Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

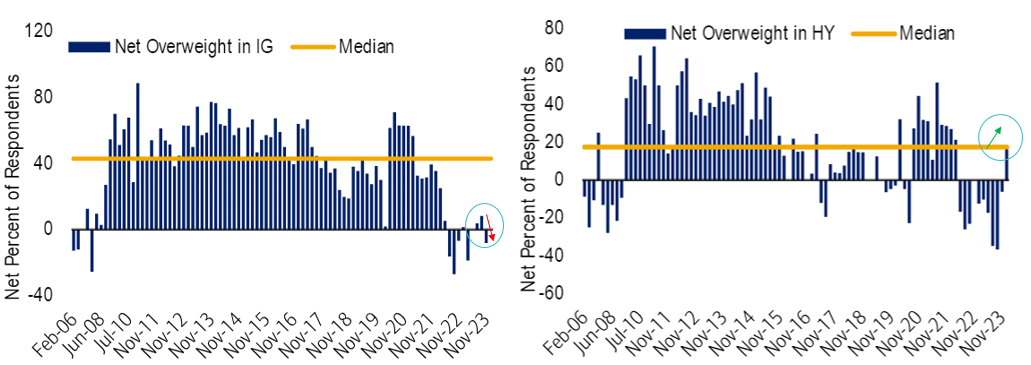

Investor Repositioning on HY Revealed in Latest BoFA Credit Survey 🔄📈

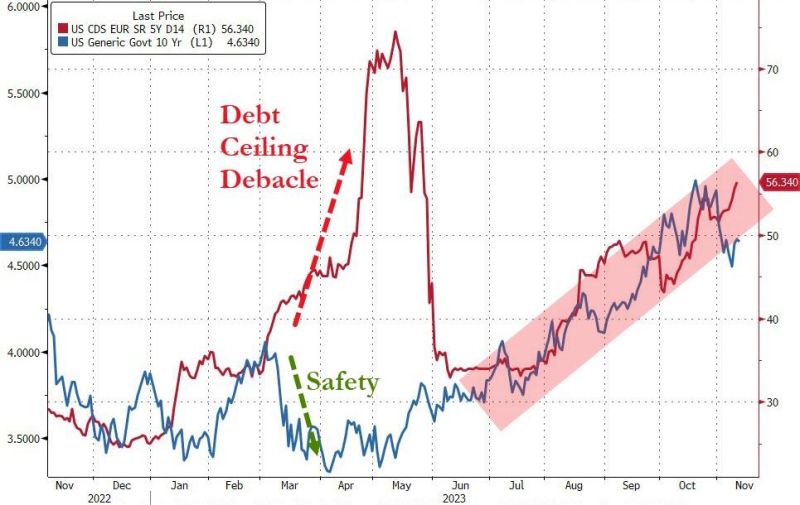

The recent BofA Credit Investor Survey reveals significant shifts in market sentiment. For Investment Grade (IG) investors, net positioning dropped to -8% net underweight in November from a +8% net overweight in September. Conversely, High Yield (HY) witnessed an uptick, reaching +18% net overweight in November, the highest since Jan-2022. Notably, HY investors are more optimistic about spreads, with the net share expecting wider spreads dropping significantly for the 3 and 6-month horizons. Delving deeper into investor positioning, the HY landscape presents a nuanced picture. The primary repositioning in November focused on the #frontend (1-3y) and #higherquality of the HY. Many asset allocators are embracing a barbell strategy, blending exposure to the intermediate/long end of high-quality corporate bonds or Treasuries with a portion invested in the front end of the US HY, enhancing the average yield. The goal is to navigate economic uncertainties by benefiting from the safety of high-quality fixed income and compensating for potential defaults in the HY space. Could this strategic approach push the HY-IG Yield Ratio lower, considering it already reaches post-GFC lows? #CreditMarkets #Investing #FinanceInsights 📊💼 Source: BoFA

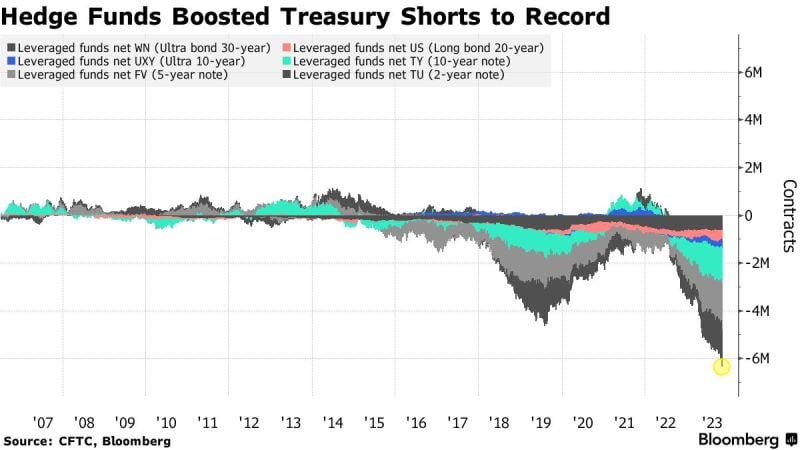

Hedge Funds extended short positions on Treasuries to a record just before smaller-than-expected US bond sales and weaker jobs data spurred a rally

Leveraged funds ramped up net short Treasury futures positions to the most in data going back to 2006, according to an aggregate of the latest Commodity Futures Trading Commission figures as of Oct. 31. The bets persisted even though the cash bonds had rallied the week before. Source: Bloomberg

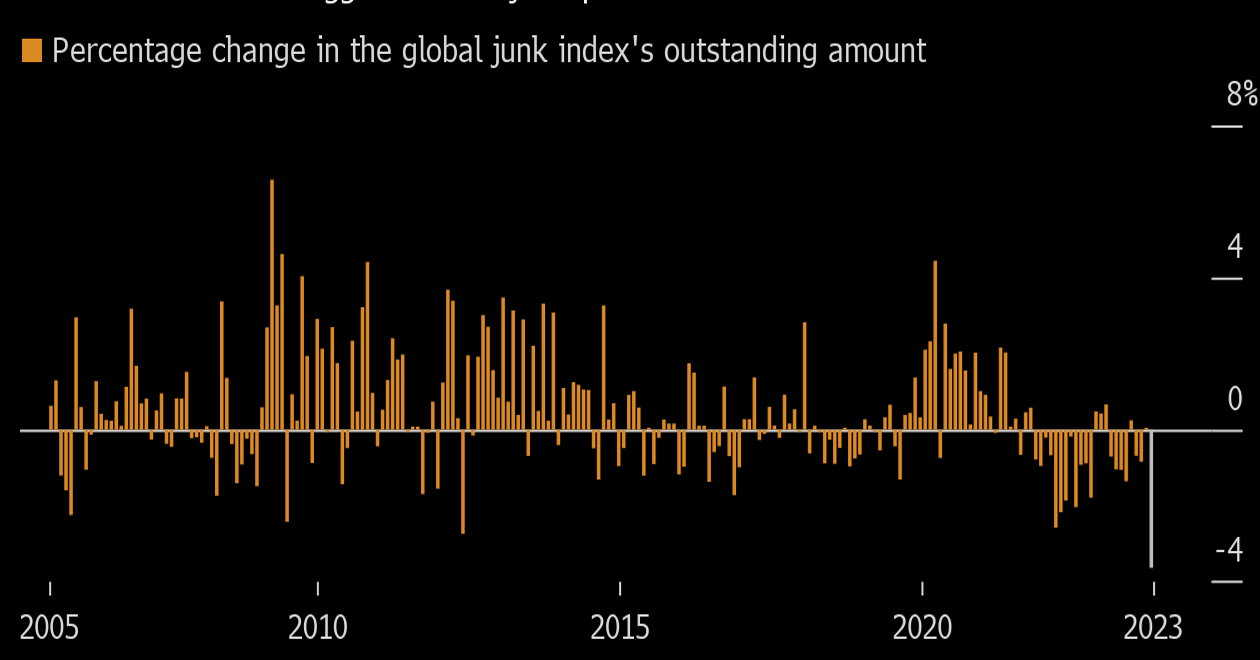

Ford's Rise to Investment Grade Sparks Historic Shift in Junk Bond Market!

Ford's recent credit rating upgrade to Investment Grade status triggered a remarkable $46.8 billion exit from junk bond indexes, marking the most significant reduction in the global junk bond benchmark since 2005. This makes Ford the largest "rising star" in history. It underscores a transformation in corporate priorities, with a heightened focus on financial resilience amidst economic uncertainties. The trend of "fallen angels" descending into junk status has notably decelerated, and analysts anticipate more companies achieving investment grade status in the coming years. Source: Bloomberg #Finance #InvestmentGrade #JunkBonds 📉📊📈

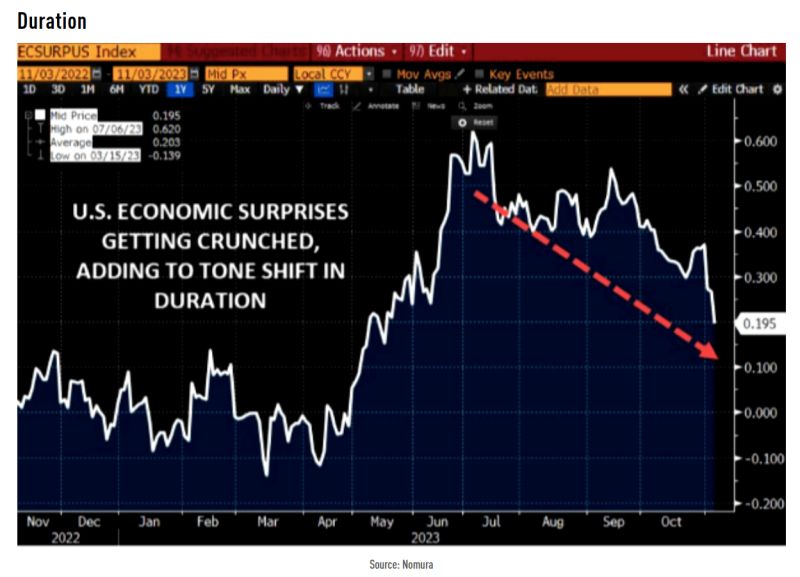

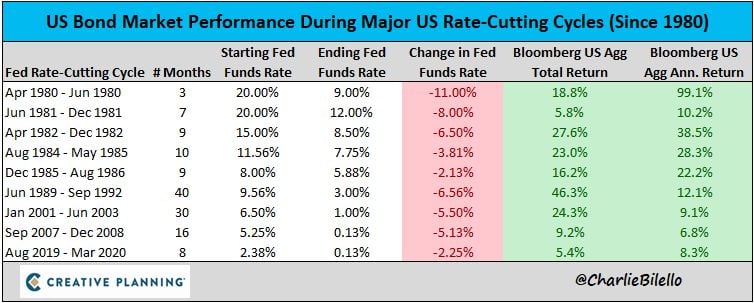

The Fed is now expected to start cutting rates in May 2024

Here's how bonds have performed during prior rate-cutting cycles... Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks