Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

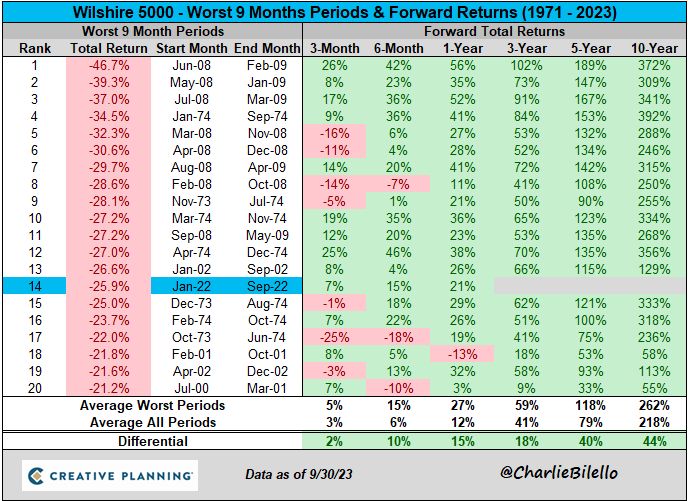

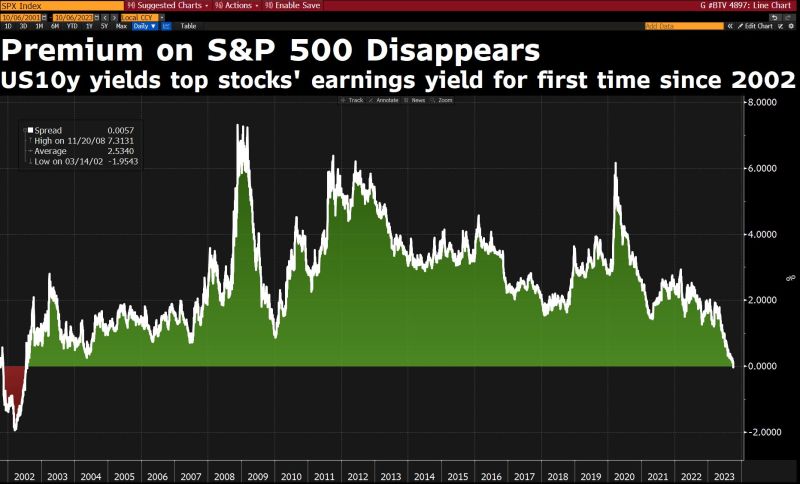

Who has the losses on the books? Value of global bonds has lost another $1.04tn. This brings the total losses to $3.9tn since mid-July

Source: HolgerZ, Bloomberg

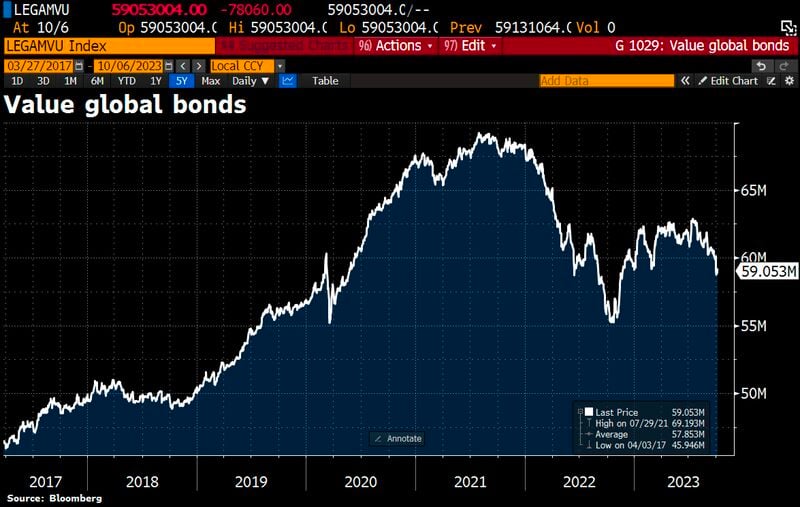

Interesting FT article on UK neobanks: "UK fintech: neobanks may end up blending in"

Low fees mean profits have remained elusive. But higher interest rates are now compensating for that, not least with better returns on client money put out on deposit. Satisfaction scores by customers are also much higher than traditional banks. Some lessons need to be learned. Source: https://lnkd.in/emZyY76d

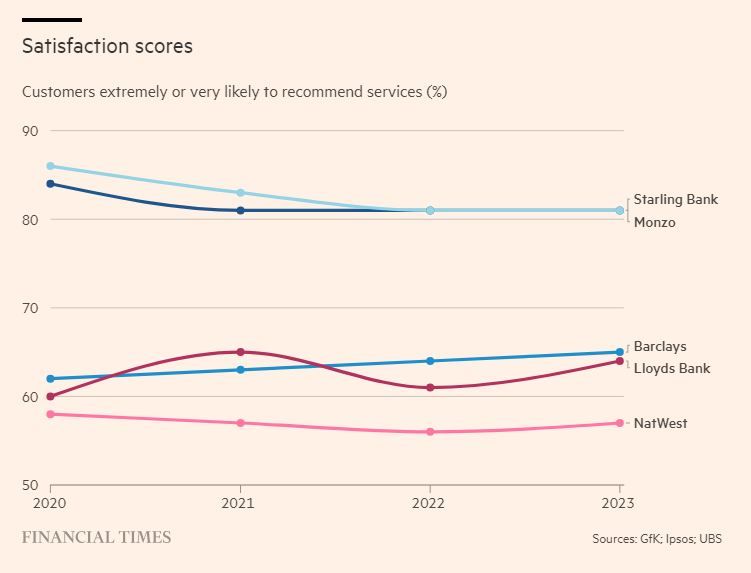

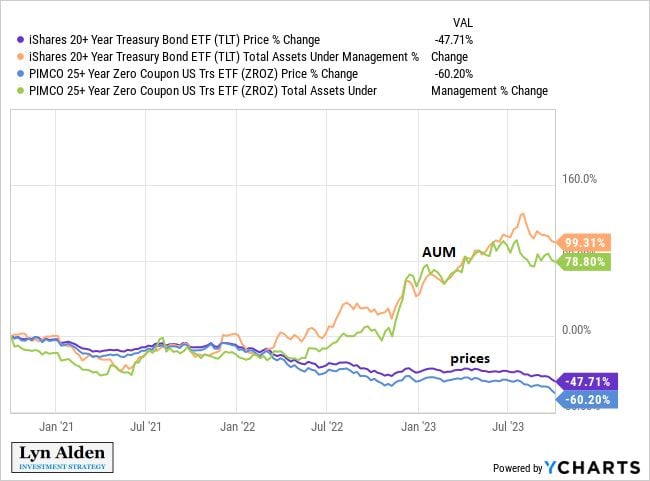

Open interest for bullish call contracts has soared to an all-time high for $TLT

Traders see an end to the market rout that has led to TLT’s longest streak of weekly losses since 2022. Source: Credit From Macro to Micro

Long dated bonds: are investors in denial?

As $TLT and $ZROZ duration bond funds fell in price, their assets under management kept increasing as investors just kept pouring their funds in. Source: Lyn Alden

CDS traders are sending default swaps on the big US BANKS sharply wider

- Deutsche Bank believes the rise in yields could propel Banks' Unrealized losses $140 Billion higher to a record $700 Billion. DB strategist Zeng warns the Q3 explosion in rates has no doubt widened the unrealized losses in US banks bond portfolios, which was already the catalyst for multiple bank failures this year at a time when #rates blew out to far more normal levels.

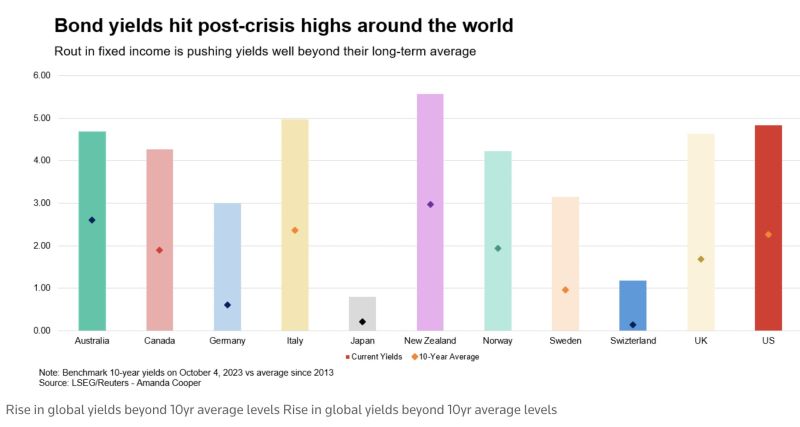

The global bond markets rout in one chart

The world's biggest bond markets hit by heavy selloff: Bond yileds hit post-crisis highs around the world: US 30y yields hit 5% before retreating. German bund yields hit 3%. Bond rout sounds alarm bells globally. Source: HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks