Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

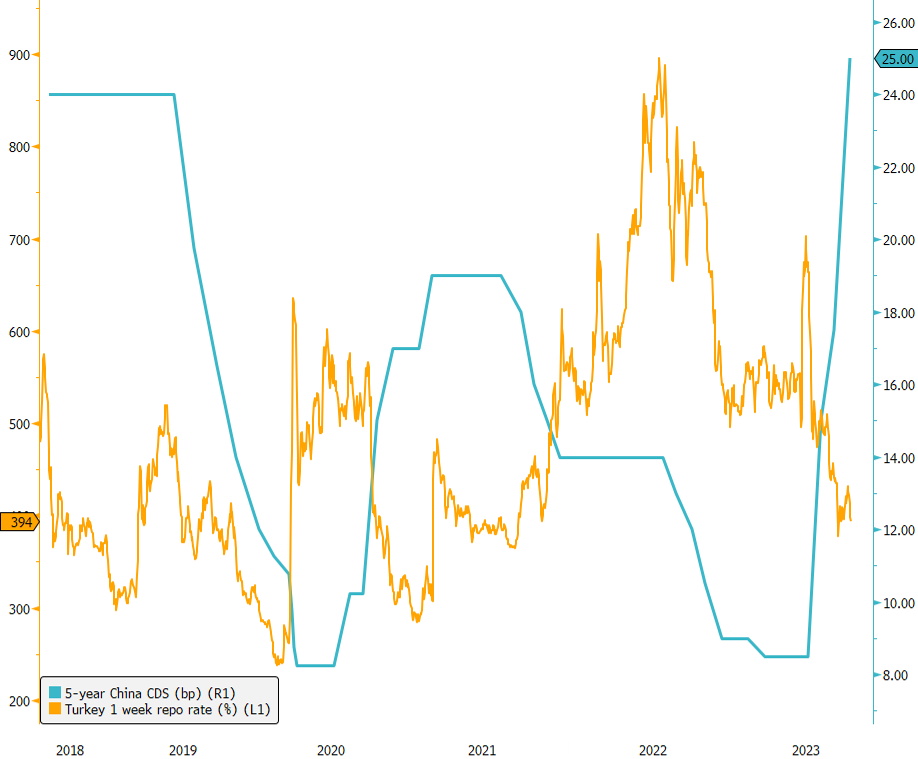

Turkey's Aggressive Rate Hike Triggers 5-Year CDS Drop!

The Turkey Central Bank has taken a significant step in its battle against inflation by implementing a supersized rate hike of 750bps, bringing rates to 25%. This move was unexpected, as the market had anticipated a more "modest" hike to 20%. Turkish fixed income assets have responded positively, with the Turkey 5-year CDS retreating below 400bps. Even Turkey's US Dollar-denominated bonds saw a boost from the news. With the Central Bank of Turkey adopting a more orthodox approach to its monetary policy, the question arises: can they successfully bring inflation back to reasonable levels? To provide context, the latest inflation figure for the month of July was at a staggering 47.8%... Source: Bloomberg

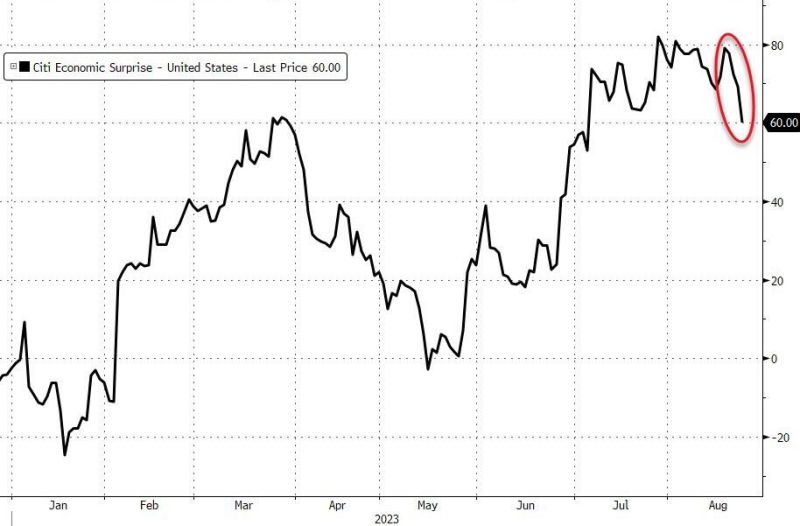

A fresh increase in the Atlanta Fed’s GDPNow model reinforces the reasoning behind hawkish-for-longer monetary policy, which is weighing on equities and bonds

The latest model estimate shows real 3Q GDP growth of 5.9%, up from 5.8% on Aug. 16 (it was less than 4% two weeks ago). Source: J-C Gand, Atlanta Fed

Since the COVID Crash lows in March 2020, US equity markets have more than doubled the performance of bonds

As shown below, that's the best performance ever over a similar time window, topping the strongest stocks-bonds outperformance from the tech bubble of the late 1990s and early 2000s. Source: Bespoke, J-C Gand

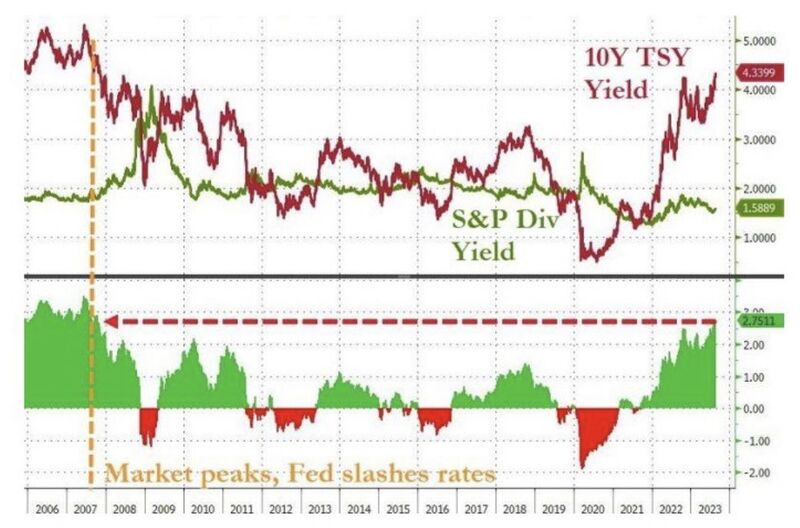

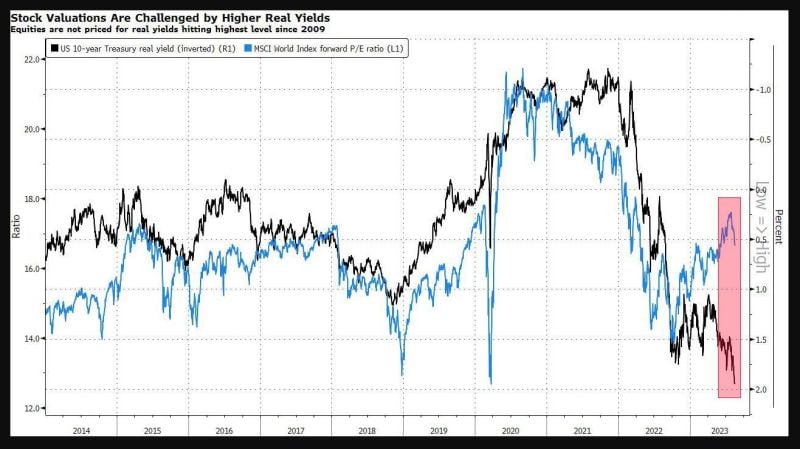

Higher real bond yields create a challenge for global equities valuations

Source: Bloomberg

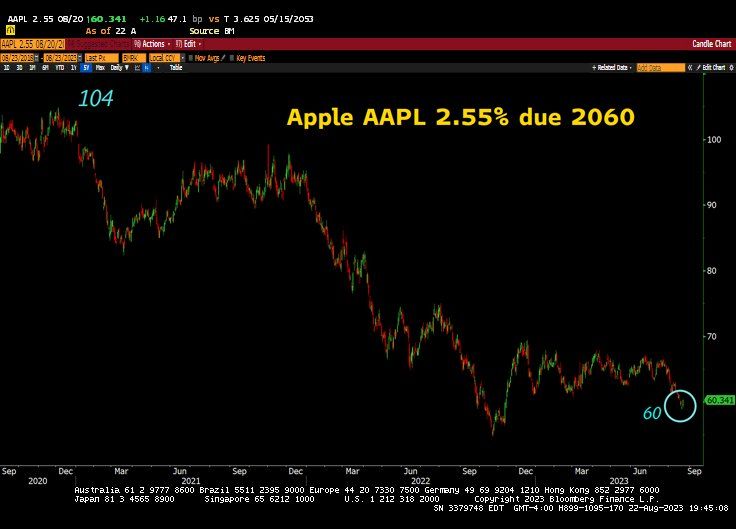

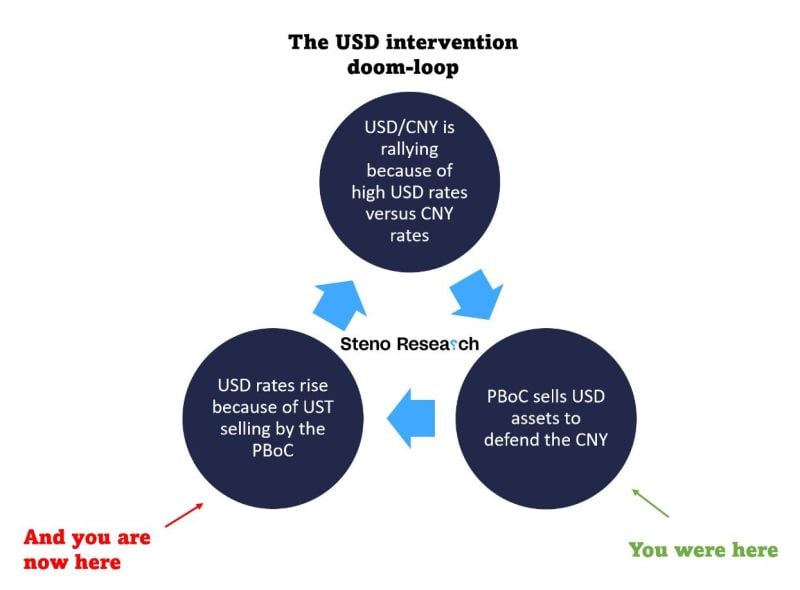

Nice one by Steno research

While there are some fundamental reasons for US Treasury yields to keep rising (check out the Atlanta Fed Nowcast model poiting towards nearly 6% annualized real GDP growth in 3Q), what is currently going in China probably has some impact as well Source: Stenio research

Investing with intelligence

Our latest research, commentary and market outlooks