Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

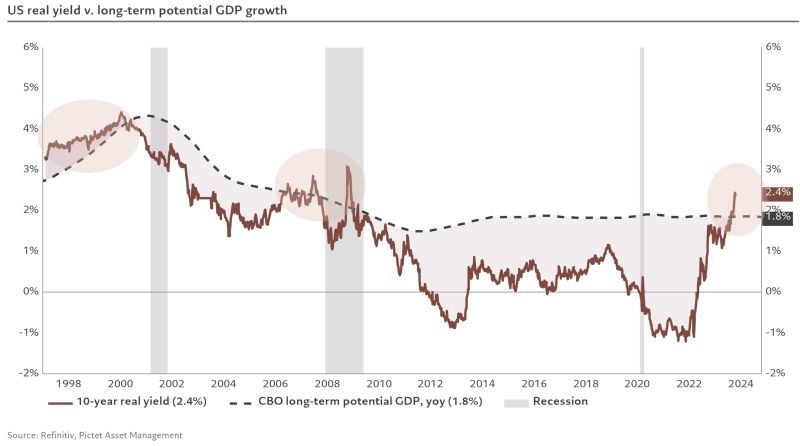

Fed Chair Jay Powell on why longer-term yields are moving higher: “It’s not apparently about expectations of higher inflation

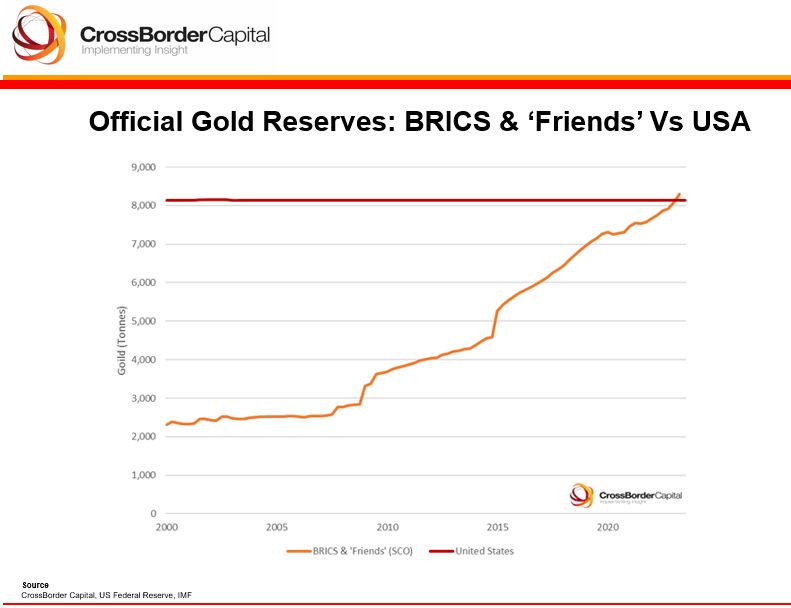

And it’s also not mainly about shorter term policy moves.” He probably has a point as #realyields are surging toward 2.5%, the highest since 2008. So what else can explain the surge in bond yields? Hints: 1) 1. A resilient economy — Q3 REAL GDP growth is expected to be around 3% annualized, well above trend growth of 1.5% to 2%, driven in large part by a resilient labor market and a strong consumer 2) Supply/demand imbalances — Given the growing U.S. fiscal deficit, the Treasury Department has been increasing its auction sizes for U.S. Treasury bills and notes. This year, the total amount of Treasuries issued in auctions is expected to climb to over $3 trillion, higher than at any year over the past decade (excluding 2020). This figure is expected to increase next year. Meanwhile, some of the natural demand for these bonds has moderated: The Fed is undertaking QT (reducing its holding of Treasuries by about $650 billion over the last year) and some foreign buyers, such as China, have slowly been reducing their holdings of U.S. Treasuries as well. Source: Lisa Ambramowitz, Bloomberg, Edward Jones

The US 10-year note yield is now officially above the median cap rate for the first time since 2008, according to Reventure Consulting

In simple terms, the return on an investment property is now BELOW the 10-year note yield. It should be no surprise that investor house purchases are now down a massive 45% this year. Source: The Kobeissi Letter

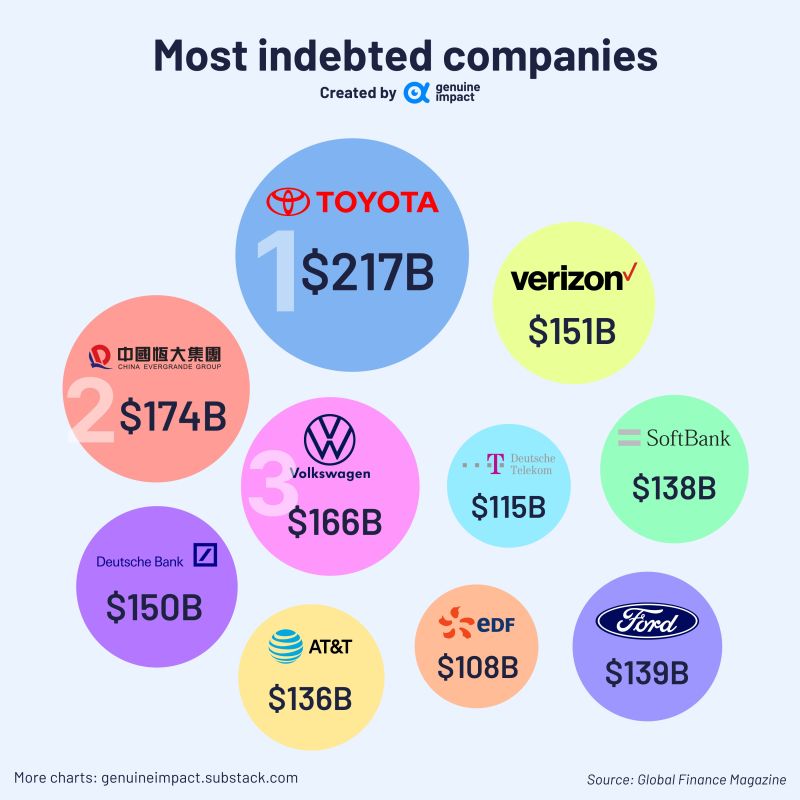

At the time of rising bond yields, here's a list of teh most indebted companies in the world by Genuine Impact

🚗Toyota Group is the most indebted company globally in 2023. 🏠While Evergrande Group, one of China’s biggest property developers, has lower debt than Toyota, its performance is significantly inferior to Toyota. It recently faced a debt crisis and is on the verge of collapse.

Investing with intelligence

Our latest research, commentary and market outlooks