Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

EM Middle East Sovereign Bonds Impacted by the Israeli-Palestinian Conflict

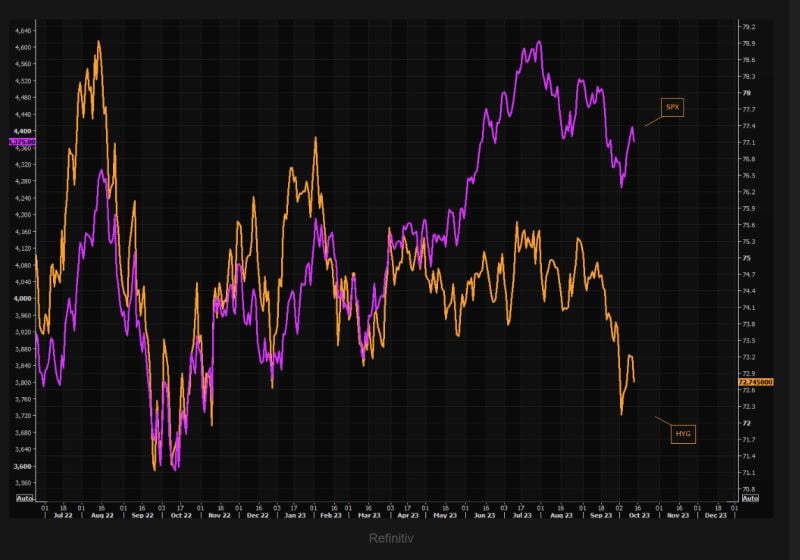

Since the commencement of the Israel-Palestine conflict, the 5-year CDS (Credit Default Swap) for Middle East sovereign bonds has experienced a significant surge. 📈 Notably, the market's response doesn't reflect heightened concern. This is evident as US equities have continued to climb since the conflict's onset, while interest rates have surged back to previous highs. 📈📊 Thus far, the impact has primarily reverberated in the commodities market, with fluctuations affecting oil and gold prices. Additionally, the Middle East sovereign countries in the EM (Emerging Markets) segment have also felt the repercussions. 🛢️💰 Is the market right to be this complacent in the face of ongoing geopolitical tensions?

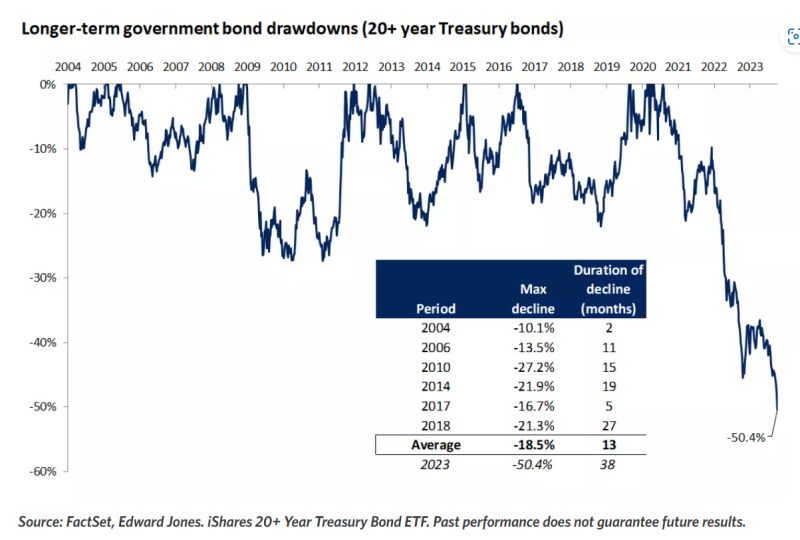

Big opportunities ahead for fixed income investors?

The past three years' pain in bonds could indeed be setting the stage for outsized gains ahead. To put the decline into perspective, long-term government bonds, with maturities greater than 20 years, have dropped 50% from their 2020 peak, a drawdown that is comparable to the 56% decline in stocks during the height of the Global Financial Crisis in 2008 Source: Edward Jones

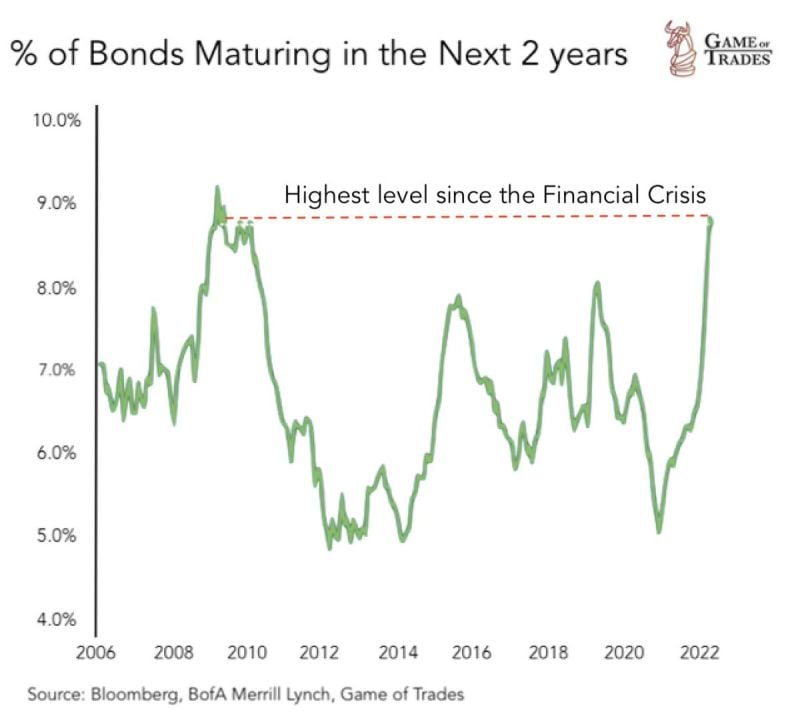

9% of bonds are set to mature in the next 2 years → The highest level since the Financial Crisis

High interest rates will make refinancing more difficult Source: Game of Trades

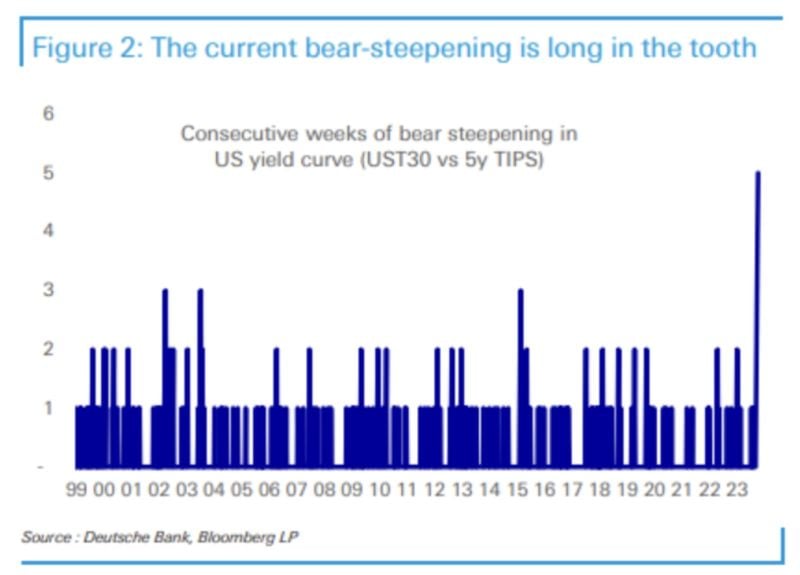

The Treasury Yield Curve has been steepening (i.e. uninverting) for 5 straight weeks, the longest streak in more than 25 years

Source: DB, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks