Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

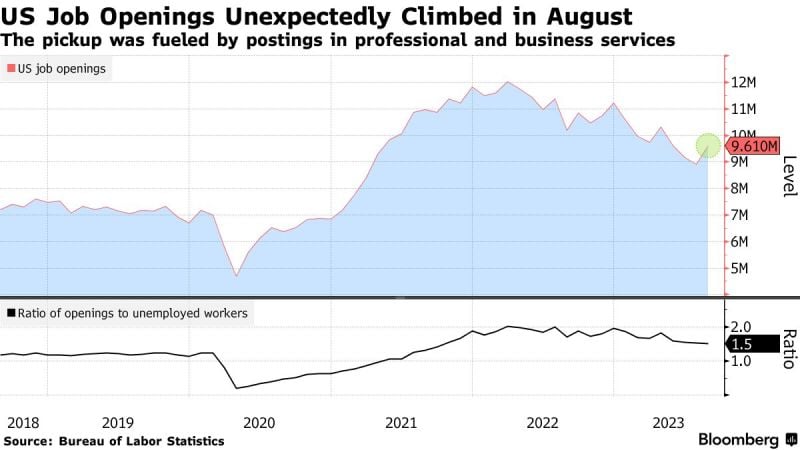

US job openings top all forecasts as white-collar positions jumped: equity markets tanking as US 10 year yields hit fresh 16y high with all of the increase is due to a rise in real yields

US 10y nominal yields is now at 4.73%, 10y real yields (nominal yields-10y inflation expectations) at 2.37%. THE FACTS - US job openings unexpectedly increased in August, fueled by a surge in white-collar postings, highlighting the durability of labor demand. - The number of available positions increased to 9.61 million from a revised 8.92 million in July, the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey, or JOLTS, showed Tuesday. Hiring edged up, while layoffs remained low. - The level of openings topped all estimates in a Bloomberg survey of economists. - The so-called quits rate, which measures voluntary job leavers as a share of total employment, held at 2.3%, matching the lowest since 2020. Fewer quits implies Americans are less confident in their ability to find another job in the current market. OUR TAKE In the current context of "higher rates for longer" fears, investors are probably over-reacting to this report which is adding some confusion to the current trend (which has been a progressive cooling down of the job market). Source chart: Bloomberg

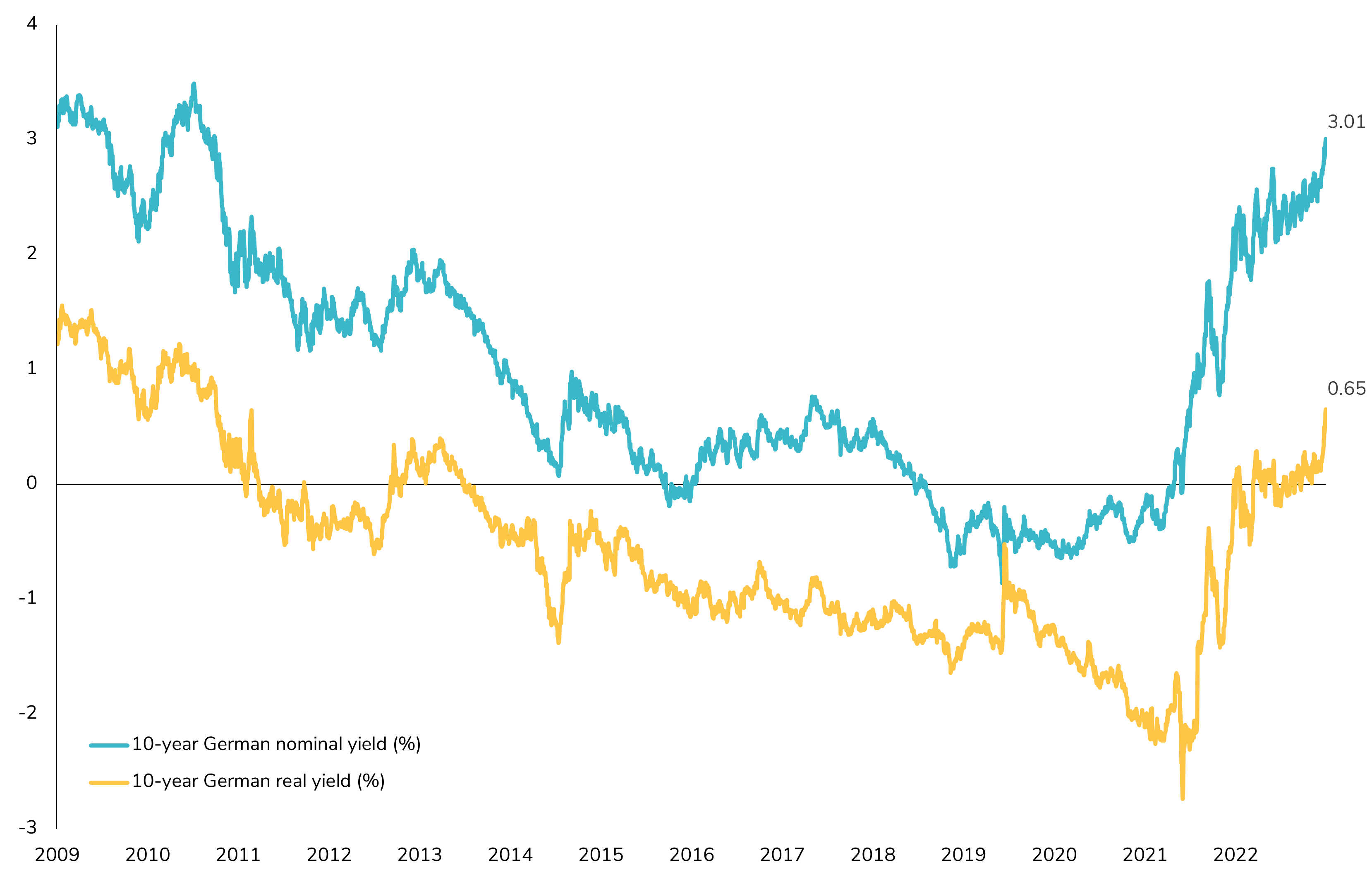

German Bond Yields Surge to 3%, Unseen Since 2011!

In sync with global bond markets, German bond yields are experiencing a significant surge, marking a noteworthy milestone. The 10-year German yield has ascended to a remarkable 3%, a level not witnessed since 2011. This notable surge is primarily rooted in the rise of real yields, clearly depicted by the yellow line on the charts. Interestingly, inflation expectations, measured by the breakeven rate, have remained steadfast since the beginning of 2023, with the 10-year German breakeven rate holding firm at 2.29%. Despite the enduring challenges in Europe's economic outlook, there have been noticeable improvements, albeit against the backdrop of economic strain. Over the summer, the Citi Economic Surprise Index for Europe has impressively rebounded, transitioning from a daunting -150 to a more manageable -50. This reflects positive developments amid the ongoing challenges. However, the persistent turbulence in the government bond market can be attributed to several factors. These include the synchronized reduction of balance sheets by most developed central banks, which directly impacts real interest rates and term premiums. Additionally, the narrative of "higher for longer" has prompted a recalibration of flows into the front end of the yield curve, driven by concerns about the long end's convexity potentially not performing well in this scenario. The current resilience of the US economy, coupled with uncertainties surrounding the potential for a second phase of rising inflation within a soft landing scenario and a larger fiscal deficit, adds further complexity to this landscape. Source : Bloomberg

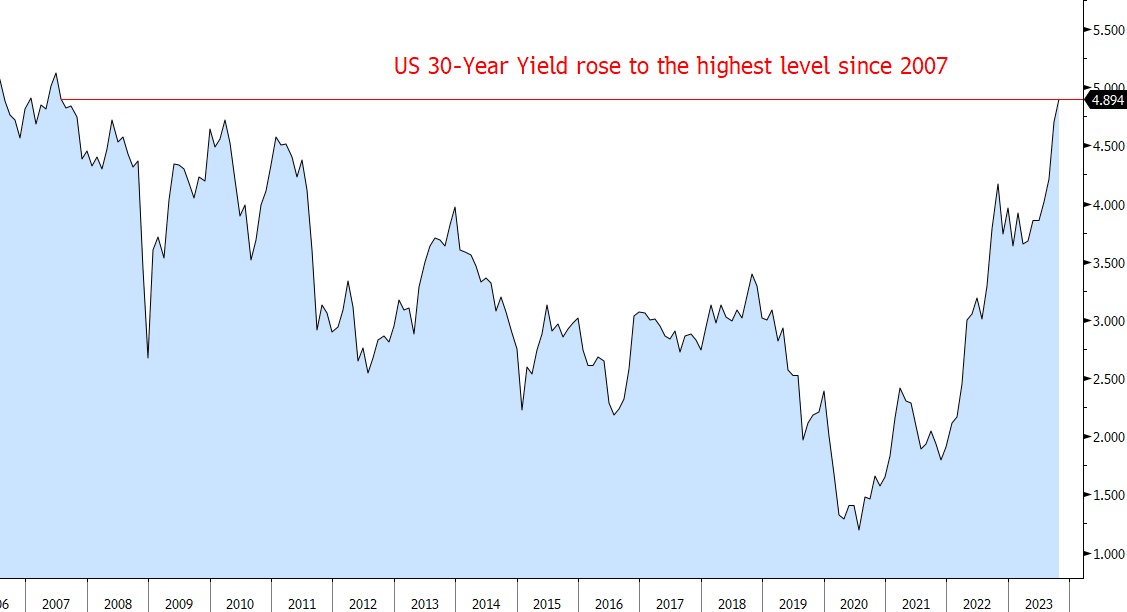

Is China to blame for the rise in US long rates?

China has cut its holdings in US Treasuries to $822bn, lowest level since 2009. Beijing has been selling $300bn in Treasuries since 2021, & pace of Chinese selling has been faster in recent months, Apollos's Slok has calculated. Source: HolgerZ, Bloomberg

Incredibly, ultra long-duration Treasury bonds have now lost more in % terms than stocks did during Great Financial Crisis

The drawdown in extended duration Treasury ETF ( 58.3%) now exceeds PEAK-TO-TROUGH losses in S&P 500 during stock market crash of 2007 - 2009 (56.0%) Source: Jack Farley

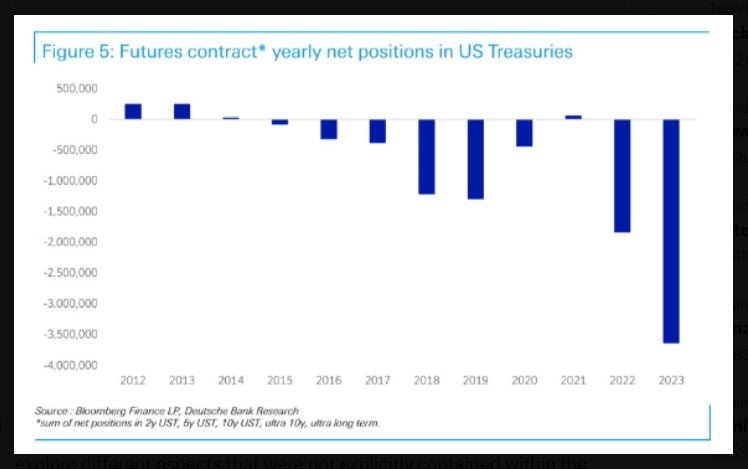

Hedge funds have now built the largest short position in U.S. Treasuries in history

Source: DB, barchart

Investing with intelligence

Our latest research, commentary and market outlooks