Mayhem

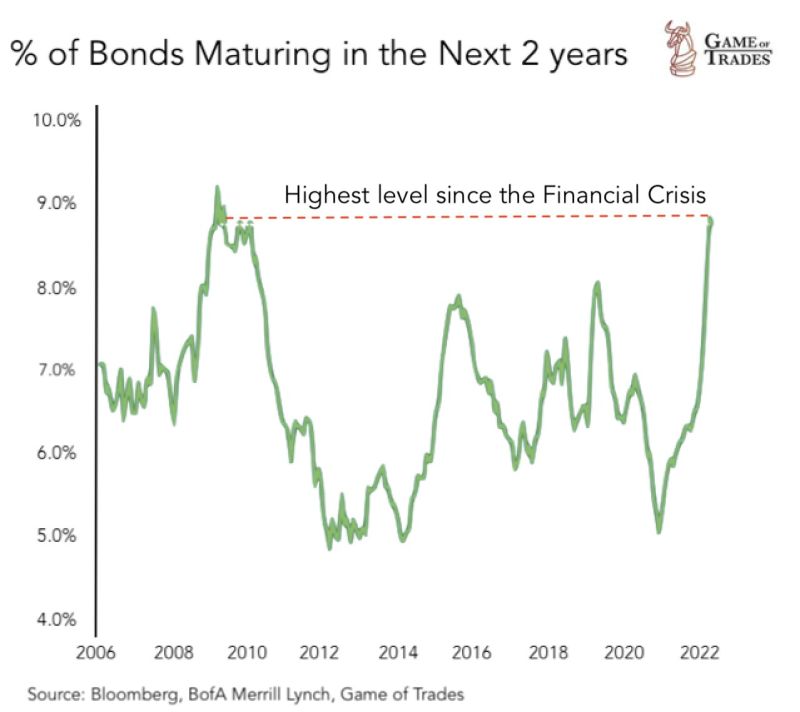

This level was last seen during the Financial Crisis

9% of bonds are due to mature within the next 2 years. High interest rates will make it harder to refinance. Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks