Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

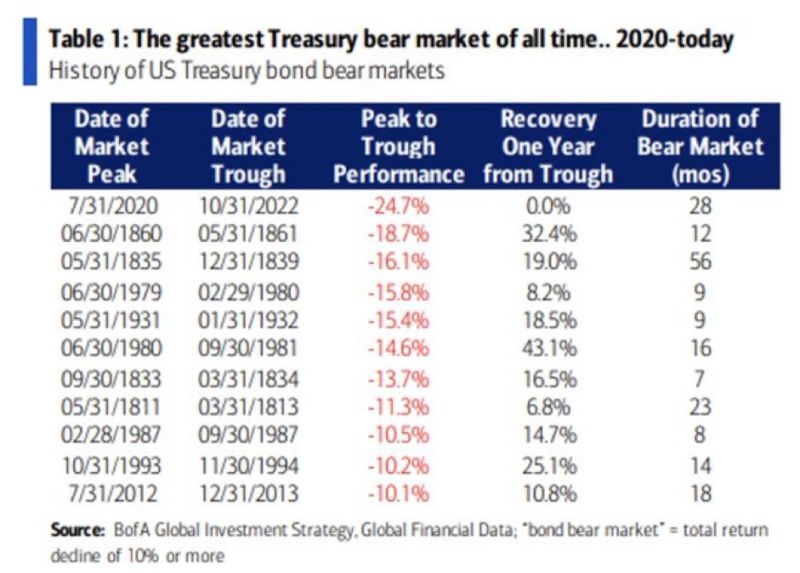

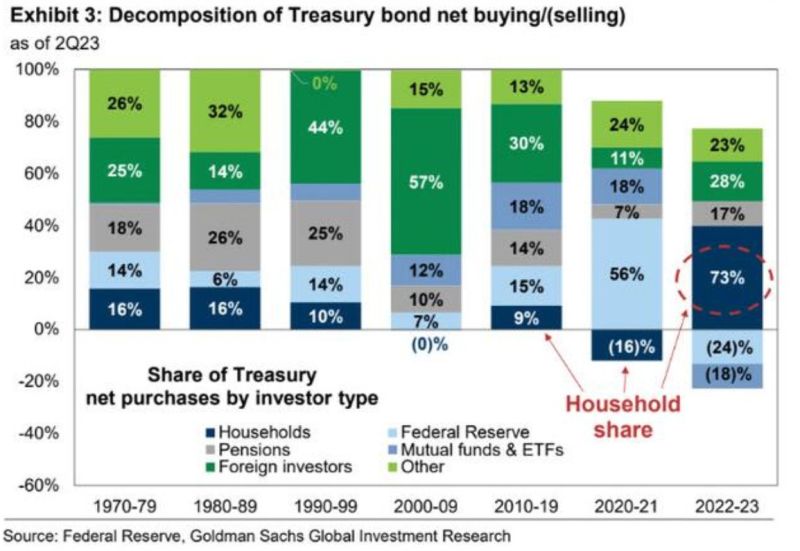

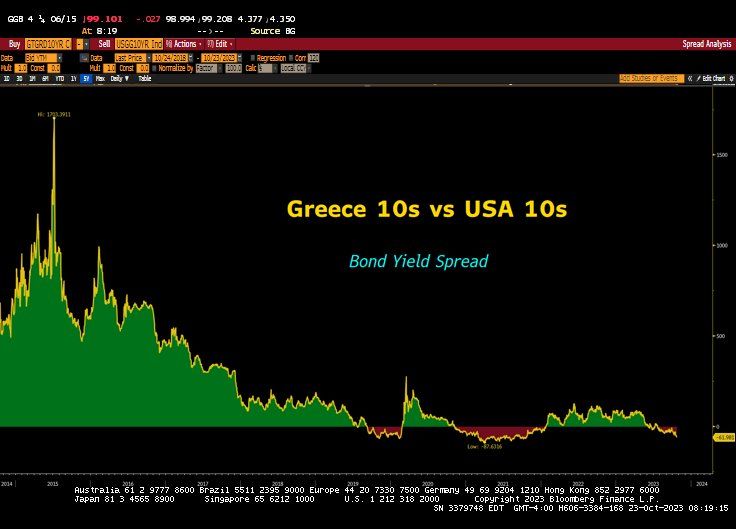

With the US 10-year yield close to 5%, long duration bonds start to look attractive

There is one issue though: sentiment on long-dated bonds look too optimistic E.g 1/ not a single sell-side analyst does have a 10-year target yield above 5% for the next 6 months; 2/ Long-dated bonds funds are enjoying record inflows; 3/ Magazine cover pages look upbeat on bonds (source: J-C Parets). The consensus is not always wrong but so much optimism is usually not a good sign from a contrarian perspective.

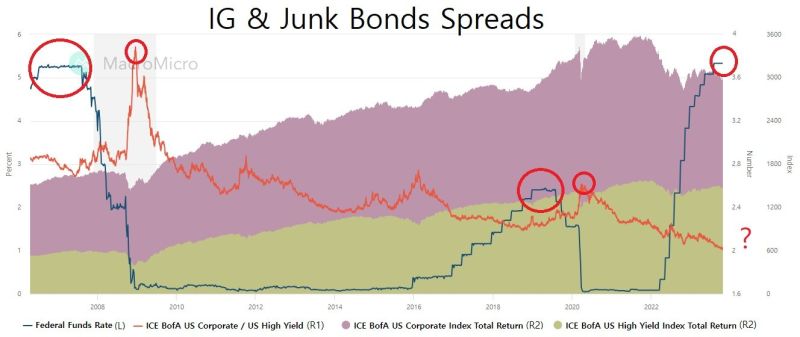

How long does it take for the FED to break the corporate bond market?

2008 : 1 year of plateau, resulted in credit event after another 1 full year. (Total 2 years) 2020 : 7 months of plateau, resulted in credit event after 6 months. (Total 13 months, 54% of 2008) 2023 : it's been 3 months into plateau so far. Chart made from MacroMicroMe - source: James Choi

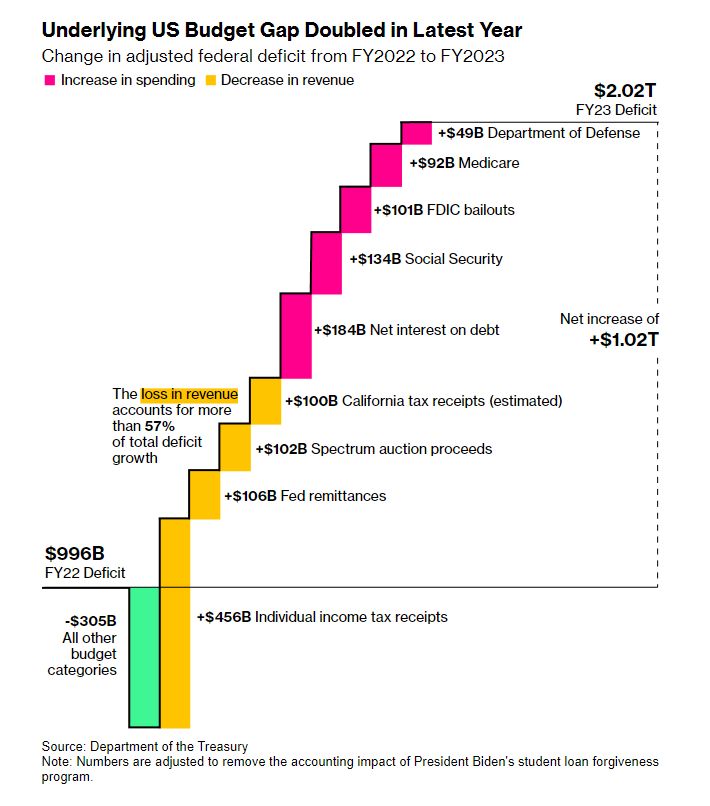

This chart illustrates another factor contributing to the increase in US bond yields:

Concerns about the govt's ability to manage its debt responsibly. The price of insuring against the possibility of the US government defaulting on its obligations (CDS Price) has recently jumped Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks