Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

This is not the price chart of a meme stock going under or a "pump and dump" altcoin

This is the Austria AA+ 100 year bond being hammered by the rise of bond yields... The price of the 100 year Austrian government bond has plunged near all-time lows and is trading 72% below its All-Time-High. Source: Bloomberg, HolgerZ

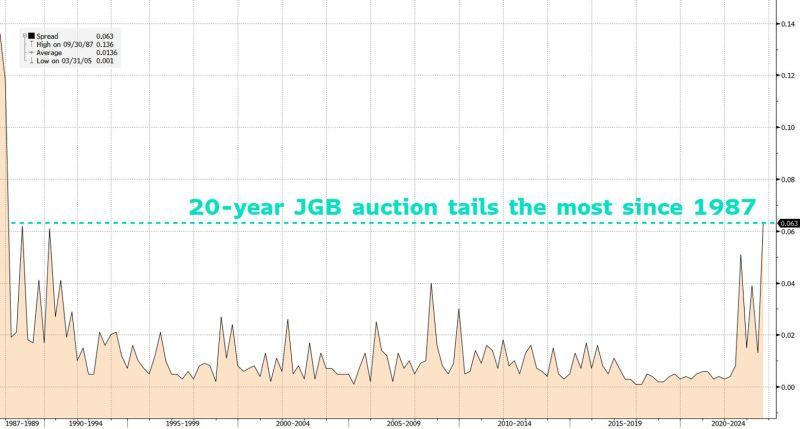

An horrible 20-year JGB auction today tailed the most since 1987, showing that investors require a higher yield to buy JGB

Rising JGB yields threaten bonds worldwide, so we see EU and US sovereign yields accelerating their rise this morning. Source: Althea Spinozzi aka "The Bond girl"

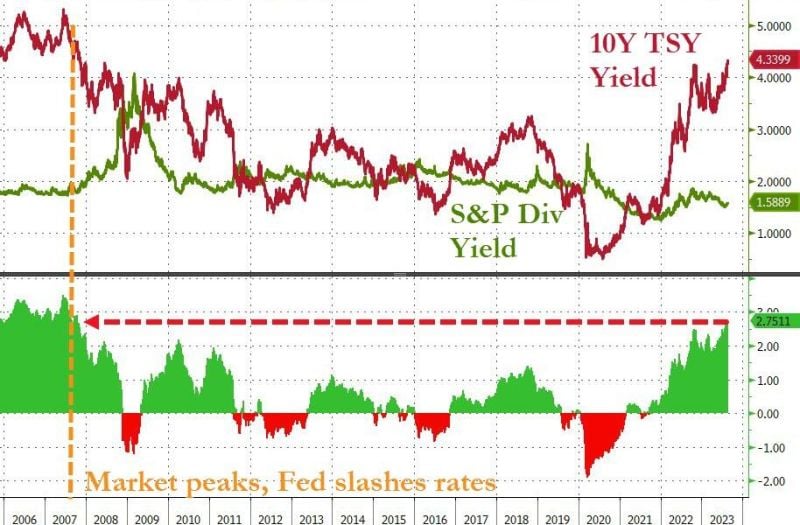

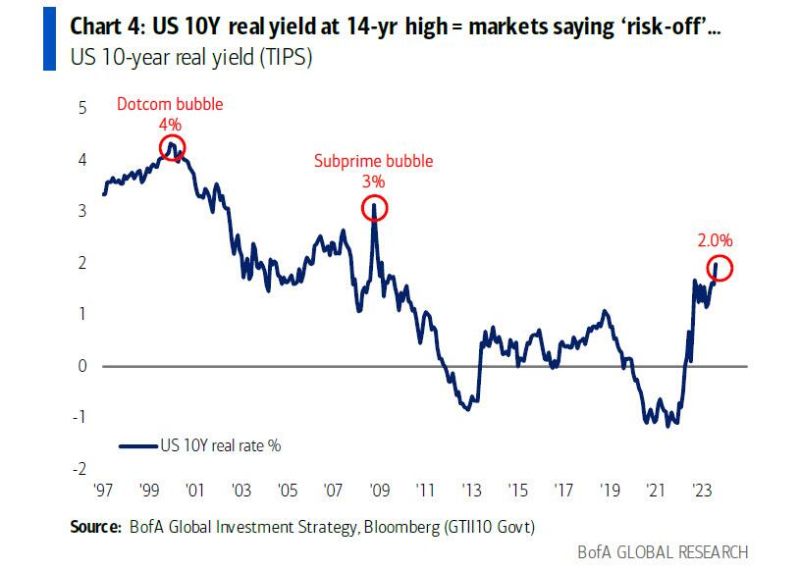

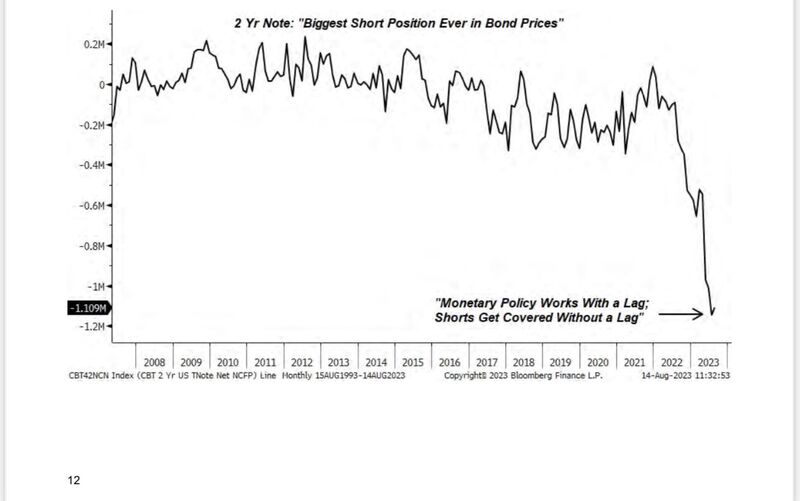

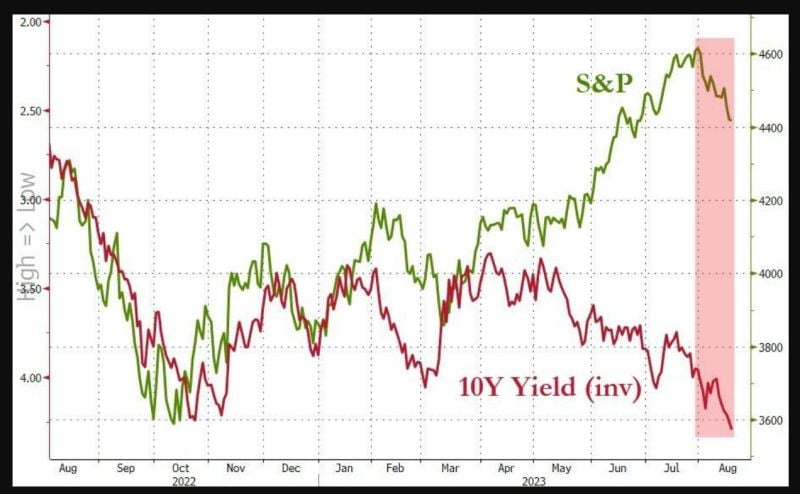

A tricky time for US government bonds...

US Treasuries are facing multiple headwinds - economic strength (Atlanta Fed's real-time GDP growth forecast is tracking close to 4% for the third quarter), an uptick in energy prices and FED QT. But another headwind is fading demand stemming from historical buyers of US Treasuries: 1- China US Treasury holdings just hit a 14-year low at less than $850bn 2- Saudi Arabia’s stockpile of US Treasuries fell to the lowest level in more than six year (less than $100B) 3 - As Japanese long-term yields rose (due to a tweak in their #monetarypolicy), the largest foreign holders of US Treasuries, Japanese investors, became less interested in US bonds and asked for a premium. Source cartoon: GISreportonline

As highlighted by Caleb Franzen, the relative chart of SP500 / M2 money supply is trading at the exact same level as July 2007

This range also coincided with market peaks in: • Feb.'20 • Q4'21 While the S&P 500 itself has gained +181% in the past 16 years, $SPX/M2 has made no progress. Should this be seen as a logical resistance zone?

Investing with intelligence

Our latest research, commentary and market outlooks