Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

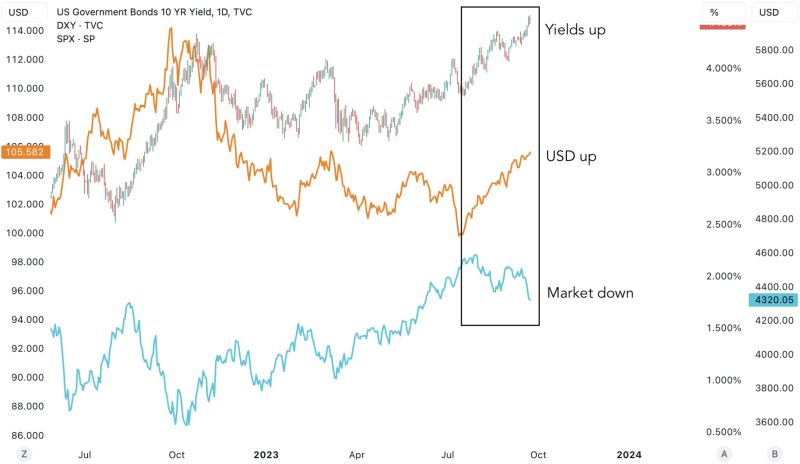

This chart by Goldman shows the regime change which has been in place over the last few weeks

Despite the rise in 30-year real yields, short duration stocks (i.e value and the likes) were underperforming long duration ones (i.e IT/growth stocks). Things are now normalizing as short duration stocks are progressively catching up in terms of relative performance. The growth/IT basket probably needs 30-year real yield to reverse trend in order to outperform again...

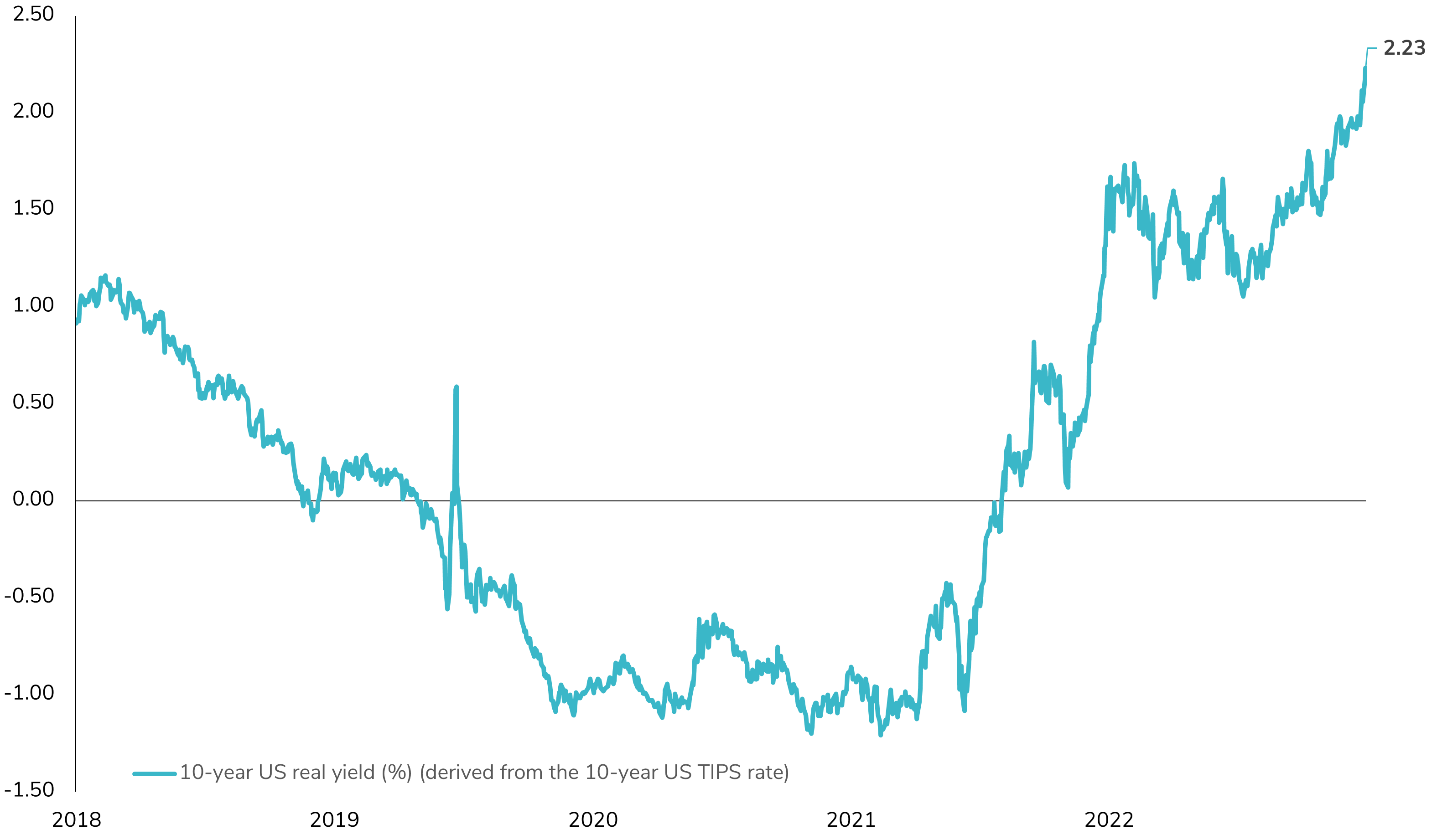

TIPS - A Revival in Focus!

Long-term U.S. Treasury Inflation Protection Securities (TIPS) have witnessed a significant double-digit decline since the start of 2022, despite the presence of high U.S. inflation. While the inflation-linked component has acted as a safety net, providing a cushion of around 10% over 20 months, the surge in the 10-year real rate from -1.0% to 2.2% over the same period has had a marked and negative impact on the total TIPS yield (-14%). Yet, the question lingers: Is now the opportune moment to contemplate TIPS? We are currently at a level of LT real rates (2.23%) not seen since 2008. Interestingly, TIPS exhibit a lower beta compared to U.S. Treasuries (currently standing at 0.8). This attribute becomes especially valuable in light of the considerable volatility in U.S. interest rates (with the MOVE index still >100). hould we delve into the realm of inflation-linked bonds, which constitute a global market valued at over $3.5 trillion? This consideration gains significance as uncertainties surrounding inflation persist, driven by factors like de-globalization, supply shocks, increased fiscal spending, and the ongoing transition to renewable energy sources. Source: Bloomberg

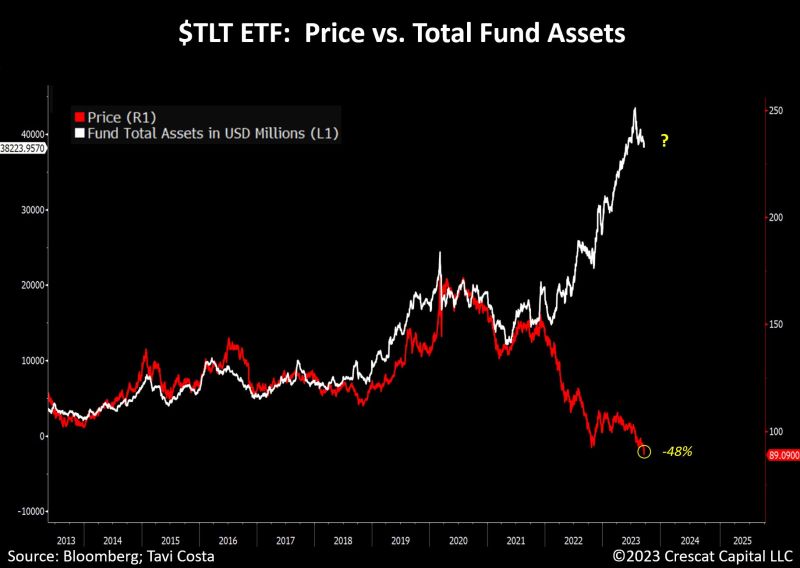

Bond tracking ETF, $TLT, just closed at its lowest level since February 2011

The ETF is now officially down 50% from its high just 3 years ago in 2020. Yet, investors continue to desperately pour money into Treasuries despite the massive underperformance. Indeed, despite the rise in bond yields, investors keep piling into $TLT (iShares US Treasuries 20year+) etf. Another $750m last week as 60/40 portfolios are stubbornly allocating funds to this underperforming asset, hoping for a return to a disinflationary environment. As mentioned by Eric Balchunas / Bloomberg, it is quite rare seeing an ETF taking in so much money ($16b YTD, #2 overall) while being down so much and so consistently (especially when you can get just as much yield with no duration risk...). Such a behaviour happened with the China Internet ETF $KWEB... not a great omen... Source: Bloomberg, Eric Balchunas, Tavi Costa

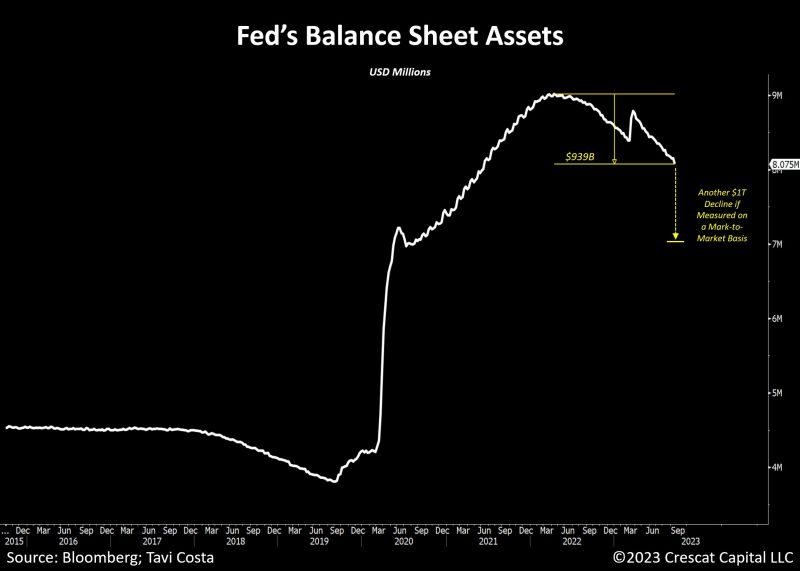

Treasury notes, bonds, and mortgage-back securities account for over 80% of the Federal Reserve's balance sheet

Last week, the Fed's balance sheet plunged by almost $75BN last week, its biggest weekly drop since July 2020. The Fed's balance sheet is now over 10% below its April 2022 peak. But this is WITHOUT taking into account the current drop in value of the bonds held on the balance sheet. Indeed, if they were to be re-evaluated using a mark-to-market methodology, the Fed's assets could be reduced by another $1 trillion. To provide some context, he recent decline in market value would likely exceed the entirety of their QT policy thus far, which accounted for $939B. This would essentially revert their balance sheet size back to 2020 levels. Source: Bloomberg, Tavi Costa

A government shutdown would reflect negatively on America’s credit rating, says Moody’s, the only remaining major credit grader to assign the US a top AAA rating

“While government debt service payments would not be impacted & a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years,” analysts led by William Foster wrote in a report Monday. Source: Bloomberg

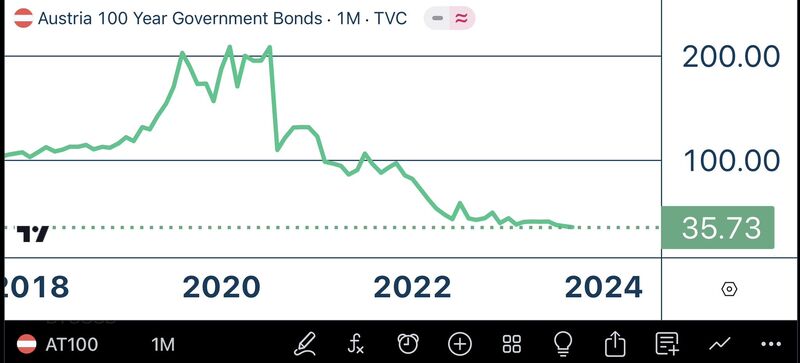

The Power of Duration! This is not the chart of an altcoin, this is the chart of Austria’s 100-year bond, down 82% from its 2021 peak!

Source: Jeroen Blokland

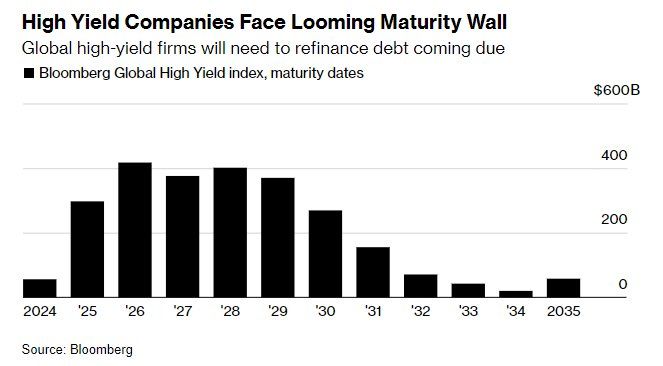

HIGH YIELD BONDS, THE BILL COMES DUE...

Global high yield bonds have been quite resilient so far in this cycle but the reality is that they will hit the maturity wall starting next year. And things will probably become more challenging whatever the economic scenario. If the economy does well and interest rates stay high for longer, the refinancing cost is likely to become more expensive. If the economy moves into recession, credit spreads are likely to go up hence still putting upward pressure on refinancing cost. So either way delinquencies are likely to increase. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks