Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- nvidia

- AI

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- amazon

- microsoft

- ethereum

- meta

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

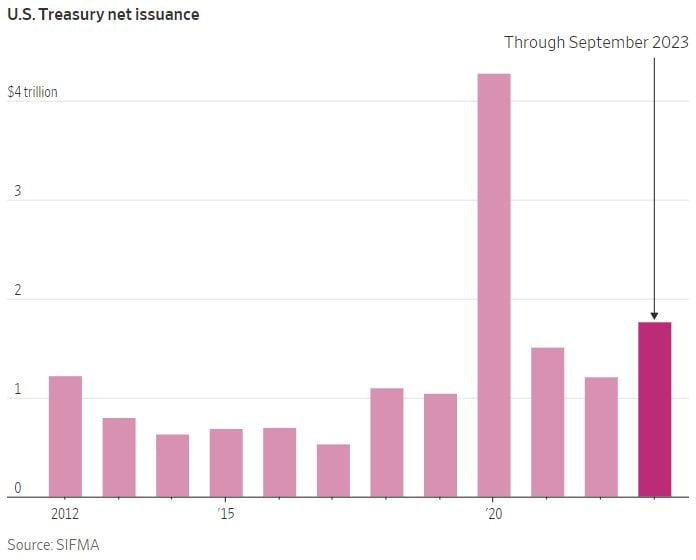

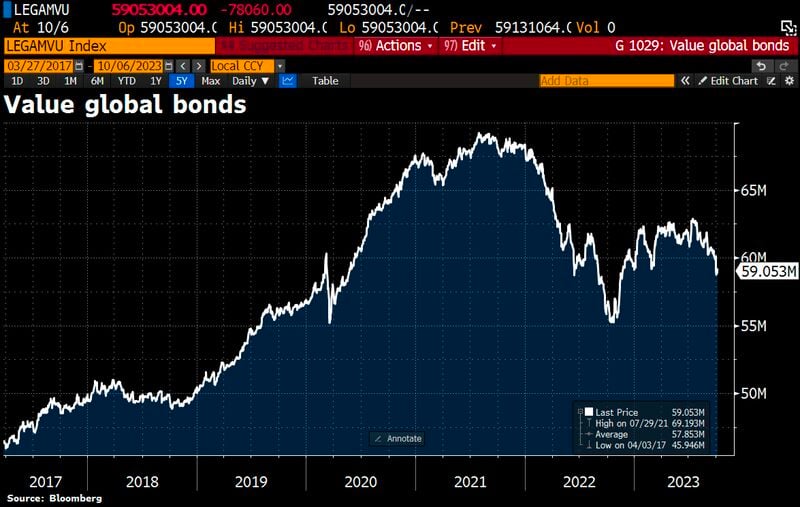

Who has the losses on the books? Value of global bonds has lost another $1.04tn. This brings the total losses to $3.9tn since mid-July

Source: HolgerZ, Bloomberg

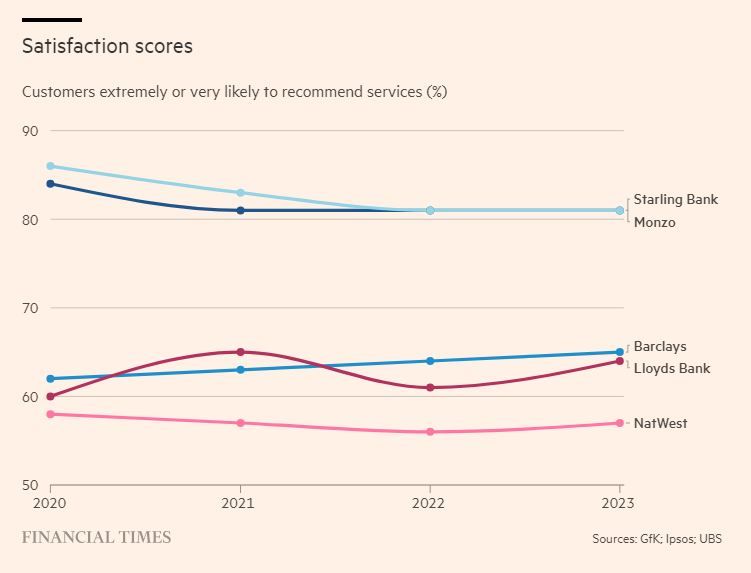

Interesting FT article on UK neobanks: "UK fintech: neobanks may end up blending in"

Low fees mean profits have remained elusive. But higher interest rates are now compensating for that, not least with better returns on client money put out on deposit. Satisfaction scores by customers are also much higher than traditional banks. Some lessons need to be learned. Source: https://lnkd.in/emZyY76d

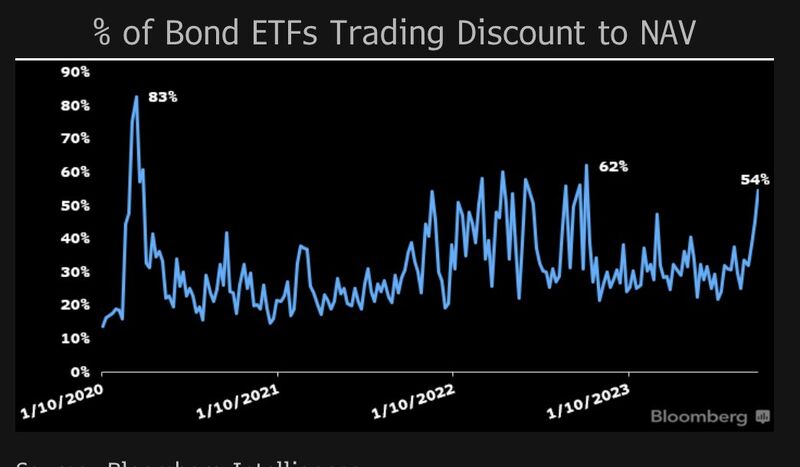

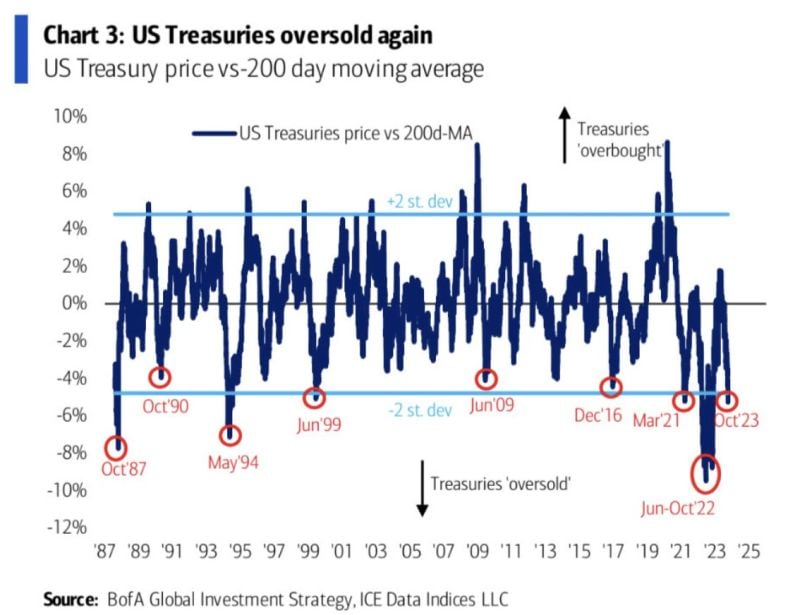

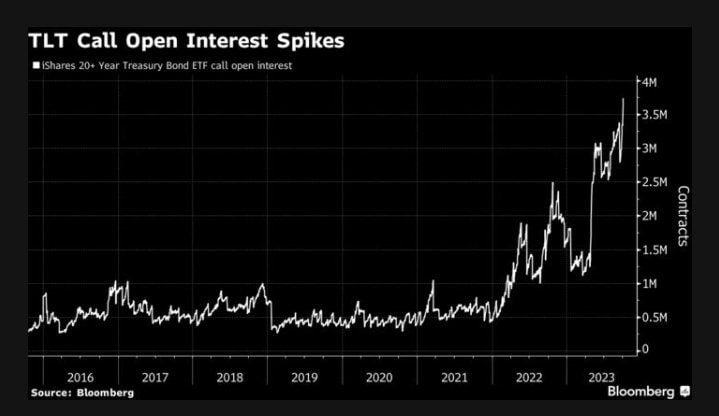

Open interest for bullish call contracts has soared to an all-time high for $TLT

Traders see an end to the market rout that has led to TLT’s longest streak of weekly losses since 2022. Source: Credit From Macro to Micro

Investing with intelligence

Our latest research, commentary and market outlooks