Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

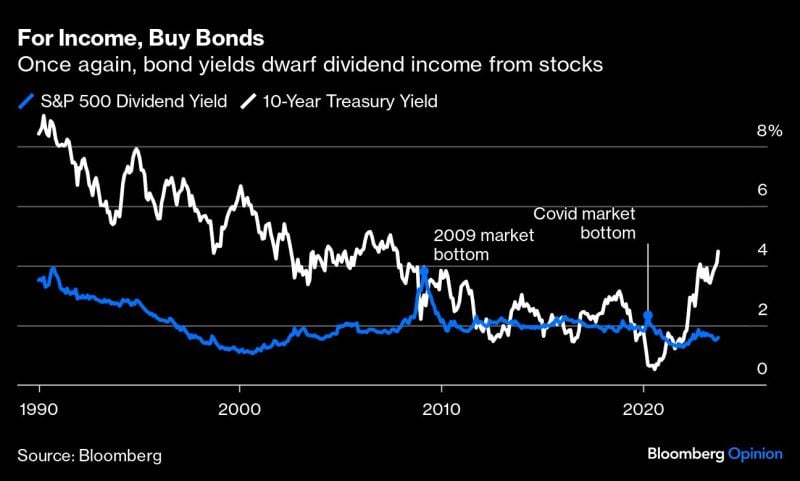

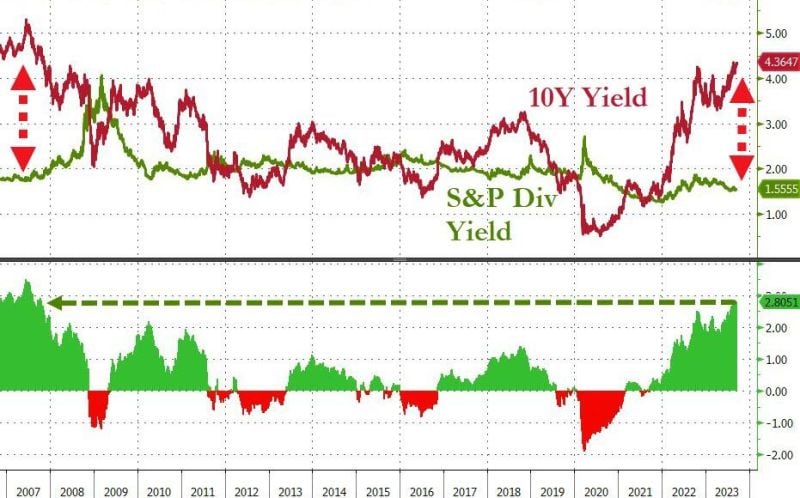

Treasury Yields now surpass Stock Dividend Yields by the widest margin since the Global Financial Crisis

Source: Bloomberg, Bar chart

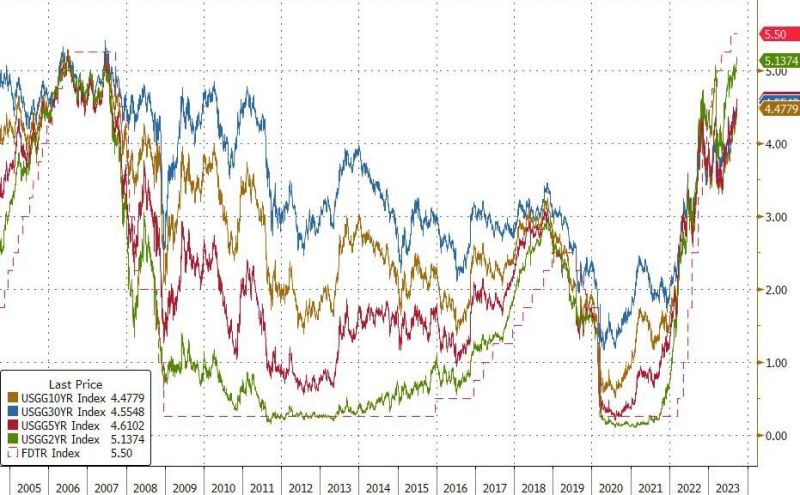

Inflation fear is NOT the driver of rising yields

Indeed, 10y real yields (10y nominal yields - 10y inflation expectations) jumped to 2.11%, the highest since 2009. In other words, investors are demanding higher REAL yields in the face of political chaos in Washington and high debt. Source: Bloomberg, HolgerZ

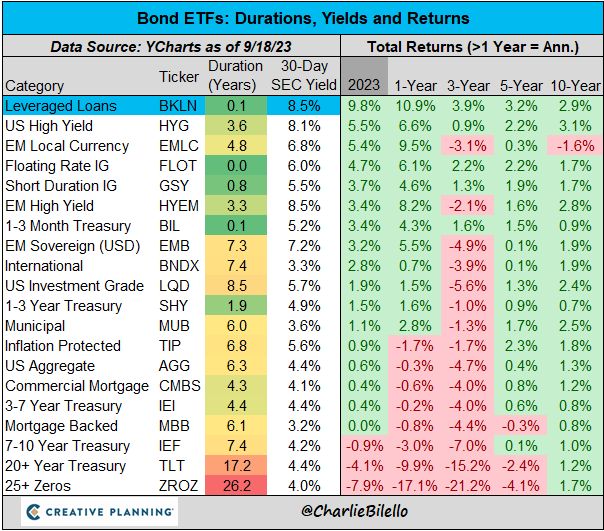

The longest duration bond ETF is now down 60% from its peak in March 2020

How is that possible? The 30-Year Treasury yield has moved from an all-time low of 0.8% in March 2020 up to 4.6% today. Long duration + Rising interest rates from extremely low levels = Pain $ZROZ Source: Charlie Bilello

The best performing segment of the bond market this year? Leveraged Loans, up close to 10%. $BKLN

Source: Charlie Bilello

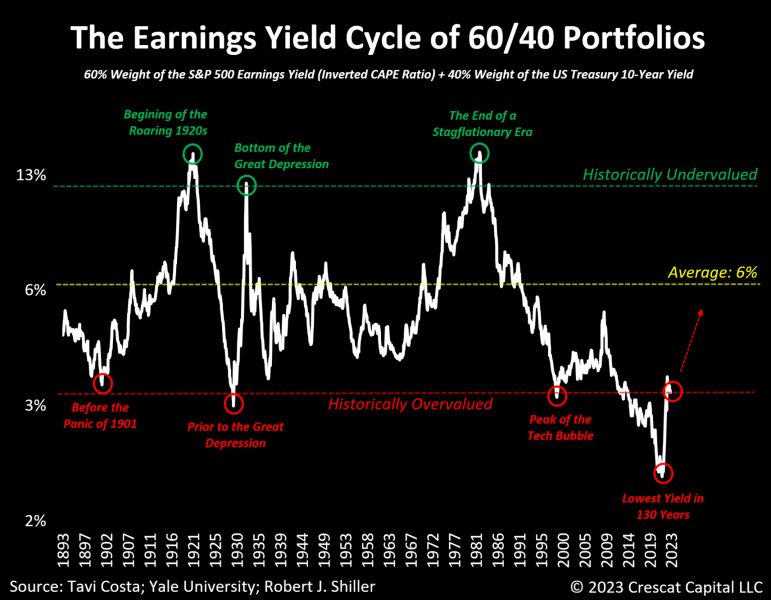

Is the 60/40 portfolio overvalued?

In August 2021, the combined valuation of overall equities and US Treasuries had reached its most expensive level in 130 years. To put the current valuation imbalance into perspective, its recent peak was a staggering 61% higher than its previous peak in the early 2000s. Although prices have corrected somewhat, particularly in the Treasury market, multiples are still elevated today. Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks